UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant To Section 14(a) Of The

Securities Exchange Act Of 1934

Filed by the Registrant

þ

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

|

¨

|

Preliminary Proxy Statement

|

|

|

|

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

|

|

þ

|

Definitive Proxy Statement

|

|

|

|

|

|

|

¨

|

Definitive Additional Materials

|

|

|

|

|

|

|

¨

|

Soliciting Material under Rule 14a-12

|

Five Point Holdings, LLC

(Name of the Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

April 26, 2019

Dear Shareholder:

You are cordially invited to attend the 2019 annual meeting of shareholders (the "

Annual Meeting

") of Five Point Holdings, LLC, a Delaware limited liability company, to be held on June 6, 2019 at 1:00 p.m. local time at our corporate offices, located at 15131 Alton Parkway, Irvine, California 92618.

At the Annual Meeting, you will be asked to: (i) elect each of Richard Beckwitt, William Browning and Michael Rossi as Class I directors to serve for a three-year term expiring at our 2022 annual meeting of shareholders; (ii) approve the amendment and restatement of the Five Point Holdings, LLC 2016 Incentive Award Plan; (iii) ratify the selection of Deloitte & Touche LLP as our independent registered public accountants for the year ending December 31, 2019; and (iv) transact such other business as may properly come before the Annual Meeting. The accompanying Notice of Annual Meeting of Shareholders and proxy statement describe these matters. We urge you to read this information carefully.

Our Board of Directors unanimously believes that the election of its three nominees to serve as our directors, the amendment and restatement of the Five Point Holdings, LLC 2016 Incentive Award Plan, and the ratification of our Audit Committee’s selection of independent registered public accountants are in the best interests of the Company and our shareholders and, accordingly, recommends a vote "

FOR

" the election of each of Richard Beckwitt, William Browning and Michael Rossi, a vote "

FOR

" the approval of the amendment and restatement of the Five Point Holdings, LLC 2016 Incentive Award Plan and a vote "

FOR

" the ratification of the selection of Deloitte & Touche LLP as our independent registered public accountants for the year ending December 31, 2019.

Your vote matters, and it is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. You may vote on the Internet or, if you are receiving a paper copy of the proxy statement, by telephone or by completing and mailing a proxy card. Voting over the Internet, by telephone or by written proxy will ensure your shares are represented at the Annual Meeting.

Thank you for your continued support and participation.

Sincerely,

Emile K. Haddad

Chairman, Chief Executive Officer and President

15131 Alton Parkway, 4th Floor, Irvine, California 92618

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 6, 2019

The 2019 annual meeting of shareholders (the "

Annual Meeting

") of Five Point Holdings, LLC, a Delaware limited liability company (the "

Company

"), will be held on June 6, 2019 at 1:00 p.m. local time at our corporate offices, located at 15131 Alton Parkway, Irvine, California 92618 for the following purposes:

1.

To re-elect each of Richard Beckwitt, William Browning and Michael Rossi to the Company’s Board of Directors (the "

Board

") for a three-year term expiring at the 2022 annual meeting of shareholders or until their successors are duly elected and qualified or until earlier resignation or removal. All three individuals so nominated and named in the proxy statement are currently members of the Company’s Board.

2.

To approve the amendment and restatement of the Five Point Holdings, LLC 2016 Incentive Award Plan.

3.

To ratify the selection of Deloitte & Touche LLP as our independent registered public accountants for the year ending December 31, 2019.

4.

To transact such other business as may properly come before the Annual Meeting or any continuation, adjournment or postponement thereof.

The proxy statement accompanying this notice describes each of these items of business in more detail. The Board recommends a vote "

FOR

" each of the three (3) nominees for director named in the proxy statement, "

FOR

" the amendment and restatement of the Five Point Holdings, LLC 2016 Incentive Award Plan and "

FOR

" the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm.

Only holders of record of the Company's Class A common shares and Class B common shares as of the close of business on April 9, 2019 are entitled to notice of, to attend and to vote at the Annual Meeting.

It is important that your shares be represented and voted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we encourage you to submit your proxy as soon as possible using one of the following methods: (i) by granting your proxy electronically via the Internet by following the instructions on the Notice of Internet Availability of Proxy Materials or voting instruction form previously mailed to you; or (ii) if you are receiving a paper copy of the proxy statement, by signing, dating and returning by mail the proxy card or voting instruction form provided to you or following the voting instructions on the proxy card or voting instruction form, as applicable.

By order of the Board of Directors,

Michael A. Alvarado

Chief Legal Officer, Vice President and Secretary

Important Notice Regarding the Availability of Proxy Materials for the 2019 Annual Meeting of Shareholders to be Held on June 6, 2019.

The Notice of Annual Meeting, the Proxy Statement, our 2018 Annual Report and a sample proxy card are available at

www.proxyvote.com

.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 6, 2019

TABLE OF CONTENTS

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held on June 6, 2019

INFORMATION CONCERNING VOTING AND SOLICITATION

General

Your proxy is solicited on behalf of the board of directors (our "

Board

") of Five Point Holdings, LLC, a Delaware limited liability company (as used herein, the "

Company

," "

we

," "

us

" or "

our

"), for use at our 2019 Annual Meeting of Shareholders to be held on June 6, 2019 at 1:00 p.m. local time at the Company's corporate offices, located at 15131 Alton Parkway, Irvine, California 92618, or at any continuation, postponement or adjournment thereof (the "

Annual Meeting

"), for the purposes discussed in this proxy statement and in the accompanying Notice of Annual Meeting of Shareholders and any other business properly brought before the Annual Meeting. Proxies are solicited to give all shareholders of record an opportunity to vote on matters properly presented at the Annual Meeting.

We have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the "

Notice

") to our shareholders of record, while brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar notice. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. On or about April 26, 2019, we intend to make this proxy statement available on the Internet and to mail the Notice to all shareholders entitled to vote at the Annual Meeting. We intend to mail this proxy statement, together with a proxy card, to those shareholders entitled to vote at the Annual Meeting who have properly requested paper copies of such materials, within three business days of such request.

Some banks, brokers and other nominee record holders may be participating in the practice of "householding" proxy materials. This means that only one copy of our proxy materials or the Notice, as applicable, may have been sent to multiple shareholders in the same house. We will promptly deliver a separate Notice and, if requested, a separate proxy statement and annual report, to each shareholder that makes a request using the procedure set forth on the Notice.

Important Notice Regarding the Availability of Proxy Materials for the 2019 Annual Meeting of Shareholders to be Held on June 6, 2019.

The Notice of Annual Meeting, this proxy statement, our 2018 Annual Report and a sample proxy card are available at

www.proxyvote.com

. You are encouraged to access and review all of the important information contained in the proxy materials before voting.

Who Can Vote, Outstanding Shares

You are entitled to vote if you were a shareholder of record of either our Class A common shares or our Class B common shares (referred to collectively herein as "

Common Shares

") as of the close of business on April 9, 2019 (the "

Record Date

"). As of the close of business on the Record Date, 68,746,555 of our Class A common shares and 79,275,234 of our Class B common shares were outstanding. Holders of Common Shares as of the Record Date are entitled to one vote for each Common Share held on all matters to be voted upon at the Annual Meeting. Your shares may be voted at the Annual Meeting only if you are present in person or represented by a valid proxy.

Voting of Shares

Any shareholder as of the Record Date may vote by attending the Annual Meeting and voting in person or by submitting a proxy. The method of voting by proxy differs (1) depending on whether you are viewing this proxy statement on the Internet or receiving a paper copy and (2) for shares held as a record holder and shares held in "street name."

Record Holders

. If you hold your shares as a record holder and you are viewing this proxy statement on the Internet, you may vote by submitting a proxy over the Internet by following the instructions on the website referred to in the Notice previously mailed to you. You may request paper copies of the proxy statement and proxy card by following the instructions on the Notice. If you hold your shares as a record holder and you are reviewing a paper copy of this proxy statement, you may vote your shares by completing, dating and signing the proxy card that was included with the proxy statement and promptly returning it in the pre-addressed, postage paid envelope provided to you, or by submitting a proxy over the Internet or by telephone by following the instructions on the proxy card.

Street Name

. If you hold your shares in street name, which means your shares are held of record by a broker, bank or nominee, you will receive a notice from your broker, bank or other nominee that includes instructions on how to vote your shares. Your broker, bank or nominee will allow you to deliver your voting instructions over the Internet and may also permit you to vote by telephone. In addition, you may request paper copies of the proxy statement and proxy card from your broker by following the instructions on the Notice provided by your broker.

Shareholders may provide voting instructions by telephone by calling toll free 1-800-690-6903 from the U.S. or Canada, or via the Internet at

www.proxyvote.com

at any time before 11:59 p.m. Eastern Time on June 5, 2019. Telephone and Internet voting access is available 24 hours a day, 7 days a week until 11:59 p.m. Eastern Time on June 5, 2019. Please have your notice and proxy control number in hand when you telephone or visit the website. If you vote through the Internet, you should be aware that you may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers and that these costs must be borne by you. If you vote by Internet or telephone, then you need not return a written proxy card by mail.

YOUR VOTE IS VERY IMPORTANT.

You should submit your proxy even if you plan to attend the Annual Meeting. If you properly give your proxy and submit it to us in time to vote, one of the individuals named as your proxy will vote your shares as you have directed.

All shares entitled to vote and represented by properly submitted proxies (including those submitted electronically, telephonically and in writing) received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. If, as a record holder, you do not indicate your voting directions on your signed proxy, your shares will be voted according to the recommendation of our Board, as follows:

|

|

|

|

•

|

"

FOR

" the election of each of Richard Beckwitt, William Browning and Michael Rossi to the Board for a three-year term expiring at our 2022 annual meeting of shareholders;

|

|

|

|

|

•

|

"

FOR

" the approval of the Five Point Holdings, LLC Amended and Restated 2016 Incentive Award Plan; and

|

|

|

|

|

•

|

"

FOR

" the ratification of the selection of Deloitte & Touche LLP as our independent registered public accountants for the year ending December 31, 2019.

|

The proxy gives each of Emile Haddad and Michael Alvarado discretionary authority to vote your shares in accordance with his best judgment with respect to all additional matters that might come before the Annual Meeting and any continuation, postponement or adjournment of the Annual Meeting. If you hold your shares in street name and do not give direction to your broker on how to vote your shares, your broker does not have authority to vote on the election of the directors or the amendment and restatement of the Five Point Holdings, LLC 2016 Incentive Award Plan. Your broker does have discretion to vote on the ratification of the selection of the independent auditors.

Revocation of Proxy

If you are a shareholder of record, you may revoke your proxy at any time before your proxy is voted at the Annual Meeting by taking any of the following actions:

|

|

|

|

•

|

delivering to our secretary a signed written notice of revocation, bearing a date later than the date of the proxy, stating that the proxy is revoked;

|

|

|

|

|

•

|

signing and delivering a new paper proxy, relating to the same shares and bearing a later date than the original proxy;

|

|

|

|

|

•

|

authorizing another proxy by telephone or over the Internet (your most recent telephone or Internet authorization will be used); or

|

|

|

|

|

•

|

attending the Annual Meeting and voting in person.

|

Attendance at the Annual Meeting will not, by itself, revoke a proxy. Written notices of revocation and other communications with respect to the revocation of the Company proxies should be addressed to the mailing address of our principal executive offices and must be received prior to the Annual Meeting:

Five Point Holdings, LLC

15131 Alton Parkway, 4th Floor

Irvine, California 92618

Attn: Secretary

If your shares are held in "street name," you may change your vote by submitting new voting instructions to your broker, bank or other nominee. You must contact your broker, bank or other nominee to find out how to do so. See "voting in person" below regarding how to vote in person if your shares are held in street name.

Attending the Annual Meeting

Shareholders who wish to attend the Annual Meeting will be required to present: (1) verification of ownership of our Common Shares, such as a bank or brokerage firm account statement showing your ownership of the shares as of the record date or a letter from the broker or other nominee confirming your ownership; and (2) a valid government-issued picture identification, such as a driver’s license or passport. No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Annual Meeting.

Voting in Person

If you plan to attend the Annual Meeting and wish to vote in person, you will be given a ballot at the Annual Meeting. Please note, however, that if your shares are held in "street name," which means your shares are held of record by a broker, bank or other nominee, and you wish to vote at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the record holder of the shares, which is the broker or other nominee, authorizing you to vote at the Annual Meeting.

Quorum and Votes Required

All votes will be tabulated by the inspector of elections appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes and abstentions. The inspector of elections will also determine whether a quorum is present. A majority in voting power of the outstanding shares entitled to vote, present in person, or represented by proxy, will constitute a quorum at the Annual Meeting. Shares held by persons attending the Annual Meeting but not voting, shares represented by proxies that reflect abstentions as to a particular proposal, and broker "non-votes" will be counted as present for purposes of determining a quorum.

Brokers or other nominees who hold shares in "street name" for a beneficial owner of those shares typically have the authority to vote in their discretion on "routine" proposals when they have not received instructions from beneficial owners. However, without specific instruction from the beneficial owner, brokers or other nominees are not allowed to exercise their voting discretion with respect to the election of directors or for the approval of matters which are considered to be "non-routine." These non-voted shares are referred to as "broker non-votes." Only Proposal 3 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter. Proposal 1 (election of directors) and Proposal 2 (approving the amendment and restatement of the Five Point Holdings, LLC 2016 Incentive Award Plan) are considered non-routine matters, and without your instruction, your broker or other nominee cannot vote your shares. Broker non-votes are not considered as having voted for purposes of determining the outcome of a vote. Abstentions may be specified for all proposals except the election of directors, but your vote may be "withheld" in the election of directors. Shareholder approval of each proposal requires the following votes:

|

|

|

|

•

|

Proposal 1 - Election of Directors

. Directors will be elected by a plurality of the votes cast. Thus, the three nominees receiving the highest number of shares voted "FOR" their election will be elected. Abstentions will not be counted in determining which nominees received a plurality of votes cast since abstentions do not represent votes cast for or against a candidate. Brokers do not have discretionary authority to vote on the election of directors. Broker non-votes will not affect the outcome of the election of directors because brokers are not able to cast their votes on this proposal.

|

|

|

|

|

•

|

Proposal 2 - Approval of the Five Point Holdings, LLC Amended and Restated 2016 Incentive Award Plan

. The affirmative vote of a majority of the votes cast by shareholders entitled to vote is required for the approval of the Five Point Holdings, LLC Amended and Restated 2016 Incentive Award Plan (meaning that of the shares represented at the meeting and entitled to vote, a majority of them must be voted "FOR" the proposal for it to be approved). Abstentions will have the same effect as voting against this proposal because they represent shares present in person or by proxy and entitled to vote. Brokers do not have discretionary authority to vote on this proposal. Broker non-votes will not affect the outcome of this election because brokers are not entitled to cast their votes on this proposal.

|

|

|

|

|

•

|

Proposal 3 - Ratification of the Selection of Our Independent Auditors

. The affirmative vote of a majority of the votes cast by shareholders entitled to vote is required for the ratification of the selection of Deloitte & Touche LLP as our independent auditors (meaning that of the shares represented at the meeting and entitled to vote, a majority of them must be voted "FOR" the proposal for it to be approved). Abstentions will have the same effect as voting against this proposal because they represent shares present in person or by proxy and entitled to vote. Brokers have discretionary authority to vote on the ratification of our independent auditors, thus broker

|

non-votes are generally not expected to result from the vote on this proposal but shall be counted for purposes of determining a quorum.

Solicitation of Proxies

Our Board is soliciting proxies for the Annual Meeting from our shareholders. We will bear the entire cost of soliciting proxies from our shareholders. In addition to the solicitation by mail, the Company, our officers, employees and agents may solicit proxies by telephone, by facsimile, by email or in person. We do not expect to use a proxy solicitor to assist in the solicitation of proxies for the Annual Meeting. Copies of solicitation materials will be furnished to banks, brokers, fiduciaries and custodians holding shares in their names that are beneficially owned by our shareholders, so they may forward the solicitation materials to the beneficial owners and secure those beneficial owners’ voting instructions. We may reimburse persons representing beneficial owners for their costs of forwarding the solicitation materials to the beneficial owners.

Shareholder List

A list of shareholders entitled to vote at the Annual Meeting will be available for examination by any shareholder for any purpose germane to the Annual Meeting during ordinary business hours at our corporate offices located at 15131 Alton Parkway, 4th Floor, Irvine, California 92618 for the ten days prior to the Annual Meeting and also at the Annual Meeting.

Explanatory Note

The Company closed its initial public offering ("

IPO

") on May 15, 2017. We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to companies that are not "emerging growth companies." These provisions include, among other matters:

|

|

|

|

•

|

an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting;

|

|

|

|

|

•

|

reduced disclosure about our executive compensation arrangements and an exemption from the requirement to include a Compensation Discussion and Analysis section in this proxy statement; and

|

|

|

|

|

•

|

an exemption from the requirement to seek non-binding advisory votes on executive compensation.

|

We will remain an "emerging growth company" until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our IPO (December 31, 2022), (b) in which we have total annual gross revenue of at least $1.07 billion or (c) in which we are deemed to be a large accelerated filer, which means, among other things, that the market value of our Class A common shares held by non-affiliates is at least $700 million as of the last business day of our most recently completed second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Forward-Looking Statements

This proxy statement contains "forward-looking statements" (as defined in the Private Securities Litigation Reform Act of 1995). These statements are based on our current expectations and involve risks and uncertainties, which may cause results to differ materially from those set forth in the statements. The forward-looking statements may include statements regarding actions to be taken by us. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Forward-looking statements should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the risk factors in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2018 and in our subsequent Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

PROPOSAL 1

ELECTION OF DIRECTORS

Board Structure and Nominees

Pursuant to the terms of our Second Amended and Restated Limited Liability Company Agreement (our "

Operating Agreement

"), the Board shall consist of between three (3) and thirteen (13) directors with the exact number of directors to be fixed exclusively by the Board. The Board last fixed the authorized number of directors at thirteen (13). We currently have eleven (11) directors and two (2) vacant Board seats. The vacant Board seats resulted from the resignation of two Class I directors immediately prior to our IPO in May 2017. The directors are divided into three classes: Class I, which currently consists of two directors and two vacancies; Class II, which currently consists of five directors; and Class III, which currently consists of four directors. Each director serves a term of three years. At each annual meeting of shareholders, the term of one class expires. The term of the Class I directors expires at this Annual Meeting.

The Nominating and Corporate Governance Committee and the Board have determined to rebalance the number of directors in each Board class in order to make the class sizes of approximately equal size in accordance with the requirements of our Operating Agreement and the New York Stock Exchange ("

NYSE

"). As current Class I directors, the Board seats of Messrs. Beckwitt and Browning will expire at the Annual Meeting. The Nominating and Corporate Governance Committee and the Board have determined to nominate Mr. Rossi (currently a Class II director) to be elected to fill one of the current Class I vacancies. In connection with the Annual Meeting, the Nominating and Corporate Governance Committee and the Board intends to (i) maintain the size of the Board at thirteen (13) directors, (ii) reclassify Mr. Rossi from a Class II to a Class I director, which is contingent upon Mr. Rossi's election as a Class I director, and (iii) maintain one vacant Class I seat and one vacant Class II seat, such that following the annual meeting there will be three Class I directors with one vacant seat, four Class II directors with one vacant seat, and four Class III directors.

If elected, Messrs. Beckwitt, Browning and Rossi would each serve a three-year term expiring at the close of our 2022 Annual Meeting or until their successors are duly elected. Biographical information on each of the nominees is furnished below under "Director Biographical Information."

Set forth below is information as of April 9, 2019 regarding each of our directors, including each director nominee.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Position

|

|

Class

|

|

Director

Since

|

|

Term

Expires

|

|

Emile Haddad

|

|

60

|

|

Chairman, President and Chief Executive Officer

|

|

III

|

|

2009

|

|

2021

|

|

Rick Beckwitt

|

|

60

|

|

Director

|

|

I

|

|

2016

|

|

2019

|

|

Kathleen Brown

(1) (3)

|

|

73

|

|

Director

|

|

II

|

|

2016

|

|

2020

|

|

William Browning

(1)

(3)

|

|

65

|

|

Director

|

|

I

|

|

2016

|

|

2019

|

|

Evan Carruthers

(2)

|

|

40

|

|

Director

|

|

III

|

|

2009

|

|

2021

|

|

Jonathan Foster

(3)

(4)

|

|

58

|

|

Director

|

|

III

|

|

2016

|

|

2021

|

|

Gary Hunt

|

|

70

|

|

Director

|

|

II

|

|

2016

|

|

2020

|

|

Jon Jaffe

|

|

59

|

|

Director

|

|

II

|

|

2009

|

|

2020

|

|

Stuart Miller

|

|

61

|

|

Director

|

|

III

|

|

2016

|

|

2021

|

|

Michael Rossi*

(2) (4) (5)

|

|

75

|

|

Director

|

|

II

|

|

2016

|

|

2020

|

|

Michael Winer

(1) (2)

(4)

|

|

63

|

|

Director

|

|

II

|

|

2009

|

|

2020

|

* Mr. Rossi has been nominated for election as a Class I director at the Annual Meeting. Accordingly, if Mr. Rossi is elected as a Class I director, he will cease to serve as a Class II director.

(1) Current member of our Audit Committee

(2) Current member of our Compensation Committee

(3) Current member of our Conflicts Committee

(4) Current member of our Nominating and Corporate Governance Committee

(5) Current Lead Independent Director

The directors listed above were selected in accordance with the terms of a voting and standstill agreement that we entered into with certain of our pre-IPO shareholders (including Mr. Haddad, Lennar Corporation ("

Lennar

") and entities affiliated with Castlelake, L.P. ("

Castlelake

")). The parties to this agreement agreed to take all actions reasonably necessary to cause our Board to consist of the following thirteen (13) directors: (i) one director designated by Mr. Haddad (Mr. Haddad); (ii) one director designated by the entities affiliated with Castlelake (Mr. Carruthers); (iii) three directors designated by Lennar (Messrs. Miller, Beckwitt and Jaffe); (iv) three directors designated by the group of other pre-IPO shareholders (Mr. Winer,

Daniel Pine and Joshua Kirkham); and (v) five directors designated by the Nominating and Corporate Governance Committee of our Board (Ms. Brown and Messrs. Hunt, Browning, Foster and Rossi). On April 12, 2017, Messrs. Pine and Kirkham resigned as directors, effective as of the day prior to the date on which our registration statement for the IPO became effective. These arrangements with respect to election of directors terminated upon completion of the IPO.

Board Recommendation

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE "

FOR

" EACH OF THE THREE NAMED DIRECTOR NOMINEES. UNLESS YOU GIVE CONTRARY INSTRUCTIONS, THE SHARES REPRESENTED BY YOUR RETURNED EXECUTED PROXY WILL BE VOTED "

FOR

" EACH OF THE THREE NAMED DIRECTOR NOMINEES.

Director Biographical Information

The following biographical information is furnished with regard to our directors (including nominees) as of April 9, 2019.

Nominees for Election at the Annual Meeting to Serve for a Three-Year Term Expiring at the 2022 Annual Meeting of Shareholders

Rick Beckwitt

. Mr. Beckwitt has been a member of our Board since May 2016. Mr. Beckwitt has been the Chief Executive Officer and a director of Lennar, one of the nation’s largest homebuilders, since April 2018. Before that he served as President from April 2011 to April 2018 and as Executive Vice President of Lennar from March 2006 to 2011. Mr. Beckwitt is one of three directors designated prior to our IPO by Lennar, which is our largest investor. Since September 2014, Mr. Beckwitt has served as a director of Eagle Materials Inc., a manufacturer and distributor of building materials, and currently serves on its audit committee. Mr. Beckwitt was selected to serve on our Board because of his strong business and leadership experience and his service as a director on two publicly traded companies in the real estate and construction products industry.

William Browning

. Mr. Browning has been a member of our Board since May 2016. Mr. Browning has dedicated his time to serving on boards of directors since January 2012. From 1999 to January 2012, Mr. Browning was a senior client service partner at Ernst & Young LLP, a global leader in assurance, tax, transaction and advisory services. From 2008 to 2012, Mr. Browning served as the managing partner for Ernst & Young LLP’s Los Angeles office, which at the time of his departure was Ernst & Young LLP’s second largest practice in the Americas and the largest public accounting firm in Los Angeles with over 1,200 professionals and over $400 million in annual revenues. Mr. Browning’s extensive industry sector experience includes real estate and REITs, financial services (commercial banks, asset management, consumer finance, credit card and mortgage companies), private equity, energy (upstream/downstream, refining and natural gas), engineering and construction, and technology. Before joining Ernst & Young LLP, Mr. Browning began his professional career with Arthur Andersen & Co. in 1976, where he was admitted to partnership in 1987 and named office managing partner of its Oklahoma office in 1994. At Arthur Andersen & Co. in Oklahoma and in Los Angeles, California, Mr. Browning served clients in a wide variety of industries and led the firm’s domestic banking practice and regulatory compliance practice. Mr. Browning also serves on the board of directors of (i) Ares Commercial Real Estate Corporation, a specialty finance company that is primarily focused on directly originating, managing and servicing a diversified portfolio of commercial real estate debt-related investments, (ii) McCarthy Holdings, the holding company for McCarthy Building Companies, Inc., one of the top 10 U.S. commercial builders and the oldest American construction company, (iii) Parsley Energy, Inc., an independent oil and natural gas company, and (iv) Blackbrush Oil and Gas LP, an independent oil and gas exploration and development company. Mr. Browning is also an adjunct professor at Southern Methodist University in Dallas, Texas. Mr. Browning volunteers on the Dallas Summer Musicals board. Mr. Browning holds a B.B.A. from the University of Oklahoma and is a certified public accountant in Oklahoma. Mr. Browning’s experience in accounting and auditing, including in the real estate and REIT industries, provides our Board and, specifically, the Audit Committee, with valuable knowledge, insight and experience in such matters.

Michael Rossi

. Mr. Rossi has been a member of our Board since May 2016. Mr. Rossi has been the chairman and chief executive officer of Shorenstein Properties LLC since 2015. Prior to assuming the role of chairman, Mr. Rossi was a founding member of the company’s advisory board and served as a consultant to the company from 1994 to 2015, focusing on succession planning, business planning, compensation practices and organizational development. Mr. Rossi is a retired vice chairman of BankAmerica Corporation, serving from 1993 to 1997. Prior to serving as vice chairman, Mr. Rossi was BankAmerica’s chief credit officer. Prior to that post, he held various executive positions. From 2005 to 2007, Mr. Rossi was chairman and CEO of Aozora Bank, taking it public in November 2006. He also spent eight months as chairman of GMAC/ResCap. Mr. Rossi is the senior advisor to the San Francisco 49ers, senior advisor for Jobs and Economic Development for the Governor of the State of California and chairman of the California Workforce Development Board. He is a former chairman of the board of the Monterey Institute of International Studies, Lifesavers, the California Infrastructure and Economic Development Bank, Visit California, the American Diabetes Association of California and Claremont Graduate University. He

also served on the President’s Campaign Cabinet for the University of California at Berkeley, was a member of the board of the Special Olympics Committee of Northern California, the Thunderbird School of Global Management, the California High Speed Rail Authority, the National Urban League, North Hawaii Community Hospital, Pulte Homes, Del Webb Corporation and Union Pacific Resources, a member of the nominating committee of the Bankers Association for Foreign Trade (BAFT) and a past president of the board of BAFT. Mr. Rossi earned a B.A. from the University of California at Berkeley. Mr. Rossi was selected to serve on our Board because of his vast business and corporate governance experience with banking institutions, public agencies and other private sector companies.

Directors Continuing in Office Until the 2020 Annual Meeting of Shareholders

Kathleen Brown

. Ms. Brown has been a member of our Board since May 2016. She is a partner of the law firm Manatt, Phelps & Phillips, LLP. Prior to joining Manatt in September 2013, she worked at Goldman Sachs Group, Inc., a global investment banking and securities firm, in various leadership positions for 12 years. From 2011 to 2013, Ms. Brown served as the chairman of investment banking for Goldman’s Midwest division in Chicago and was managing director and head of the firm’s Los Angeles-based western region public sector and infrastructure group from 2003 to 2011. From 1995 to 2000, Ms. Brown was a senior executive at Bank of America where she served in various positions, including President of the Private Bank. She served as California state treasurer from 1991 to 1995. Ms. Brown currently serves on the boards of directors of Sempra Energy, Stifel Financial Corp. and Renew Financial, and she is a former director of Forestar Group, Inc. Additionally, Ms. Brown serves on the board of the California Chamber of Commerce. She is a member of the Stanford Center on Longevity Advisory Board, the Council on Foreign Relations, the Investment Committee for the Annenberg Foundation and the UCLA Medical Center Advisory Board. Ms. Brown has extensive experience in both the public and private financial sectors, as well as in-depth knowledge of California government processes. Her knowledge of the law and experience as a partner at Manatt gives her insight into the effect of laws and regulations on our businesses. This combination of public and private financial experience, legal experience and public service in the State of California makes her a valuable member of our Board.

Gary Hunt

. Mr. Hunt has been a member of our Board since May 2016. Mr. Hunt has over 31 years of experience in real estate. He spent 25 years with The Irvine Company, one of the nation’s largest master planning and land development organizations, serving 10 years as its Executive Vice President and as a member of its Board of Directors and Executive Committee. Mr. Hunt led The Irvine Company’s major entitlement, regional infrastructure, planning, legal and strategic government relations, as well as media and community relations activities. As a founding Partner in 2001 and now the Vice Chairman of California Strategies, LLC, Mr. Hunt serves as a Senior Advisor to some of the largest master-planned community and real estate developers on the west coast, including Tejon Ranch and Lewis Group of Companies. Mr. Hunt currently serves as lead independent director at William Lyon Homes and chairs its nominating and corporate governance committee. Mr. Hunt also currently serves on the boards of Glenair Corporation, Psomas and University of California, Irvine Foundation and is the former Chairman of CT Realty. He was the founding chairman of Kennecott Land Company’s Advisory Board, formerly a Senior Advisor to Strategic Hotels and Resorts REIT and Inland American Trust REIT, and was a member and lead independent director of Grubb & Ellis Corporation and for sixteen months served as interim President and CEO. Mr. Hunt was selected to serve on our Board because of his government, public policy and major land use planning, entitlement and development experience.

Jon Jaffe

. Mr. Jaffe has been a member of our Board since 2009. Mr. Jaffe has been the President and a director of Lennar, one of the nation’s largest homebuilders, since April 2018. Before that he served as Lennar's Chief Operating Officer from December 2004 to January 2019. He has had principal responsibility for Lennar’s activities in California and elsewhere in the western United States. Mr. Jaffe is one of three directors designated prior to our IPO by Lennar, which is our largest investor. Mr. Jaffe was selected to serve on our Board because of his extensive experience in the operational aspects of our industry and his experience serving as an executive officer of a publicly traded homebuilding company.

Michael Winer

. Mr. Winer has been a member of our Board since 2009. Mr. Winer was employed by Third Avenue Management LLC (or its predecessor) from May 1994 through February 2018, where he was a senior member of the investment team. Mr. Winer managed the Third Avenue Real Estate Value Fund since its inception in 1998 and the Third Avenue Real Estate Opportunities Fund, L.P. since its inception in 2006. Mr. Winer retired from Third Avenue Management LLC on February 28, 2018. Since 2001, Mr. Winer has been a director of Tejon Ranch Company, a New York Stock Exchange listed company involved in real estate development and agribusiness. Mr. Winer currently serves as Chair of the Board’s Nominating and Corporate Governance Committee and its Investment Policy Committee. He also serves on the Real Estate Committee and Audit Committee and has previously served on the Compensation Committee. Prior to joining Third Avenue Management’s predecessor in 1994, Mr. Winer was Vice President of the Asset Sales Group for Cantor Fitzgerald, L.P. where he was responsible for evaluating and underwriting portfolios of distressed real estate loans. Prior to that, he was a First Vice President of Society for Savings, a Connecticut savings bank, and Director of Asset Management for Pioneer Mortgage, a financial institution, where he directed the workout, collection and liquidation of distressed real estate loan and asset portfolios. Earlier in his career, Mr. Winer was the Co-Founder and Chief Financial Officer of Winer-Greenwald Development, Inc., a California-based real estate development firm that specialized in the development, construction, ownership and management of

commercial properties. Mr. Winer previously held executive positions at Pacific Scene, Inc. and The Hahn Company, both California-based real estate development firms. Mr. Winer began his career in public accounting with Deloitte & Touche LLP (formerly Touche Ross & Co.) where he specialized in real estate development companies. Mr. Winer serves on the Board of Trustees of the Future Citizens Foundation (dba The First Tee of Monterey County). Mr. Winer received a Bachelor of Science in Accounting from San Diego State University in 1978 and is a California Certified Public Accountant (inactive). Mr. Winer was selected to serve on our Board because of his vast investing, finance and development experience in our industry.

Directors Continuing in Office Until the 2021 Annual Meeting of Shareholders

Evan Carruthers

. Mr. Carruthers has been a member of our Board since 2009. Mr. Carruthers has been with Castlelake, a private equity firm he co-founded in partnership with managing partner Rory O’Neill, as a partner and portfolio manager since 2005. In 2014, Mr. Carruthers was named managing partner of Castlelake. Mr. Carruthers is responsible for the firm’s global investment activities across all asset classes, guiding the firm’s relationship-driven approach and supervising all investment teams at Castlelake. Mr. Carruthers was designated to serve on our Board prior to our IPO by Castlelake. Prior to founding Castlelake, Mr. Carruthers was an investment manager with Cargill Value Investment, which is now Carval Investors ("CVI"), for three years, where he was responsible for corporate and asset-based investments in North America. Prior to joining CVI, Mr. Carruthers worked for Piper Jaffray, a Minneapolis-based investment banking firm, for three years in several capacities. Mr. Carruthers serves on the Board of Directors of Aedas Homes, S.A.U. Mr. Carruthers received a Bachelor of Arts degree from the University of St. Thomas, St. Paul, Minnesota in Business Administration. Mr. Carruthers was selected to serve on our Board because of his strong business acumen and strong record of success in corporate and asset-based investments.

Jonathan Foster

. Mr. Foster has been a member of our Board since May 2016. Mr. Foster is the Founder and has been a Managing Director of Current Capital Partners LLC, a mergers and acquisitions advisory, corporate management services, and private equity investing firm, since 2008. Previously, from 2007 until 2008, Mr. Foster served as a Managing Director and Co-Head of Diversified Industrials and Services at Wachovia Securities. From 2005 until 2007, he served as Executive Vice President-Finance and Business Development of Revolution LLC. From 2002 until 2004, Mr. Foster was a Managing Director of The Cypress Group, a private equity investment firm and from 2001 until 2002, he served as a Senior Managing Director and Head of Industrial Products and Services Mergers & Acquisitions at Bear Stearns & Co. From 1999 until 2000, Mr. Foster served as the Executive Vice President, Chief Operating Officer and Chief Financial Officer of Toysrus.com, Inc. Previously, Mr. Foster was with Lazard, primarily in mergers and acquisitions, for over ten years, including as a Managing Director. Mr. Foster is also a director of Lear Corp., Masonite International Corporation and Berry Plastics. Mr. Foster was previously a member of the boards of directors of Sabine Oil & Gas, Smurfit-Stone Container Corporation and Chemtura Corporation. Mr. Foster has a bachelor’s degree in Accounting from Emory University, a master’s degree in Accounting & Finance from the London School of Economics and has attended an Executive Education Program at Harvard Business School. Mr. Foster was selected to serve on our Board because of his extensive experience in equity investing and serving as an officer and director of public and private companies.

Emile Haddad

. Mr. Haddad has been our President and Chief Executive Officer and Chairman of our Board since May 2016. Mr. Haddad has been a member of our Board since 2009. From 2009 until May 2016, Mr. Haddad was President and Chief Executive Officer of the management company, which he co-founded, that managed the development of Great Park Neighborhoods and Valencia (formerly known as Newhall Ranch). In this capacity, Mr. Haddad has been primarily responsible for investing in and managing the planning, development and operational activities for Great Park Neighborhoods, Valencia, and Candlestick and The San Francisco Shipyard. Prior to co-founding the management company in 2009, Mr. Haddad served as the Chief Investment Officer of Lennar, one of the nation’s largest homebuilders, where he was in charge of the company’s real estate investments, asset management and several joint ventures. In this capacity, Mr. Haddad led the acquisition, capitalization and development of Great Park Neighborhoods, Valencia, and Candlestick and The San Francisco Shipyard. He is on the Real Estate Advisory Boards of the University of California, Irvine and the University of California, Berkeley. He is also a member of the USC Price School of Public Policy Board of Counselors and is the Chairman of the USC Lusk Center for Real Estate Advisory Board. In addition, Mr. Haddad serves on the board of directors of PBS (Public Broadcasting System) So-Cal and Aedas Homes, S.A.U. Mr. Haddad formerly served on the Board of Trustees at the University of California, Irvine Foundation and Claremont Graduate University. Mr. Haddad received a civil engineering degree from the American University of Beirut. Mr. Haddad was selected to serve on our Board based on his executive management experience in the real estate industry, his comprehensive knowledge of our business and our operations and his proven ability to successfully execute large-scale development projects.

Stuart A. Miller

. Mr. Miller has been a member of our Board since May 2016. Mr. Miller has served as a director of Lennar, one of the nation’s largest homebuilders, since April 1990 and has served as Lennar’s Executive Chairman since April 2018. Before that, Mr. Miller served as Lennar's Chief Executive Officer from April 1997 to April 2018. Mr. Miller also served as President of Lennar from April 1997 to April 2011. Mr. Miller is one of three directors designated prior to our IPO by Lennar, which is our largest investor. As of February 12, 2019, Mr. Miller and his family owned shares of Lennar common stock entitling him to cast approximately 33% of the combined votes that could be cast by all holders of Lennar common stock.

Mr. Miller was selected to serve on our Board because of his vast knowledge of the real estate industry and his extensive experience serving as a director of Lennar.

Family Relationships and Other Information

There are no family relationships between any of our directors or executive officers.

PROPOSAL 2

APPROVAL OF THE FIVE POINT HOLDINGS, LLC

AMENDED AND RESTATED 2016 INCENTIVE AWARD PLAN

Background

We are asking our shareholders to approve the Five Point Holdings, LLC Amended and Restated 2016 Incentive Award Plan (the "

Amended Plan

"), which amends and restates the Five Point Holdings, LLC 2016 Incentive Award Plan (the "

Prior Plan

") in its entirety. The Prior Plan was originally adopted by our Board on May 2, 2016. On April 12, 2019, our Board unanimously approved the Amended Plan, which will become effective upon shareholder approval. The Amended Plan makes the following material changes to the Prior Plan:

|

|

|

|

•

|

increases the number of shares authorized for issuance by 3,209,326 shares (the "

Share Reserve Increase

");

|

|

|

|

|

•

|

imposes a minimum twelve-month vesting period upon grant for all awards, provided that up to 5% of the shares available for issuance from and after the effective date of the Amended Plan may be granted without respect to such minimum vesting requirement;

|

|

|

|

|

•

|

provides that dividends and dividend equivalents may not be paid on awards subject to vesting conditions unless and until such conditions are met;

|

|

|

|

|

•

|

clarifies that shares underlying any issued share appreciation rights that are retained by the Company to account for the exercise price of such share appreciation rights are counted against the maximum number of shares available for issuance under the Amended Plan;

|

|

|

|

|

•

|

extends the term from May 2, 2026 through June 6, 2029; and

|

|

|

|

|

•

|

removes certain provisions that were required for awards to qualify for the performance-based compensation exception to the deduction limitation under Section 162(m) of the Internal Revenue Code (the "

Code

") prior to its repeal under the legislation commonly known as the Tax Cuts and Jobs Act of 2017.

|

If approved by our shareholders, the Amended Plan will become effective on the date of the Annual Meeting. A copy of the Amended Plan is included as

Appendix A

to this proxy statement.

Shareholder Approval Requirement

Approval of the Amended Plan will constitute approval pursuant to the NYSE shareholder approval requirements applicable to equity compensation plans and approval pursuant to the shareholder approval requirements of Section 422 of the Code relating to ISOs. If our shareholders do not approve the Amended Plan pursuant to this Proposal 2, then the proposed additional shares under the Share Reserve Increase will not become available for issuance and the Prior Plan will remain in effect without any of the changes contained in the Amended Plan.

Shares Available for Issuance

Under the Prior Plan, a total of 8,500,822 shares were authorized for issuance. As of April 9, 2019, (i) 3,247,109 shares have been issued and have vested and are no longer subject to forfeiture, (ii) 3,458,543 shares have been issued but are unvested and remain subject to forfeiture (and would thereafter be available for future issuance), and (iii) 1,795,170 shares remain available for issuance. If the Amended Plan is approved, the reserved shares would increase by 3,209,326 shares compared to the Prior Plan, which would increase the aggregate award limit under the Amended Plan from 8,500,822 shares to 11,710,148 shares. The incremental 3,209,326 shares, if approved, would, together with the 1,795,170 shares that are available for immediate issuance under the Prior Plan, provide for 5,004,496 shares being available for issuance immediately following approval of the Amended Plan. By increasing the share reserve, we will be able to continue to grant equity awards to help create long-term participation in the Company and, thereby, attract, retain, motivate and reward our employees, directors and consultants. The Board believes that the effective use of share-based long-term incentive compensation is vital to the Company's future performance and aligns the incentives of our employees, directors and consultants with the interests of the Company's shareholders. If our shareholders approve this Proposal 2, we anticipate we will have sufficient shares to provide us with enough shares for awards for approximately the next two years, assuming we continue to grant awards consistent with our current practices. Usage under the Amended Plan will also be dependent upon the price of our shares, hiring activity during the next few years and forfeitures of outstanding awards under the Prior Plan. We cannot predict our future equity grant practices,

the future price of our shares or future hiring activity with any degree of certainty at this time, and the share reserve under the Amended Plan could last for a shorter or longer period of time.

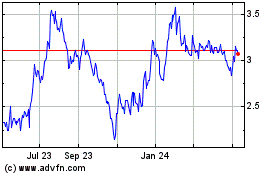

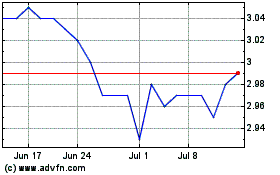

The table below summarizes the number of outstanding awards and the number of shares available under the Prior Plan as of April 9, 2019. The closing price of our Class A common shares on April 9, 2019 was $7.67.

|

|

|

|

|

|

|

Description of Shares

|

|

Number of Shares

|

|

Total shares available for grant under the Prior Plan, prior to the Share Reserve Increase

|

|

1,795,170

|

|

Total common shares outstanding

(1)

|

|

148,045,571

|

|

Outstanding unvested time-based awards

(2)

|

|

2,294,076

|

|

Outstanding unvested performance-based awards

(2)(3)

|

|

1,164,467

|

|

Total outstanding unvested time-based awards and performance-based awards

(3)

|

|

3,458,543

|

|

Outstanding unvested time-based awards issued in lieu of cash compensation

(4)

|

|

11,842

|

|

|

|

|

(1)

|

Consists of 68,746,555 outstanding Class A common shares, 41,404,961 Class A common shares issuable in exchange for an equal number of outstanding Class A units of Five Point Operating Company, LP, 37,870,273 Class A common shares issuable in exchange for an equal number of outstanding Class A units of The Shipyard Communities, LLC, and 23,782 Class A common shares issuable upon conversion of the 79,275,234 outstanding Class B common shares (at the conversion ratio of 0.0003).

|

|

|

|

|

(2)

|

Included in the 3,458,543 shares disclosed under "Total outstanding unvested time-based awards and performance-based awards."

|

|

|

|

|

(3)

|

Performance-based awards consist of restricted share awards at the target level, plus an additional 50% of the target level in the form of restricted share units ("

RSUs

"). Both the restricted share awards and RSUs are included in the number of shares issued in the table above. There are no options currently outstanding.

|

|

|

|

|

(4)

|

Reflects the number of unvested restricted shares issued to Mr. Winer in lieu of cash compensation payable to him for service on our Board. Such shares are included in the 2,294,076 shares disclosed under "Outstanding unvested time-based awards."

|

Background for the Determination of the Share Reserve Under the Amended Plan

In its determination to approve the Amended Plan, the Board was primarily motivated by a desire to ensure the Company has an available pool of shares from which to grant long-term equity incentive awards, which we believe is a primary incentive and retention mechanism for our employees, directors and consultants. In determining the number of shares by which to increase the reserve under the Amended Plan, the Board reviewed the Compensation Committee’s recommendations, which were based on an analysis prepared by and recommendations of The POE Group, Inc. ("

POE

"), the Compensation Committee’s independent compensation consultant.

In determining whether to approve the Amended Plan, including the Share Reserve Increase, our Compensation Committee and Board of Directors considered the following:

|

|

|

|

•

|

The number of shares to be reserved for issuance under the Amended Plan represents an increase of 3,209,326 shares from the aggregate number of shares reserved for issuance under the Prior Plan, resulting in a total of 5,004,496 shares being immediately available for issuance following approval of the Amended Plan.

|

|

|

|

|

•

|

The remaining reserve for future awards under the Prior Plan as of April 9, 2019 was 1,795,170 shares or 1.2% of our outstanding Class A common shares and Class B common shares. At the end of fiscal years 2017 and 2018, our total overhang rate attributable to the number of shares subject to equity compensation awards outstanding at the end of the fiscal year (calculated by dividing (1) the sum of the number of shares subject to equity awards that were unvested and outstanding at the end of the fiscal year plus shares remaining available for issuance for future awards at the end of the fiscal year by (2) the number of Class A common shares and Class B common shares outstanding at the end of the calendar year), was approximately 4.7% and 4.1%, respectively, and as of April 9, 2019 (calculated at April 9, 2019), it was approximately 3.5%.

|

|

|

|

|

•

|

In calendar years 2017 and 2018, equity awards representing a total of approximately 453,172 shares and 1,724,268 shares, respectively, were granted under the Prior Plan, all of which were granted as full value restricted share awards (and none were granted as options), for an annual equity burn rate of 0.3% and 1.2%, respectively. This level of equity awards represents a two-year average burn rate of 0.8%. Annual equity burn rate is calculated by dividing the number of Class A common shares subject to equity awards granted during the year by the number of Class A common shares and Class B common shares outstanding at the end of the year.

|

|

|

|

|

•

|

For 2019 through April 9, 2019, we granted equity awards under the Prior Plan covering a total of 2,286,819 shares, all of which were granted as full value restricted share awards or restricted share units and include 1,164,467 performance awards granted at the "maximum" performance level. We anticipate that this will be the majority of shares awarded for 2019. Our estimated annual burn rate for 2019 is 1.5%.

|

Other factors that shareholders may consider in evaluating the proposal to approve the Amended Plan include:

|

|

|

|

•

|

If we exhaust current share reserves under the Prior Plan without approval of the Amended Plan, we would lose an important compensation tool aligned with shareholder interests to attract, motivate and retain highly qualified talent.

|

|

|

|

|

•

|

If the Amended Plan is approved, we estimate that the proposed aggregate share reserve under the Amended Plan would be sufficient for approximately two years of awards, assuming we continue to grant awards consistent with our current practices and noting that future circumstances may require us to change our equity grant practices.

|

In evaluating the proposal to approve the Amended Plan, shareholders may also consider the provisions in the Amended Plan, which we believe are consistent with best practices in equity compensation and further protect our shareholders’ interests. Such provisions include:

|

|

|

|

•

|

Shares tendered by participants to satisfy the exercise price or tax withholding obligation with respect to any award will not be "added back" to the shares available for issuance under the Amended Plan. Shares subject to a share appreciation right that are not issued in connection with the share settlement of the share appreciation right on exercise, and shares purchased on the open market with the cash proceeds from the exercise of options are also not added back to the shares available for issuance under the Amended Plan.

|

|

|

|

|

•

|

Awards issued under the Amended Plan may not be repriced without shareholder approval.

|

|

|

|

|

•

|

Dividends and dividend equivalents may not be paid on awards subject to vesting conditions unless and until such conditions are met.

|

|

|

|

|

•

|

With certain exceptions, awards or portions of an award granted under the Amended Plan may not vest earlier than the first anniversary of the award's grant date.

|

|

|

|

|

•

|

The Amended Plan is administered by our Compensation Committee, which is composed entirely of independent directors.

|

In light of the factors described above, and the fact that the ability to continue to grant equity compensation is vital to our ability to continue to attract and retain employees in the competitive labor markets in which we compete, the Board has determined that the size of the share reserve under the Amended Plan is reasonable and appropriate at this time.

Description of the Amended Plan

The following sets forth a description of the material features and terms of the Amended Plan. The following summary is qualified in its entirety by reference to the full text of the Amended Plan, which is attached hereto as Appendix A.

Plan Administration

. The Compensation Committee of our Board is the administrator of the Amended Plan. The Compensation Committee is composed solely of non-employee directors, as defined under Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the "

Exchange Act

"), and "independent directors" within the meaning of the rules of the NYSE.

The Compensation Committee has the authority to, among other things:

|

|

|

|

•

|

construe and interpret the Amended Plan;

|

|

|

|

|

•

|

make rules and regulations relating to the administration of the Amended Plan;

|

|

|

|

|

•

|

designate eligible persons to receive awards;

|

|

|

|

|

•

|

establish the terms and conditions of awards; and

|

|

|

|

|

•

|

determine whether the awards or any portion thereof will contain time-based restrictions or performance-based restrictions, and, with respect to performance-based awards, the criteria for achievement of performance goals, as set forth in more detail below.

|

The Compensation Committee may delegate its authority to administer the Amended Plan from time to time, subject to certain limitations. Any references to Compensation Committee in this summary of the Amended Plan include any such delegatee.

Eligibility

. The Compensation Committee will designate those employees, consultants and non-employee directors who are to receive awards under the Amended Plan. As of March 31, 2019, there were 10 non-employee directors and approximately 175 employees and five consultants who would be eligible to receive awards under the Amended Plan.

Shares Authorized

. Subject to adjustment in the event of a merger, recapitalization, share split, reorganization or similar transaction, the maximum aggregate number of Class A common shares available for issuance under the Amended Plan is 11,710,148, all of which may be made subject to incentive share options, and the maximum aggregate number of incentive units of Five Point Operating Company, LP (the "

Operating Company

") (referred to as "

LTIP Units

") available for issuance under the Amended Plan is 11,710,148, less the number of Class A common shares made subject to awards (such that the maximum number of Class A common shares and LTIP Units available under the Amended Plan is 11,710,148). As of the date hereof, awards have been made under the Amended Plan with respect to 6,705,652 of our Class A common shares and no LTIP Units.

Our Class A common shares or LTIP Units that are subject to or underlie awards which expire or for any reason are canceled, terminated, forfeited, fail to vest or for any other reason are not paid or delivered under the Amended Plan will again be available for issuance in connection with future awards granted under the Amended Plan. Our Class A common shares or LTIP Units surrendered or withheld as payment of either the exercise price of an award or withholding taxes in respect of such an award will be counted against the Amended Plan limits and will not again be available for issuance in connection with future awards.

Individual Limits

. In respect of each participant who is not a non-employee director, the aggregate number of Class A common shares subject to options and share appreciation rights awarded during any calendar year may not exceed 631,912 Class A common shares, and the aggregate number of Class A common shares and LTIP Units made subject to awards other than options and share appreciation rights during any calendar year may not exceed 631,912 shares and LTIP Units in the aggregate. Each of these limits is subject to adjustment in the event of a merger, recapitalization, share split, reorganization or similar transaction.

Types of Awards

. The Amended Plan provides for the grant of share options, restricted shares, RSUs, performance awards (which include, but are not limited to, cash bonuses), distribution equivalent awards, deferred share awards, share payment awards, share appreciation rights, other incentive awards (which include, but are not limited to, LTIP Unit awards) and performance share awards.

Options.

Options to purchase Class A common shares may be granted alone or in tandem with share appreciation rights. A share option may be granted in the form of a non-qualified share option or an incentive share option (i.e., an incentive stock option within the meaning of Section 422 of the Code). All shares available under the Amended Plan may be made subject to incentive share options, but no incentive share options will be granted to any person who is not an employee of the Company, the Operating Company or a majority owned subsidiary corporation. The price at which a share may be purchased under an option (the "exercise price") will be determined by the Compensation Committee, but may not be less than the fair market value of our Class A common shares on the date the option is granted. The Compensation Committee may establish the term of each option, but no option may be exercisable after 10 years from the grant date. The amount of incentive share options that become exercisable for the first time in a particular year cannot exceed a value of $100,000 per participant, determined using the fair market value of the shares on the date of grant. No options have been granted under the Prior Plan through the date of this Proxy Statement.

An optionee generally will not recognize taxable income upon the grant of a nonqualified share option. Rather, at the time of exercise of such option, the optionee will recognize ordinary income for income tax purposes in an amount equal to the excess of the fair market value of the shares purchased over the exercise price. The employer will generally be entitled to a tax deduction at such time and in the same amount that the optionee recognizes ordinary income. An optionee will not recognize any ordinary income upon the grant or timely exercise of an incentive share option. Exercise of an incentive share option generally will be timely if made during its term and if the optionee remains an employee at all times during the period beginning on the date of grant and ending on the date three months before the date of exercise. The tax consequences of an untimely exercise of an incentive share option will be determined in accordance with the rules applicable to nonqualified share

options. If shares acquired pursuant to the exercise of an incentive share option are disposed of by the optionee prior to the expiration of two years from the date of grant or within one year from the date of exercise (a so-called "disqualifying disposition"), any gain realized by the optionee generally will be taxable at the time of such disqualifying disposition as follows: (i) at ordinary income rates to the extent of the difference between the exercise price and the lesser of the fair market value of the shares on the date the option is exercised or the amount realized on such disqualifying disposition; and (ii) if the stock is a capital asset of the optionee, as short-term or long-term capital gain (depending upon the length of time such shares were held by the optionee) to the extent of any excess of the amount realized on such disqualifying disposition over the sum of the exercise price and any ordinary income recognized by the optionee. In such case, the employer may claim an income tax deduction at the time of such disqualifying disposition for the amount taxable to the optionee as ordinary income.

SAR

s. Share appreciation rights ("

SARs

") may be granted either alone or in tandem with share options. The exercise price of a SAR must be equal to or greater than the fair market value of our Class A common shares on the date of grant. The Compensation Committee may establish the term of each SAR, but no SAR will be exercisable after 10 years from the grant date.

Restricted Shares/RSUs

. Restricted shares and RSUs may be issued to eligible participants, as determined by the Compensation Committee. The restrictions on such awards are determined by the Compensation Committee, and may include time based, performance-based and service-based restrictions. RSUs may be settled in cash, Class A common shares or a combination thereof. Holders of restricted shares will have voting rights during the restriction period. Holders of restricted shares and restricted share units will not receive distributions or distribution equivalents unless and until the underlying restricted shares or RSUs have vested.

Performance Awards

. Performance awards may be issued to any eligible individual, as deemed by the Compensation Committee. The value of performance awards may be linked to the performance criteria identified below, or to other specific criteria determined by the Compensation Committee. Performance awards may be paid in cash, shares or a combination of both, as determined by the Compensation Committee. Without limiting the generality of the foregoing, performance awards may be granted in the form of a cash bonus payable upon the attainment of objective performance goals or such other criteria as are established by the Compensation Committee.

Distribution Equivalent Awards

. Distribution equivalent awards may be granted either alone or in tandem with other awards, as determined by the Compensation Committee. Distribution equivalent awards are based on the distributions that are declared on our Class A common shares, to be credited as of the distribution payment dates during the period between the date that the distribution equivalent awards are granted and such dates that the distribution equivalent awards terminate or expire. If distribution equivalents are granted with respect to shares covered by another award, the distribution equivalent may be paid out at the time and to the extent that vesting conditions of the award shares are satisfied. Distribution equivalent awards can be converted to cash or Class A common shares by a formula determined by the Compensation Committee. Distribution equivalents are not payable with respect to share options or share appreciation rights unless otherwise determined by the Compensation Committee.

Share Payment Awards

. Share payments may be issued to eligible participants, as determined by the Compensation Committee. The number of shares of any share payment may be based upon performance criteria or any other specific criteria. Share payment awards may be made in lieu of base salary, bonus, fees or other cash compensation otherwise payable to such eligible individual.

Deferred Share Awards

. Deferred share awards may be issued to eligible participants, as determined by the Compensation Committee. The number of shares of deferred shares will be determined by the Compensation Committee and may be based on performance criteria or other specific criteria. Shares underlying a deferred share award which is subject to a vesting schedule or other conditions or criteria set up by the Compensation Committee will not be issued until such vesting requirements or other conditions or criteria, as applicable, have been satisfied. Unless otherwise provided by the Compensation Committee, a holder of a deferred share award will have no rights as a shareholder until the award has vested and the shares have been issued.

Performance Share Awards

. Performance share awards may be granted to any eligible individual who is selected by the Compensation Committee. Vesting of performance share awards may be linked to any one or more performance criteria or time-vesting or other criteria, as determined by the Compensation Committee.

Other Incentive Awards

. Other incentive awards may be issued to eligible participants, as determined by the Compensation Committee. Such other incentive awards may cover shares or the right to purchase shares or have a value derived from the value of, or an exercise or conversion privilege at a price related to, or otherwise payable in or based on shares, shareholder