First Quarter 2019

- Q1 GAAP EPS from Continuing Operations

Up $0.17 or 24% to $0.87, Primarily Reflects Revenue Growth and

Improved Operating Performance

- Q1 Comparable EPS (non-GAAP) from

Continuing Operations Up $0.15 or 16% to $1.11, Primarily Reflects

Revenue Growth and Improved Operating Performance in all Business

Segments

- Record Q1 Total Revenue Grows 15% to

$2.2 Billion

- Record Q1 Operating Revenue (non-GAAP)

Up 14% to $1.8 Billion; Double-Digit Growth in all Business

Segments

2019 Forecast

- Raised Full-Year 2019 GAAP EPS Forecast

Range from Prior Forecast of $5.18 to $5.48 to $5.28 to $5.58

- Raised Full-Year 2019 Comparable EPS

Forecast Range (non-GAAP) from Prior Forecast of $6.00 to $6.30 to

$6.05 to $6.35

Ryder System, Inc. (NYSE: R), a leader in commercial fleet

management, dedicated transportation, and supply chain solutions,

today reported first quarter earnings and revenue. In the first

quarter, the company reported record total revenue and record

operating revenue. Revenue and earnings before tax grew in all

three business segments reflecting new business and higher volumes.

First quarter GAAP EPS was up 24% to $0.87 and comparable EPS was

up 16% to $1.11, reflecting revenue growth and improved operating

performance.

Results for the three months ended March 31 were as follows:

(dollars in millions, except EPS)

Earnings Before

Taxes Earnings Diluted Earnings Per

Share 2019 2018 Change 2019

2018 Change 2019 2018

Change GAAP $ 68.2 52.7

29% $ 45.9 37.3 23% $ 0.87

0.70 24% Non-operating pension costs

6.5 1.2 4.6 0.6 0.09 0.01 ERP implementation costs 3.6 — 2.7 — 0.05

— Restructuring and other, net 2.6 (0.4 ) 1.8 (0.4 ) 0.04 —

Goodwill impairment — 15.5 — 15.5 — 0.29 Tax adjustments — —

3.5 (1.9 ) 0.06 (0.04 ) Comparable (non-GAAP)

$ 80.8 69.0 17% $ 58.5 51.1 14% $ 1.11

0.96 16%

Total and operating revenue for the three months ended March 31

were as follows:

(in millions)

Total Revenue Operating

Revenue (non-GAAP) 2019 2018 %

Change 2019 2018 % Change Total $

2,180.3 1,904.2 15% $ 1,759.0

1,543.7 14% FMS $ 1,351.6 1,243.1 9% $ 1,143.7

1,039.2 10% DTS $ 349.6 299.0 17% $ 235.6 201.4 17% SCS $ 635.7

494.7 28% $ 477.1 382.8 25%

Commenting on the company’s first quarter results, Ryder

Chairman and CEO Robert Sanchez said, "We are pleased to report

double-digit operating revenue and earnings growth, driven by

strong performance in our contractual businesses. This growth

reflects continued outsourcing trends and the impact of our sales

and marketing initiatives. We out-performed our forecast, primarily

due to better than anticipated impact of the new lease accounting

standard and to a lesser extent stronger performance in ChoiceLease

and Dedicated.

"We are encouraged by accelerated growth in the ChoiceLease

fleet, which increased organically by a record 4,200 vehicles this

quarter, with 40% of the growth coming from customers new to

outsourcing. Once these customers outsource their fleets to us, we

typically expand and retain these relationships for decades.

"Our transactional rental and used vehicles sales businesses

performed in line with our expectations. Additionally, used vehicle

inventory levels remain within our target range.

"In both Dedicated Transportation Solutions and Supply Chain

Solutions, we saw earnings improvement reflecting revenue growth

and stronger operating performance.

"Turning to our longer-term strategic initiatives, we’re excited

by the positive results we saw from our Atlanta pilot of COOP by

Ryder™ and have expanded the platform to South Florida. COOP is the

first and only asset sharing platform of its kind for commercial

vehicles, which enables fleet owners to generate revenue from their

underutilized vehicles and provides an asset-light earnings source

for Ryder."

First Quarter Business Segment Operating Results

Fleet Management Solutions

In the Fleet Management Solutions (FMS) business segment, total

revenue was $1.35 billion, up 9% compared with $1.24 billion in the

year-earlier period. FMS operating revenue (a non-GAAP measure

excluding fuel) was $1.14 billion, up 10% from the year-earlier

period. Ryder ChoiceLeaseTM (lease) revenue increased 8% reflecting

a larger average fleet size and higher prices on replacement

vehicles. The lease fleet grew by 4,200 vehicles for the quarter.

Commercial rental revenue increased 15% from the prior year due to

higher demand and pricing.

FMS earnings before tax were $60.9 million, up 12%, compared

with $54.3 million in 2018, reflecting ChoiceLease and to a lesser

extent commercial rental growth. Lease results benefited from fleet

growth, reflecting strong outsourcing trends and our sales and

marketing initiatives. Commercial rental performance improved due

to stronger demand and higher pricing. Rental power fleet

utilization was 74.9% for the first quarter consistent with the

year-earlier period. Both lease and rental performance benefited

from a significant maintenance cost recovery item. These benefits

were offset by higher depreciation of $8.6 million due to vehicle

residual-value changes and accelerated depreciation, as well as

higher liability insurance costs related to development of prior

years' claims. In addition, overheads were higher, reflecting

growth-related investments in sales, marketing, and technology.

Used vehicle results slightly declined from the prior year as

increased sales of used vehicles at higher prices were offset by

higher valuation adjustments on a larger inventory. FMS earnings

before tax as a percentage of FMS total revenue and FMS operating

revenue (a non-GAAP measure) were 4.5% and 5.3%, respectively, both

are up by 10 basis points from the prior year.

Dedicated Transportation Solutions

In the Dedicated Transportation Solutions (DTS) business

segment, total revenue was up 17% to $350 million and DTS operating

revenue (a non-GAAP measure excluding fuel and subcontracted

transportation) was up 17% to $236 million compared with the

year-earlier period. DTS total and operating revenue growth

reflects new business, customer expansions, and increased

volumes.

DTS earnings before tax of $17.4 million increased 33% compared

with $13.1 million in 2018, due to revenue growth, improved

operating performance, and favorable insurance results related to

development of prior years' claims. DTS earnings before tax as a

percentage of DTS total revenue and DTS operating revenue (a

non-GAAP measure) were 5.0% and 7.4%, respectively, up 60 and 90

basis points from the year-earlier period.

Supply Chain Solutions

In the Supply Chain Solutions (SCS) business segment, total

revenue was up 28% to $636 million and SCS operating revenue (a

non-GAAP measure excluding fuel and subcontracted transportation)

was up 25% to $477 million compared with the year-earlier period.

SCS operating revenue growth largely reflects new business,

increased volumes, and higher pricing. Total and operating revenue

growth also reflects the acquisition of MXD Group, Inc., re-branded

as Ryder Last Mile, during the second quarter of 2018.

SCS earnings before tax of $32.3 million increased 27% in the

first quarter of 2019 compared with $25.5 million in 2018, driven

by revenue growth. SCS earnings before tax as a percentage of SCS

total revenue and SCS operating revenue (a non-GAAP measure) were

5.1% and 6.8%, respectively, down 10 basis points and up 10 basis

points from the year-earlier period.

Corporate Financial Information

Central Support Services

Central Support Services (CSS) are overhead costs incurred to

support all business segments and product lines. Most CSS costs are

allocated to the business segments. In the first quarter of 2019,

unallocated CSS costs increased to $13 million from $11 million in

the prior year.

Income Taxes

The company’s effective income tax rate from continuing

operations for the first quarter of 2019 increased from 29.2% to

32.7%. The increase reflects the expiration of certain state net

operating losses in 2019 and a one-time beneficial adjustment

associated with uncertain tax positions in 2018. The comparable

effective income tax rate (a non-GAAP measure) from continuing

operations for the first quarter of 2019 increased from 26.0% to

27.6%. This increase reflects a change in the mix of jurisdictional

earnings.

Additional Items Excluded from Segment and Comparable

Earnings

Non-operating components of pension costs are excluded from both

segment earnings before tax and comparable earnings (a non-GAAP

measure) to more accurately reflect the operating performance of

the business. Non-operating pension costs totaled $6.5 million

($4.6 million after tax) or $0.09 per diluted share in the first

quarter of 2019, up from $1.2 million ($0.6 million after tax) or

$0.01 per diluted share in the year-earlier period.

First quarter 2019 results include $3.6 million ($2.7 million

after tax) or $0.05 per diluted share of expense related to the

implementation of an Enterprise Resource Planning (ERP) system.

Results also include restructuring and other, net of $2.6 million

($1.8 million after tax) or $0.04 per diluted share, primarily

reflecting consulting fees related to a cost-savings initiative,

partially offset by income from the company's Singapore operations

which will be exited in 2019.

First quarter 2018 results reflect a non-cash, pre-tax charge of

$15.5 million ($15.5 million after tax) or $0.29 per diluted share

related to the impairment of goodwill in our FMS Europe reporting

unit and $0.4 million ($0.4 million after tax) of restructuring and

other, net, including income related to the company's Singapore

operations.

Lease Accounting

The company adopted a new lease accounting standard effective

January 1, 2019, which has no impact on cash flow or total earnings

over the life of a lease contract. The new standard, however,

changes the timing of lease revenue and related commission expense

recognition to better align with maintenance costs. Adoption of the

standard increased earnings per share by $0.11 in the first quarter

of 2019 and $0.06 in the first quarter of 2018. Although we saw a

benefit from lease accounting in the first quarter, we expect

adoption of the standard to reduce full year 2019 earnings per

share by approximately $0.15 as the fleet is expected to get

younger during the year.

Capital Expenditures

Capital expenditures increased to $1.11 billion in the first

quarter of 2019, compared with $711 million in first quarter of

2018. The increase in capital expenditures reflects higher planned

investments to grow and refresh the lease fleets. Proceeds of $103

million, primarily from used vehicle sales, increased 15%. Net

capital expenditures (including proceeds from the sale of assets)

were $1.01 billion in 2019, up from $621 million in 2018.

Cash Flow and Leverage

Operating cash flow was $485 million in the first quarter of

2019, up from $337 million in first quarter of 2018. Total cash

generated (a non-GAAP measure that includes proceeds from used

vehicle sales) was $589 million, compared with $427 million in

2018. Free cash flow (a non-GAAP measure) was negative $438

million, compared with negative $236 million in 2018, reflecting

increased net capital spending.

Total debt as of March 31, 2019 was $7.1 billion, up from

$6.6 billion in 2018. Debt to equity for the first quarter of 2019

was 278% compared with 262% at year-end 2018, within Ryder’s

long-term target range of 250% to 300%.

2019 Earnings Forecast

Commenting on the company’s outlook, Mr. Sanchez said, "We

continue to see a healthy economic environment and customers remain

confident in making long-term contractual commitments. In addition,

demand for rental and used vehicles remains favorable, however, we

continue to plan for a somewhat softer year-over-year comparisons

in the second half. Overall, we are on track to meet our earnings

expectations for the full year with a modestly better than expected

impact from lease accounting.

"We are on pace to meet or beat our 2019 revenue growth targets

in all business segments. In rental, our strategy to leverage

e-commerce growth by expanding our medium-duty truck fleet is

proceeding well. In used vehicles sales, we are expanding our

retail sales capacity to handle additional volume and we continue

to expect pricing to be slightly down, particularly in the second

half of the year. In addition, we anticipate executing well on our

recently announced maintenance cost initiative for the full

year.

"In supply chain solutions, we expect revenue comparisons to

turn negative in the second half of the year due to previously

announced lost business; however, year-over-year earnings are

expected to improve. In dedicated transportation solutions, we

expect continued improvements in operating performance. Finally,

our capital spending and leverage outlook remains consistent with

our prior expectations."

In view of these factors, Ryder is revising its full-year 2019

GAAP EPS forecast to a range of $5.28 to $5.58, as compared to the

prior forecast of $5.18 to $5.48. In 2018, full-year GAAP EPS was

$5.44. The company is also increasing its forecast for full-year

2019 comparable EPS from continuing operations to $6.05 to $6.35,

from the prior forecast of $6.00 to $6.30. In 2018, full-year

comparable EPS was $5.97.

Ryder is establishing a second quarter 2019 GAAP EPS forecast of

$1.14 to $1.24, compared with $0.88 in the second quarter 2018. The

company is also establishing a second quarter 2019 forecast for

comparable EPS from continuing operations of $1.34 to $1.44,

compared with $1.46 in the second quarter 2018. The EPS forecast

for the second quarter of 2019 includes a negative impact of $0.05

associated with the adoption of the new lease accounting standard

compared to a benefit of $0.05 in the year earlier period. The

lease accounting impact in the second quarter reflects an expected

decline in the fleet age.

Supplemental Company

Information

First Quarter Net Earnings

(dollars in millions, except EPS)

Earnings Diluted

EPS 2019 2018 2019 2018 Earnings

from continuing operations $ 45.9 37.3 $ 0.87 0.70 Discontinued

operations (0.6 ) (0.4 ) (0.01 ) (0.01 ) Net earnings $ 45.3

36.9 $ 0.86 0.70

Business Description

Ryder System, Inc. is a FORTUNE 500® commercial fleet

management, dedicated transportation, and supply chain solutions

company. Ryder’s stock (NYSE: R) is a component of the Dow Jones

Transportation Average and the S&P MidCap 400® index. The

company’s financial performance is reported in the following three,

inter-related business segments:

- Fleet Management Solutions -

Ryder’s FMS business segment provides a broad range of services to

help businesses of all sizes, across virtually every industry,

deliver for their customers. From leasing, maintenance, and

fueling, to commercial rental and used vehicle sales, customers

rely on Ryder’s expertise to help them lower their costs, redirect

capital to other parts of their business, and focus on what they do

best - so they can grow.

- Dedicated Transportation

Solutions - Ryder’s DTS business segment combines the best of

Ryder’s leasing and maintenance capability with the safest and most

professional drivers in the industry. With a dedicated

transportation solution, Ryder helps customers increase their

competitive position, reduce risk, and integrate their

transportation needs with their overall supply chain.

- Supply Chain Solutions - Ryder’s

SCS business segment optimizes logistics networks to make them more

responsive and able to be leveraged as a competitive advantage.

Globally-recognized brands in the automotive, consumer goods, food

and beverage, healthcare, industrial, oil and gas, technology, and

retail industries rely on Ryder’s leading-edge technologies and

world-class logistics engineers to help them deliver the goods that

consumers use every day.

Notations

Earnings Before Tax (EBT): Ryder’s primary measurement of

business segment financial performance, earnings before tax (EBT),

allocates Central Support Services to each business segment and

excludes restructuring and other items, as well as non-operating

pension costs.

Capital Expenditures: In Ryder’s business, capital

expenditures are generally used to purchase revenue earning

equipment (trucks, tractors, and trailers) primarily to support the

ChoiceLease product line and secondarily to support the commercial

rental product line within Ryder’s FMS business segment. The level

of capital required to support the ChoiceLease product line varies

directly with customer contract signings for growth and replacement

vehicles. These contracts are long-term agreements that result in

ongoing revenues and cash flows to Ryder, typically over a three-

to ten-year term. The commercial rental product line utilizes

capital for the purchase of vehicles to replenish and expand

Ryder’s fleet available for shorter-term use by contractual or

occasional customers.

For more information on Ryder System, Inc., visit http://investors.ryder.com/.

Conference Call and Webcast

Information:

Ryder’s earnings conference call and webcast is scheduled for

April 30, 2019, from 11:00 a.m. to 12:00 noon Eastern Time.

Speakers will be Chairman and Chief Executive Officer Robert

Sanchez, and Executive Vice President and Chief Financial Officer

Scott Parker. To join please click the below URL five minutes prior

to the start of the webcast. You will need to complete the

registration page to gain access to the webcast.

Ryder First Quarter Earnings Call Webcast URL:

https://globalmeet.webcasts.com/starthere.jsp?ei=1237864&tp_key=a8dff3a172

If you do not have computer speakers or headphones and/or would

like to dial-into the webcast, please dial into the phone bridge

below. In addition, please click the “listen by phone” option on

the webcast player for the optimal viewing experience.

LIVE AUDIO VIA PHONE

Please dial the audio phone number approximately 10 minutes

prior to the start of the call.

Toll Free Number 888-352-6803 USA Toll Number:

323-701-0225 Audio Passcode: Ryder Conference Leader: Bob Brunn

AUDIO REPLAY VIA PHONE

An audio replay of the call will be available one hour after

call ends for 30 days.

Toll Free Number: 888-203-1112 USA Toll

Number: 719-457-0820 Replay Passcode: 1420126

AUDIO REPLAY VIA MP3

DOWNLOAD

A podcast of the call will be available within 24 hours after

the end of the call at http://investors.ryder.com. Interested

listeners may download the audio file and either save or listen to

it on their computer or any portable MP3 player. Go

to http://investors.ryder.com, select Financials/Quarterly

Reports and the date in order to access the file.

AUDIO & SLIDE REPLAY VIA

INTERNET

An audio replay including the slide presentation will be

available on the Internet within two hours following the

call. Go to http://investors.ryder.com,

select Financials/Quarterly Reports and the date in order to

access the file.

Note Regarding Forward-Looking Statements:

Certain statements and information included in this news release

are “forward-looking statements” under the Federal Private

Securities Litigation Reform Act of 1995, including our

expectations regarding market trends and economic environment, our

financial condition, fleet growth, performance in our product lines

and segments, the strength of our sales pipeline, projections

related to customer retention, demand, utilization and pricing

trends in commercial rental, volumes and pricing trends in used

vehicle sales, used vehicle inventory levels, residual values,

return on capital spread, operating cash flow, free cash flow,

capital expenditures, leverage, our ability to make investments in

sales, marketing, IT, e-commerce and new product initiatives, costs

of implementing our ERP system ,benefits of our sales and marketing

initiatives, maintenance costs on certain older model year

vehicles, and the impact and adequacy of steps we have taken to

address our cost structure, including our maintenance initiatives

and zero-based budgeting process. Our forward-looking statements

also include our expectations regarding the impact from the new

lease accounting standard on our earnings, financial position, cash

flow, leverage and the demand for our products and services. The

expected impact on these items may differ due to changes in the

distribution of lease fleet by age, the number of early

terminations, vehicle type and lease terms, and the percentage of

leases fulfilled with new versus used vehicles. All of these

statements are based on our preliminary estimates and are subject

to our continuing evaluation of our leases under the new lease

accounting standard as well as necessary changes to accounting and

business processes in order to implement the recognition and

disclosure requirements of the new standard.

All of our forward-looking statements should be evaluated with

consideration given to the many risks and uncertainties inherent in

our business that could cause actual results and events to differ

materially from those in the forward-looking statements. Important

factors that could cause such differences include, among others,

our ability to adapt to changing market conditions, lower than

expected contractual sales, decreases in commercial rental demand

or poor acceptance of rental pricing, worsening of market demand

for used vehicles impacting current pricing and our anticipated

proportion of retail versus wholesale sales, lack of customer

demand for our services, higher than expected maintenance costs,

lower than expected benefits from our cost-savings, lower than

expected benefits from our sales, marketing and new product

initiatives, higher than expected costs related to our ERP

implementation, setbacks or uncertainty in the economic market,

implementation or enforcement of regulations, decreases in freight

demand or volumes, poor operational execution including with

respect to new accounts and product launches, our ability to obtain

adequate profit margins for our services, our inability to maintain

current pricing levels due to soft economic conditions, business

interruptions or expenditures due to severe weather or natural

occurrences, competition from other service providers and new

entrants, customer retention levels, loss of key customers, driver

and technician shortages resulting in higher procurement costs and

turnover rates, unexpected bad debt reserves or write-offs, changes

in customers' business environments that will limit their ability

to commit to long-term vehicle leases, a decrease in credit

ratings, increased debt costs, adequacy of accounting estimates,

reserves and accruals particularly with respect to pension, taxes,

depreciation, insurance and revenue, impact of changes in

accounting policies, the sudden or unusual changes in fuel prices,

unanticipated currency exchange rate fluctuations, our ability to

manage our cost structure, and the risks described in our filings

with the Securities and Exchange Commission. The risks included

here are not exhaustive. New risks emerge from time to time and it

is not possible for management to predict all such risk factors or

to assess the impact of such risks on our business. Accordingly, we

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Note Regarding Non-GAAP Financial

Measures: This news release includes certain non-GAAP

financial measures as defined under SEC rules, including:

Comparable Earnings Measures,

including comparable earnings from continuing operations,

comparable earnings per share from continuing operations (as well

as forecasts), comparable earnings before income tax, comparable

earnings before interest, income tax, depreciation and amortization

(as well as forecasts), and comparable effective income tax rate.

Additionally, our adjusted return on average capital (ROC) and

adjusted return on capital spread (ROC spread) measures are

calculated based on comparable earnings items.

Operating Revenue Measures, including

operating revenue and operating revenue growth excluding foreign

exchange for Ryder and its business segments, and segment EBT as a

percentage of operating revenue.

Cash Flow Measures, including total

cash generated and free cash flow (as well as forecasts).

Refer to Appendix - Non-GAAP Financial Measure Reconciliations

at the end of the tables following this press release for

reconciliations of the non-GAAP financial measures contained in

this release to the nearest GAAP measure. Additional information

regarding non-GAAP financial measures as required by Regulation G

and Item 10(e) of Regulation S-K can be found in our most recent

Form 10-K, and our Form 8-K filed as of the date of this release

with the SEC, which are available at

http://investors.ryder.com.

RYDER SYSTEM, INC. AND SUBSIDIARIES CONSOLIDATED

CONDENSED STATEMENTS OF EARNINGS - UNAUDITED Periods ended

March 31, 2019 and 2018

(In millions, except per share

amounts)

Three Months 2019 2018 Lease and rental

revenues $ 899.6 825.0 Services revenue 1,132.0 928.1 Fuel services

revenue 148.7 151.1 Total revenues 2,180.3

1,904.2 Cost of lease and rental 664.3 615.6 Cost of

services 971.7 788.8 Cost of fuel services 143.3 146.9 Other

operating expenses 33.6 33.0 Selling, general and administrative

expenses 231.3 207.8 Non-operating pension costs 6.5 1.2 Used

vehicle sales, net 8.2 7.4 Interest expense 55.3 38.2 Miscellaneous

income, net (8.2 ) (2.5 ) Restructuring and other items, net 6.2

15.1 2,112.2 1,851.5 Earnings

from continuing operations before income taxes 68.2 52.7 Provision

for income taxes 22.3 15.4 Earnings from continuing

operations 45.9 37.3 Loss from discontinued operations, net of tax

(0.6 ) (0.4 ) Net earnings $ 45.3 36.9

Earnings (loss) per common share - Diluted Continuing operations $

0.87 0.70 Discontinued operations (0.01 ) (0.01 ) Net earnings $

0.86 0.70 Earnings per share information -

Diluted Earnings from continuing operations $ 45.9 37.3 Less:

Earnings allocated to unvested stock (0.2 ) (0.1 ) Earnings from

continuing operations available to common stockholders $ 45.7

37.2 Weighted-average shares outstanding -

Diluted 52.6 53.0 EPS from continuing

operations $ 0.87 0.70 Non-operating pension costs 0.09 0.01 ERP

implementation costs 0.05 — Restructuring and other, net 0.04 —

Goodwill impairment — 0.29 Tax adjustments 0.06 (0.04 )

Comparable EPS from continuing

operations*

$ 1.11 0.96

* Non-GAAP financial measure. A reconciliation of GAAP EPS from

continuing operations to comparable EPS from continuing operations

is set forth in this table.

Note: Amounts may not be additive due to rounding.

RYDER SYSTEM, INC. AND SUBSIDIARIES CONSOLIDATED

CONDENSED BALANCE SHEETS - UNAUDITED

(Dollars in millions)

March 31,2019

December 31,

2018

Assets: Cash and cash equivalents $ 62.8 68.1 Other current

assets 1,499.5 1,501.0 Revenue earning equipment, net 9,982.6

9,407.1 Operating property and equipment, net 871.5 862.1 Other

assets 1,534.5 1,511.4 $ 13,950.9 13,349.7

Liabilities and shareholders' equity: Current liabilities $ 1,637.1

1,579.6 Total debt 7,143.2 6,649.3 Other non-current liabilities

(including deferred income taxes) 2,602.4 2,582.8 Shareholders'

equity 2,568.2 2,538.0 $ 13,950.9 13,349.7

SELECTED KEY RATIOS AND METRICS

March 31,2019

December 31,

2018

Debt to equity 278% 262% Effective interest rate (average

cost of debt) 3.2% 3.0% Three months ended March 31,

2019 2018 Cash provided by operating activities from

continuing operations $ 485.3 336.9

Free cash flow*

(437.9 ) (235.9 ) Capital expenditures paid 1,026.7 662.7

Capital expenditures (accrual basis) $ 1,113.8 710.9 Less: Proceeds

from sales (primarily revenue earning equipment) (103.5 ) (90.0 )

Net capital expenditures $ 1,010.3 621.0

Twelve months ended March 31, 2019 2018 Return

on average shareholders' equity** 11.7% 38.9% Return on average

assets** 2.2% 6.8%

Adjusted return on capital*

5.2% 4.5% Weighted average cost of capital 4.8% 4.2%

Return on capital spread***

0.4% 0.3%

* Non-GAAP financial measure. See reconciliation of the non-GAAP

elements of this calculation reconciled to the corresponding GAAP

measures included in the Appendix - Non-GAAP Financial Measures

section at the end of this release.

** 2018 calculations include the benefit from Tax Reform

recorded in the fourth quarter of 2017.

*** Non-GAAP financial measure. Adjusted return on capital

spread is calculated as the difference of the adjusted return on

capital and the weighted average cost of capital.

Note: Amounts may not be additive due to rounding.

RYDER SYSTEM, INC. AND SUBSIDIARIES LEASE ACCOUNTING

IMPACT - UNAUDITED

(Dollars in millions)

Adoption of the new lease standard

impacted our previously reported Consolidated Condensed Statements

of Operations

and Comprehensive Income results as

follows (in millions, except per share amounts):

Three months ended March 31, 2018 New Lease As

Previously Standard Reported Adjustments* As Revised

Lease and rental revenues $ 824.3 0.7 825.0 Total revenues 1,903.5

0.7 1,904.2 Cost of lease and rental 619.2 (3.6 ) 615.6 Cost of

services** 787.2 1.5 788.8 Other operating expenses 33.5 (0.5 )

33.0 Selling, general and administrative expenses 208.6 (0.8 )

207.8 Interest expense 37.8 0.4 38.2 Restructuring and other items,

net** 16.0 (0.9 ) 15.1 Earnings from continuing operations before

income taxes 48.1 4.6 52.7 Provision for income taxes 14.2 1.2 15.4

Earnings from continuing operations 33.9 3.4 37.3 Net earnings 33.5

3.4 36.9 Comprehensive income 51.0 3.4 54.3 Earnings

per common share - Basic Continuing operations $ 0.65 0.06 0.71 Net

earnings $ 0.64 0.06 0.70 Earnings per common share -

Diluted Continuing operations $ 0.64 0.06 0.70 Net earnings $ 0.63

0.06 0.70

* Included in the New Lease Standard Adjustments is the

immaterial correction of the lease classification of certain leases

of revenue earning equipment in our FMS Europe segment as

sales-type leases as well as the immaterial correction of certain

facility leases as finance leases. Further information will be

included in the Company's interim financial statements to be filed

on Form 10-Q.

** The changes to Cost of services and Restructuring and other

items, net primarily reflects the reclassification of our Singapore

operations that we will shut down during 2019 to this financial

statement line item.

LEASE ACCOUNTING IMPACT ON EPS

1Q 2Q 3Q 4Q Full Year 2018

Impact on EPS 0.06 0.05 0.04 0.08 0.23 2019 Forecast 1Q 2Q

Full Year Impact on EPS 0.11 (0.05 ) (0.15 )

RYDER

SYSTEM, INC. AND SUBSIDIARIES LEASE ACCOUNTING IMPACT -

UNAUDITED

(Dollars in millions)

Adoption of the new lease standard

impacted our previously reported Consolidated Condensed Balance

Sheet as follows (in millions):

December 31, 2018 New Lease

As Previously Standard Reported Adjustments*

As Revised Receivables net $ 1,219.4 24.1 1,243.5 Prepaid expenses

and other current assets 201.6 (23.3 ) 178.3 Total current assets

1,568.4 0.7 1,569.1 Revenue earning equipment, net 9,498.0 (90.9 )

9,407.1 Operating property and equipment, net 843.8 18.2 862.1

Sales-type leases and other assets 606.6 370.5 977.1 Total assets

13,051.1 298.6 13,349.7 Short-term debt and current portion of long

term-debt 930.0 7.2 937.1 Accrued expenses and other current

liabilities 630.5 217.2 847.7 Total current liabilities 2,292.3

224.4 2,516.7 Long-term debt 5,693.6 18.5 5,712.1 Other non-current

liabilities 849.9 552.7 1,402.6 Deferred income taxes 1,304.8

(124.6 ) 1,180.2 Total liabilities 10,140.8 671.0 10,811.7 Retained

earnings 2,710.7 (372.0 ) 2,338.6 Accumulated other comprehensive

loss (911.3 ) (0.3 ) (911.6 ) Total shareholders' equity 2,910.3

(372.4 ) 2,538.0 Total liabilities and shareholders' equity

13,051.1 298.6 13,349.7

* Included in the New Lease Standard Adjustments is the

immaterial correction of the lease classification of certain leases

of revenue earning equipment in our FMS Europe segment as

sales-type leases as well as the immaterial correction of certain

facility leases as finance leases. Further information will be

included in the Company's interim financial statements to be filed

on Form 10-Q.

RYDER SYSTEM, INC. AND SUBSIDIARIES BUSINESS SEGMENT

REVENUE AND EARNINGS - UNAUDITED Periods ended March 31,

2019 and 2018

(Dollars in millions)

Three Months 2019 2018 B(W)

Total

Revenue: Fleet Management Solutions: ChoiceLease $ 748.6 690.9

8% SelectCare 135.8 121.9 11% Commercial rental 236.1 204.5 15%

Other 23.2 21.9 6% Fuel services revenue 207.9 203.8

2% Total Fleet Management Solutions 1,351.6 1,243.1 9% Dedicated

Transportation Solutions 349.6 299.0 17% Supply Chain Solutions

635.7 494.7 28% Eliminations (156.6 ) (132.5 ) (18)% Total revenue

$ 2,180.3 1,904.2 15%

Operating Revenue: *

Fleet Management Solutions $ 1,143.7 1,039.2 10% Dedicated

Transportation Solutions 235.6 201.4 17% Supply Chain Solutions

477.1 382.8 25% Eliminations (97.4 ) (79.8 ) (22)% Operating

revenue $ 1,759.0 1,543.7 14%

Business segment earnings: Earnings from continuing

operations before income taxes: Fleet Management Solutions $ 60.9

54.3 12% Dedicated Transportation Solutions 17.4 13.1 33% Supply

Chain Solutions 32.3 25.5 27% Eliminations (17.3 ) (13.3 ) (30)%

93.3 79.6 17% Unallocated Central Support Services (12.5 ) (10.6 )

(18)% Non-operating pension costs (6.5 ) (1.2 ) NM Restructuring

and other items, net (6.2 ) (15.1 ) NM Earnings from continuing

operations before income taxes 68.2 52.7 29% Provision for income

taxes 22.3 15.4 (45)% Earnings from continuing

operations $ 45.9 37.3 23%

* Non-GAAP financial measure. See reconciliation of GAAP total

revenue to operating revenue in the Appendix - Non-GAAP Financial

Measures section at the end of this release.

Note: Amounts may not be additive due to rounding.

RYDER SYSTEM, INC. AND SUBSIDIARIES BUSINESS SEGMENT

INFORMATION - UNAUDITED Periods ended March 31, 2019 and

2018

(Dollars in millions)

Three Months 2019 2018 B(W)

Fleet

Management Solutions FMS total revenue $ 1,351.6 1,243.1

9% Fuel services revenue(a) (207.9 ) (203.8 ) 2%

FMS operating revenue*

$ 1,143.7 1,039.2 10% Segment earnings before

income taxes $ 60.9 54.3 12% FMS earnings

before income taxes as % of FMS total revenue 4.5 % 4.4 %

FMS earnings before income taxes as % of

FMS operating revenue*

5.3 % 5.2 %

Dedicated Transportation Solutions

DTS total revenue $ 349.6 299.0 17% Subcontracted

transportation (76.8 ) (63.7 ) 21% Fuel (37.2 ) (33.8 ) 10%

DTS operating revenue*

$ 235.6 201.4 17% Segment earnings before

income taxes $ 17.4 13.1 33% DTS earnings

before income taxes as % of DTS total revenue 5.0 % 4.4 %

DTS earnings before income taxes as % of

DTS operating revenue*

7.4 % 6.5 %

Supply Chain Solutions SCS

total revenue $ 635.7 494.7 28% Subcontracted transportation (128.0

) (86.9 ) 47% Fuel (30.6 ) (25.0 ) 22%

SCS operating revenue*

$ 477.1 382.8 25% Segment earnings before

income taxes $ 32.3 25.5 27 % SCS earnings

before income taxes as % of SCS total revenue 5.1 % 5.2 %

SCS earnings before income taxes as % of

SCS operating revenue*

6.8 % 6.7 %

*Non-GAAP financial measure. A reconciliation of (1) GAAP total

revenue to operating revenue for each business segment (FMS, DTS

and SCS) and (2) segment earnings before taxes (EBT) as % of

segment total revenue to segment EBT as % of segment operating

revenue for each business segment is set forth in this table.

Note: Amounts may not be additive due to rounding.

(a) Includes intercompany fuel sales from FMS to DTS and

SCS.

RYDER SYSTEM, INC. AND SUBSIDIARIES BUSINESS SEGMENT

INFORMATION - UNAUDITED KEY PERFORMANCE INDICATORS

Three months ended March 31, Change 2019

2018

2019/2018

ChoiceLease Average fleet count 151,400 140,100 8%

End of period fleet count 153,500 140,800 9% Miles/unit per day

change - % (a) 0.8 % (1.1 )%

Commercial rental

Average fleet count 43,000 38,600 11% End of period fleet count

43,800 39,300 11% Rental utilization - power units 74.9 % 74.8 % 10

bps Rental rate change - % (b) 2.9 % 2.7 %

Customer vehicles under SelectCare contracts Average

fleet count 56,200 54,200 4% End of period fleet count 55,900

54,500 3%

Customer vehicles under

SelectCare on-demand (c) Fleet serviced during the

period 9,000 8,100 11%

DTS Average fleet count

(d) 9,500 8,500 12% End of period fleet count (d) 9,700 8,700 11%

SCS Average fleet count (d) 9,700 8,400 15%

End of period fleet count (d) 9,800 8,400 17%

Used

vehicle sales (UVS) Average UVS inventory 7,300 6,000 22% End

of period fleet count 7,600 6,000 27% Used vehicles sold 4,900

4,200 17% UVS pricing change - % (e) Tractors 17 % 5 % Trucks 3 % 2

%

Notes:

(a) Represents the percentage change compared to prior year period

in miles driven per vehicle per workday on US lease power units.

(b) Represents percentage change compared to prior year

period in average global rental rate per day on power units using

constant currency. (c) Comprised of the number of vehicles

serviced under on-demand maintenance agreements. Vehicles included

in the end of period count may have been serviced more than one

time during the respective period. (d) These vehicle counts

are also included within the average fleet counts for ChoiceLease,

Commercial Rental and SelectCare. (e) Represents percentage

change compared to prior year period in average sales proceeds on

used vehicle sales using constant currency.

RYDER SYSTEM, INC. AND SUBSIDIARIES

APPENDIX - NON-GAAP FINANCIAL MEASURE

RECONCILIATIONS - UNAUDITED

This press release and accompanying tables include “non-GAAP

financial measures” as defined by SEC rules. As required by SEC

rules, we provide a reconciliation of each non-GAAP financial

measure to the most comparable GAAP measure. Non-GAAP financial

measures should be considered in addition to, but not as a

substitute for or superior to, other measures of financial

performance prepared in accordance with GAAP.

Specifically, the following non-GAAP financial measures are

included in this presentation:

Non-GAAP Financial Measure Comparable GAAP

Measure Reconciliation in Section Entitled

Operating Revenue Measures:

Operating Revenue Total Revenue Appendix - Non-GAAP

Financial Measure Reconciliations FMS Operating Revenue FMS Total

Revenue Business Segment Information - Unaudited DTS Operating

Revenue DTS Total Revenue SCS Operating Revenue SCS Total

Revenue FMS EBT as a % of FMS Operating Revenue FMS EBT as a

% of FMS Total Revenue Business Segment Information - Unaudited DTS

EBT as a % of DTS Operating Revenue DTS EBT as a % of DTS Total

Revenue SCS EBT as a % of SCS Operating Revenue SCS EBT as a

% of SCS Total Revenue

Comparable Earnings Measures:

Comparable Earnings Before Income Tax

and Comparable Tax Rate

Earnings Before Income Tax and

Effective Tax Rate from Continuing

Operations

Appendix - Non-GAAP Financial Measure Reconciliations

Comparable Earnings Earnings from Continuing Operations

Appendix - Non-GAAP Financial Measure Reconciliations

Comparable EPS and Comparable EPS

Forecast

EPS from Continuing OperationsEPS Forecast from Continuing

Operations Consolidated Condensed Statements of Earnings -

UnauditedAppendix - Non-GAAP Financial Measure Reconciliations

(Forecast) Adjusted Return on Average Capital (ROC) and Adjusted

ROC Spread

Not Applicable. However, non-GAAP

elements of the calculation have been

reconciled to the corresponding GAAP

measures. A numerical reconciliation

of

net earnings to adjusted net earnings

and average total debt and average

shareholders' equity to adjusted

average

total capital is provided.

Appendix - Non-GAAP Financial Measure Reconciliations

Comparable Earnings Before Interest, Taxes, Depreciation and

Amortization Earnings from Continuing Operations

Appendix - Non-GAAP Financial Measure Reconciliations

Cash Flow

Measures: Total Cash Generated and

Free Cash Flow Cash Provided by Operating Activities

Appendix - Non-GAAP Financial Measure Reconciliations

RYDER SYSTEM, INC. AND SUBSIDIARIES

APPENDIX - NON-GAAP FINANCIAL MEASURE

RECONCILIATIONS - UNAUDITED

(Dollars in millions)

OPERATING REVENUE

RECONCILIATION

Three months ended March 31, 2019 2018

Total revenue $ 2,180.3 1,904.2 Fuel (216.5 ) (210.0 )

Subcontracted transportation (204.8 ) (150.6 )

Operating revenue*

$ 1,759.0 1,543.7

TOTAL CASH

GENERATED/FREE CASH FLOW RECONCILIATION

Three months ended March 31, 2019 2018

Net cash provided by operating activities from continuing

operations $ 485.3 336.9 Proceeds from sales (primarily revenue

earning equipment) (a) 103.5 90.0

Total cash generated*

588.8 426.8 Purchases of property and revenue earning equipment (a)

(1,026.7 ) (662.7 )

Free cash flow**

$ (437.9 ) (235.9 ) Memo: Net cash provided by financing

activities $ 434.3 229.6 Net cash used in investing activities $

(923.2 ) (572.8 )

Notes:

(a) Included in cash flows from investing activities.

*Non-GAAP financial measure.

** Non-GAAP financial measure. We refer to the net amount of

cash generated from operating activities and investing activities

(excluding changes in restricted cash and acquisitions) from

continuing operations as “free cash flow”. We calculate free cash

flow as the sum of net cash provided by operating activities and

net cash provided by the sale of revenue earning equipment and

operating property and equipment, collections on direct finance

leases and other cash inflows from investing activities, less

purchases of property and revenue earning equipment.

Note: Amounts may not be additive due to rounding.

RYDER SYSTEM, INC. AND SUBSIDIARIES APPENDIX -

NON-GAAP FINANCIAL MEASURE RECONCILIATIONS - UNAUDITED

(Dollars in millions)

ADJUSTED RETURN

ON CAPITAL RECONCILIATION

Twelve months ended March 31, 2019 2018

Net earnings (12-month rolling period) $ 293.7 785.1 +

Restructuring and other items 13.0 41.1 + Income taxes 109.8

(487.8 ) Adjusted earnings before income taxes 416.5 338.5 +

Adjusted interest expense

(a) 197.6 143.8 - Adjusted income

taxes

(b) (155.6 ) (155.6 ) = Adjusted net earnings for ROC

(numerator)

[A] $ 458.5 326.7 Average

total debt $ 6,335.7 5,424.1 Average off-balance sheet debt — —

Average shareholders' equity 2,515.4 2,016.9 Adjustment to equity

(c) 28.9 (138.2 ) Adjusted average total capital

(denominator)

[B] $ 8,880.0 7,302.8

Adjusted ROC* [A]/[B]

5.2% 4.5% Weighted average cost of capital 4.8% 4.2%

Adjusted return on capital spread 0.4% 0.3%

Notes:

(a) Represents reported interest expense plus imputed interest on

off-balance sheet obligations. (b) Represents provision for income

taxes plus income taxes on restructuring and other charges and

adjusted interest expense. (c) Represents the impact to equity of

items to arrive at comparable earnings.

* Non-GAAP financial measure. Non-GAAP elements of the

calculation have been reconciled to the corresponding GAAP

measures. A numerical reconciliation of net earnings to adjusted

net earnings and average total debt and average shareholders'

equity to adjusted average total capital set forth in this

table.

Note: Amounts may not be additive due to rounding.

RYDER SYSTEM, INC. AND SUBSIDIARIES APPENDIX - NON-GAAP

FINANCIAL MEASURE RECONCILIATIONS - UNAUDITED

(Dollars in millions)

COMPARABLE

EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND

AMORTIZATION

Three months ended March 31, 2019 2018

Earnings from continuing operations $ 45.9 37.3 + Provision for

income taxes 22.3 15.4 Earnings before income taxes

from continuing operations 68.2 52.7 + Non-operating

pension costs 6.5 1.2 + ERP implementation costs 3.6 — +

Restructuring and other, net 2.6 (0.4 ) + Goodwill impairment —

15.5

Comparable earnings before income taxes

from continuing operations*

80.8 69.0 + Interest expense 55.3 38.2 + Depreciation

377.4 332.8 + Losses from used vehicle fair value adjustments 16.7

13.6 + Amortization 34.6 26.1

Comparable EBITDA*

$ 564.7 479.7

* Non-GAAP financial measure. Non-GAAP elements of the

calculation have been reconciled to the corresponding GAAP

measures. A numerical reconciliation of earnings before income

taxes from continuing operations to comparable earnings before

income taxes from continuing operations is set forth in this

table.

Note: Amounts may not be additive due to rounding.

RYDER SYSTEM, INC. AND SUBSIDIARIES APPENDIX - NON-GAAP

FINANCIAL MEASURE RECONCILIATIONS - UNAUDITED

(In millions, except per share

amounts)

COMPARABLE

EARNINGS/EARNINGS BEFORE INCOME TAX/TAX RATE

RECONCILIATION

2019

Consolidated Statements of Earnings

Line Item

Three Months Earnings from continuing operations before

income taxes $ 68.2 Non-operating pension costs Non-operating

pension costs 6.5 ERP implementation costs SG&A 3.6

Restructuring and other, net Restructuring and other items, net 2.6

Comparable earnings from continuing operations before income

taxes* 80.8 Provision for income taxes (22.3 ) Income

tax effects of non-GAAP adjustments** (0.1 ) Comparable provision

for income taxes** (22.3 ) Earnings from continuing

operations 45.9 Non-operating pension costs Non-operating pension

costs 4.6 ERP implementation costs SG&A 2.7 Restructuring and

other, net Restructuring and other items, net 1.8 Tax adjustments

Provision for income taxes 3.5 Comparable earnings from

continuing operations* $ 58.5 Tax rate on continuing

operations 32.7 % Income tax effects of non-GAAP adjustments** (5.1

)% Comparable tax rate on continuing operations** 27.6 %

* Non-GAAP financial measure.

** The comparable provision for income taxes is computed using

the same methodology as the GAAP provision for income taxes. Income

tax effects of non-GAAP adjustments are calculated based on the

statutory tax rates of the jurisdictions to which the non-GAAP

adjustments relate.

Note: Amounts may not be additive due to rounding.

RYDER SYSTEM, INC. AND SUBSIDIARIES APPENDIX - NON-GAAP

FINANCIAL MEASURE RECONCILIATIONS - UNAUDITED

(In millions, except per share

amounts)

2018

Consolidated Statements of Earnings

Line Item

Three Months Earnings from continuing operations before

income taxes $ 52.7 Non-operating pension costs Non-operating

pension costs 1.2 Restructuring and other, net Restructuring and

other items, net (0.4 ) Goodwill impairment Restructuring and other

items, net 15.5 Comparable earnings from continuing

operations before income taxes* 69.0 Provision for

income taxes (15.4 ) Income tax effects of non-GAAP adjustments**

(2.6 ) Comparable provision for income taxes** (17.9 )

Earnings from continuing operations 37.3 Non-operating pension

costs Non-operating pension costs 0.6 Restructuring and other, net

Restructuring and other items, net (0.4 ) Goodwill impairment

Restructuring and other items, net 15.5 Tax adjustments Provision

for income taxes (1.9 ) Comparable earnings from continuing

operations* $ 51.1 Tax rate on continuing operations

29.2 % Income tax effects of non-GAAP adjustments** (3.2 )%

Comparable tax rate on continuing operations** 26.0 %

* Non-GAAP financial measure.

** The comparable provision for income taxes is computed using

the same methodology as the GAAP provision for income taxes. Income

tax effects of non-GAAP adjustments are calculated based on the

statutory tax rates of the jurisdictions to which the non-GAAP

adjustments relate.

Note: Amounts may not be additive due to rounding.

RYDER SYSTEM, INC. AND SUBSIDIARIES APPENDIX - NON-GAAP

FINANCIAL MEASURE RECONCILIATIONS - UNAUDITED

COMPARABLE

EARNINGS PER SHARE FORECAST RECONCILIATION

Comparable earnings per share from continuing operations

forecast:*

Second Quarter

2019

Full Year

2019

EPS from continuing operations $1.14 to $1.24 $5.28 to $5.58

Non-operating pension costs, net of tax 0.09 0.35 ERP

implementation costs 0.07 0.26 Restructuring and other, net 0.04

0.10 Tax adjustments — 0.06 Comparable EPS from continuing

operations forecast* $1.34 to $1.44 $6.05 to $6.35

Note: Amounts may not be additive due to rounding.

TOTAL CASH

GENERATED/FREE CASH FLOW FORECAST RECONCILIATION

2019 Forecast Net Cash Provided by Operating

Activities from Continuing Operations $ 2,130 Proceeds from sales

(primarily revenue earning equipment) (1) 450 Total cash

generated* 2,580 Capital expenditures (1)(2) (3,700 )

Free cash flow**

$ (1,120 ) Memo: Net cash provided by financing activities $

1,100 Net cash used in investing activities $ (3,250 )

(1) Included in cash flows from investing activities.

(2) Capital expenditures presented net of changes in accounts

payable related to purchases of revenue earning equipment.

*Non-GAAP financial measure.

**Non-GAAP financial measure. We refer to the net amount of cash

generated from operating activities and investing activities

(excluding changes in restricted cash and acquisitions) from

continuing operations as “free cash flow”. We calculate free cash

flow as the sum of net cash provided by operating activities and

net cash provided by the sale of revenue earning equipment and

operating property and equipment, collections on direct finance

leases and other cash inflows from investing activities, less

purchases of property and revenue earning equipment.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190430005286/en/

Media:Amy Federman (305) 500-4989

Investor Relations:Bob Brunn (305) 500-4053

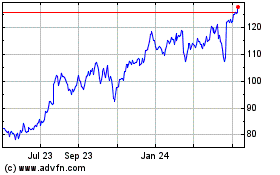

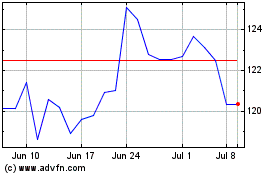

Ryder System (NYSE:R)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ryder System (NYSE:R)

Historical Stock Chart

From Apr 2023 to Apr 2024