Clean Energy Investments to

Watch

May 1, 2019 -- InvestorsHub NewsWire -- Microcap Speculators --

Investments in wind and solar will need to reach $13 trillion over

30 years so as to reduce CO2 emissions by 64% in 2050 compared to

current levels, according to a new report published last week by

Dutch bank ING. As individual investors, investing in these clean

energy companies could pay off big time.

A company to watch in the space is CleanSpark, Inc.

(USOTC:

CLSK), a microgrid company with several revenue

generating projects. It released an Edgar filing reporting $20

million in financing in the form of Debenture, the Series B

Preferred Stock, the Warrant and the Common Stock. With the

warrants being priced $3.50 per share with respect to 2,000,000

Warrant Shares, $4.00 with respect to 100,000 Warrant Shares, $5.00

with respect to 100,000 Warrant Shares, $7.50 with respect to

50,000 Warrant Shares and $10.00 with respect to 50,000 Warrant

Shares, the parties are surely anticipating growth. This

committed financing will help accelerate the development and

deployment of CleanSpark's Distributed Energy Resource (DER)

Solutions to commercial customers.

CLSK has outlined several initiatives in their recent letter to

shareholders. CLSK is planning to initiate a marketing

campaign to start reaching indoor cannabis growers dealing with

inefficient energy usage in need of their services, push forward

their projects with recent acquisition of Intellectual Property of

Pioneer Critical Power Inc, and facilitate growth in their R&D

to find new industries their solution can improve. Start your

research now.

Today we are highlighting: CleanSpark, Inc. (USOTC:

CLSK), Brookfield Renewable Partners L.P. (NYSE:

BEP), Covanta Holding Corporation (NYSE:

CVA), Plug Power, Inc. (NASDAQ:

PLUG), and Capstone Turbine Corporation (CPST).

This financing is the latest in a long string of positive

announcements by CleanSpark, Inc. (USOTC:

CLSK) (Market Cap: $109.370M; Share Price:

$2.20). The company engaged a firm to navigate

their uplisting, announced the near completion of a $900k contract

to install a CLSK microgrid at a U.S. Marine Corps Base and has

been progressing on a $18.3 million deal with NYSE company

MAC. Continue reading to learn why now is the time to start

your research on CLSK.

CLSK’s microgrid energy solution for the cannabis industry

dramatically decreases the cost of energy associated with producing

each pound of valuable cash crop. A cannabis business using

$90,000 per year in energy has the potential to reduce its

operating costs (flowering stage) from $270/lb. to $200/lb.,

producing a 15% ROI over 10 years.

________

Brookfield Renewable Partners L.P. (NYSE:

BEP) (Market Cap: $9.877B; Share Price:

$31.52) recently announced the 2019 First Quarter

Conference Call and Webcast set for Thursday, May 2, 2019 at 9:00

a.m. (Eastern Time) to discuss results and current business

initiatives with members of senior management. These results

will be released on Thursday, May 2, 2019 at approximately 7:00

a.m. and will be available on the company website.

Brookfield Renewable Partners L.P. owns a portfolio of renewable

power generating facilities primarily in North America, Colombia,

Brazil, Europe, India, and China. The company generates

electricity through hydro, wind, solar, cogeneration, and biomass

sources. Brookfield Renewable Partners Limited operates as

the general partner of Brookfield Renewable Partners L.P. It

operates one of the world's largest publicly traded, pure-play

renewable power platforms. Its portfolio consists of hydroelectric,

wind, solar and storage facilities in North America, South America,

Europe and Asia, and totals over 17,000 megawatts of installed

capacity and an 8,000-megawatt development pipeline.

Brookfield Renewable is the flagship listed renewable power company

of Brookfield Asset Management, a leading global alternative asset

manager with over $350 billion of assets under management.

_________

Covanta Holding Corporation (NYSE:

CVA) (Market Cap: $2.362B; Share Price:

$18.07) reported financial results today for the

three months ended March 31, 2019 last week. The key

highlights include:

- Affirmation of 2019 guidance

- Reached financial close on Rookery project in the UK

- Began operations at Manhattan Marine Transfer Station

Covanta Holding Corporation, through its subsidiaries, provides

waste and energy services to municipal entities primarily in the

United States and Canada. It owns and operates infrastructure

for the conversion of waste to energy, as well as engages in

related waste transport and disposal, and other renewable energy

production businesses. Annually, Covanta's modern

Energy-from-Waste facilities safely convert approximately 22

million tons of waste from municipalities and businesses into

clean, renewable electricity to power one million homes and recycle

over 600,000 tons of metal.

_________

Plug Power Inc. (NASDAQ:

PLUG) (Market Cap: $607.321M; Share Price:

$2.49), a leader providing energy solutions that

change the way the world moves, has added Lipari Foods to its

growing customer list in hydrogen powered e-mobility. Lipari

Foods has selected Plug Power GenDrive fuel cells and GenFuel

hydrogen fueling station solutions to power the electric material

handling vehicles at its campus in Warren, Michigan. Recently

it announced Sanjay Shrestha as Chief Strategy Officer (CSO).

Plug Power Inc., an alternative energy technology provider,

engages in the design, development, manufacture, and

commercialization of hydrogen and fuel cell systems for the

material handling and stationary power markets primarily in North

America and Europe. It focuses on proton exchange membrane

(PEM) fuel cell and fuel processing technologies, fuel cell/battery

hybrid technologies, and related hydrogen storage and dispensing

infrastructure. Plug Power is the innovator that has taken

hydrogen and fuel cell technology from concept to

commercialization. Plug Power has revolutionized the material

handling industry with its full-service GenKey solution, which is

designed to increase productivity, lower operating costs and reduce

carbon footprints in a reliable, cost-effective way.

_________

Capstone Turbine Corporation (CPST) (Market Cap:

$62.931M; Share Price: $0.8790), the world’s leading

clean technology manufacturer of microturbine energy systems,

announced on April 10 that its global distributor network signed

multiple industry-leading Factory Protection Plan (FPP) service

contracts covering a combined total of 30.7 megawatts (MW) during

the fourth quarter of fiscal 2019. This brings the total

Capstone fleet covered under FPP to a record 241.7 MWs. "With these

new FPP contracts, our existing FPP backlog ends the year at the

highest level in the company's history, eclipsing our last record

at the end of fiscal 2017," said Jeff Foster, Capstone's Senior

Vice President of Customer Service and Product

Development.

Capstone Turbine Corporation develops, manufactures, markets,

and services microturbine technology solutions for use in

stationary distributed power generation applications

worldwide. It offers microturbine units, components, and

various accessories for applications, including cogeneration

comprising combined heat and power (CHP) and integrated CHP, as

well as combined cooling, heat, and power; and renewable energy,

natural resources, and critical power supply. The company's

microturbines are also used as battery charging generators for

hybrid electric vehicle applications. It is the world's

leading producer of low-emission microturbine systems and was the

first to market commercially viable microturbine energy

products.

_________

Signed by

Priyanka Goel, CFA

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting has agreed to a three-month

term consulting agreement with CLSK dated 9/12/18. The

agreement calls for $10,000 in cash, and 30,000 restricted 144

shares of CLSK per month. Regal and CLSK have signed an

amendment to extend the contract for twelve months starting

10/10/18, and increased the cash component to $20,000 per month.

CLSK has paid an additional $12,000 for services provided in

November. CLSK has paid an additional $88,000 for services provided

in December. CLSK has paid an additional $100,000 for

services for January. CLSK has paid an additional $100,000

for services for February. Regal was paid an additional

$100,000 for March services. CLSK has paid an additional

$100,000 for services for March. CLSK has paid an additional

$80,000 for services for April. CLSK has paid All payments

were made directly by Clean Spark, Inc. to Regal Consulting, LLC.

to provide investor relations services, of which this article is a

part of. Regal Consulting also paid one thousand dollars cash

to microcapspeculators.com to distribute this article. Regal

Consulting may have a position in the securities mentioned in this

article at the time of publication, and may increase or decrease

its position without notice. This article is based on public

information and the opinions of Regal Consulting. CLSK was given an

opportunity to edit this article. This article contains

forward-looking statements that are subject to certain risks and

uncertainties that could cause actual results to differ materially

from any results predicted herein. Regal Consulting is not

registered with any financial or securities regulatory authority,

and does not provide or claim to provide investment advice.

http://www.regalconsultingllc.com/full

legal disclaimer/

Full Legal Disclaimer Click Here.

Contact Information:

Company Name: ACR Communication LLC.

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

SOURCE: Microcap Speculators

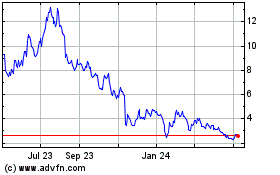

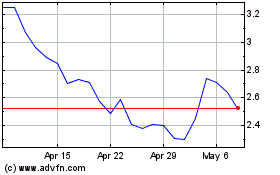

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Apr 2023 to Apr 2024