Current Report Filing (8-k)

April 30 2019 - 6:30AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 22, 2019

|

Singlepoint Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-53425

|

|

26-1240905

|

|

(State or other jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

2999 North 44th Street, Suite 530 Phoenix, AZ

|

|

85018

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(855) 711-2009

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8 K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a 12 under the Exchange Act (17 CFR 240.14a 12)

¨

Pre commencement communications pursuant to Rule 14d 2(b) under the Exchange Act (17 CFR 240.14d 2(b))

¨

Pre commencement communications pursuant to Rule 13e 4(c) under the Exchange Act (17 CFR 240.13e 4(c))

Item 8.01 Other Events.

On April 22, 2019 Singlepoint Inc. (the “Company”) entered into a Non-Binding Letter of Intent (“LOI”) with Proactive Nutra, LLC (“Proactive”) to acquire Proactive for aggregate consideration of One Million Dollars payable $500,000 upon closing, $250,000 in shares of common stock of the Company and a promissory note of $250,000. The parties agreed that the foregoing consideration is subject to adjustment based upon levels of net profits of Proactive to be agreed to amongst the parties.

The obligation to consummate the proposed transaction are subject to and conditioned upon the negotiation and execution of suitable documentation. In addition, the closing of the transactions are subject to the satisfaction (or waiver) of certain conditions

, including

: (1) the Company completing, to it reasonable satisfaction, its due diligence review of the business and operations of Proactive; (2) no material adverse change in the business of Proactive; (3) completion, to the Company’s satisfaction, of an audit of Seller’s financial statements by the Company’s independent registered public accounting firm in accordance with the standards of the Public Company Accounting Oversight Board (United States); (4) the Company obtaining financing for the proposed consideration; and (5) the Company shall come to agreement to employ certain employees of Proactive (as determined by the Company).

The LOI only provides a mutual indication of interest in the proposed transaction. No agreement providing for the consummation of the proposed transaction will be deemed to exist unless and until the parties execute suitable documentation. Unless and until suitable documentation is executed, neither party has any obligation to the other party of any kind with respect to the proposed transaction.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Singlepoint Inc.

|

|

|

|

|

|

|

|

Dated: April 29, 2019

|

By:

|

/s/ William Ralston

|

|

|

|

|

William Ralston

|

|

|

|

|

President

|

|

SinglePoint (QB) (USOTC:SING)

Historical Stock Chart

From Mar 2024 to Apr 2024

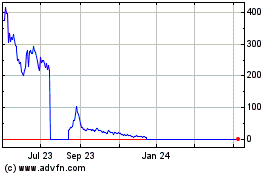

SinglePoint (QB) (USOTC:SING)

Historical Stock Chart

From Apr 2023 to Apr 2024