Current Report Filing (8-k)

April 25 2019 - 4:36PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): April 24, 2019

|

TherapeuticsMD,

Inc.

|

|

(Exact

Name of Registrant as Specified in its Charter)

|

|

Nevada

|

|

001-00100

|

|

87-0233535

|

|

(State

or Other

Jurisdiction

of Incorporation)

|

|

(Commission File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

6800

Broken Sound Parkway NW, Third Floor

Boca

Raton, FL 33487

|

|

(Address

of Principal Executive Office) (Zip Code)

|

Registrant's

telephone number, including area code: (561) 961-1900

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230-405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

April 24, 2019, TherapeuticsMD, Inc., a Nevada corporation (the “Company”), entered into a Financing Agreement (the

“Financing Agreement”) with TPG Specialty Lending, Inc., as administrative agent (the “Administrative Agent”),

various lenders from time to time party thereto, and certain of the Company’s subsidiaries party thereto from time to time

as guarantors, which provides a $300 million first lien secured term loan credit facility (the “Facility”) to the

Company.

The

Facility provides for availability to the Company in three tranches: (i) $200 million was drawn by the Company upon entering into

the Financing Agreement; (ii) $50 million will be available to the Company upon the designation of the Company’s ANNOVERA

TM

product as a new category of birth control by the U.S. Food and Drug Administration on or prior to December 31, 2019 and

satisfaction (or waiver) of other customary conditions precedent; and (iii) $50 million will be available to the Company upon

the Company achieving $11 million in net revenues from the Company’s IMVEXXY®, BIJUVA

TM

, and ANNOVERA

TM

products for the fourth quarter of 2019 and satisfaction (or waiver) of other customary conditions precedent.

Borrowings

under the Facility will accrue interest, at the Company’s option, at either (i) 3-month LIBOR plus 7.75%, subject to a LIBOR

floor of 2.70% or (ii) the prime rate plus 6.75%, subject to a prime rate floor of 5.20%. Interest on amounts borrowed under the

Facility will be payable quarterly. The outstanding principal amount of the Facility will be payable in four equal quarterly installments

beginning on June 30, 2023, with the Facility maturing on March 31, 2024. The Company will also have the right to prepay borrowings

under the Facility in whole or in part at any time, subject to a prepayment fee on the principal amount being prepaid of (i) 30.0%

for the first two years following the initial funding date of the applicable borrowing; (ii) 5.0% for the third year following

the initial funding date of the applicable borrowing; (iii) 3.0% for the fourth year following the initial funding date of the

applicable borrowing; and (iv) 1.0% for the fifth year following the initial funding date of the applicable borrowing but prior

to March 31, 2024. The four scheduled quarterly principal installment payments are not subject to prepayment fees. In connection

with the initial borrowing under the Facility, the Company paid the Administrative Agent, for the benefit of the lenders, a facility

fee equal to 2.5% of the initial amount borrowed and will be required to pay such a facility fee in connection with any subsequent

borrowings under the Facility. The Company will also be required to pay the Administrative Agent and the lenders an annual administrative

fee in addition to other fees and expenses.

The

Financing Agreement contains customary mandatory prepayments, restrictions, and covenants applicable to the Company that are customary

for financings of this type. Among other requirements, the Company will be required to (i) maintain a minimum unrestricted cash

balance of $50 million, which will increase to $60 million if the Company draws either the second or third tranche of the Facility,

and (ii) achieve certain minimum consolidated net revenue amounts attributable to commercial sales of the Company’s IMVEXXY®,

BIJUVA

TM

, and ANNOVERA

TM

products beginning with the fourth quarter of 2020. The Financing Agreement also

includes other representations, warranties, indemnities, and events of default that are customary for financings of this type,

including an event of default relating to a change of control of the Company. Upon or after an event of default, the Administrative

Agent and the lenders may declare all or a portion of the Company’s obligations under the Financing Agreement to be immediately

due and payable and exercise other rights and remedies provided for under the Financing Agreement.

The

obligations of the Company and its subsidiaries under the Financing Agreement are secured, subject to customary permitted liens

and other agreed upon exceptions, by a first priority perfected security interest in all existing and after-acquired assets of

the Company and its subsidiaries. The obligations under the Financing Agreement will be guaranteed by each of the Company’s

future direct and indirect subsidiaries, subject to certain exceptions.

The

foregoing summary of the terms of the Financing Agreement does not purport to be complete and is subject to, and qualified in

its entirety by, the full text of the Financing Agreement, a copy of which will be filed as an exhibit to the Company’s

Quarterly Report on Form 10-Q for the quarter ending June 30, 2019.

Item 1.02 Termination

of a Material Definitive Agreement.

On April 24, 2019,

the Company terminated that certain Credit and Security Agreement, dated May 1, 2018, as amended (the “MidCap Agreement”),

between the Company, its subsidiaries party thereto, MidCap Financial Trust (“MidCap”), as administrative agent, and

the lenders party thereto. A portion of the initial tranche of borrowing under the Facility in the amount of approximately $81.7

million was used to repay all amounts outstanding under the MidCap Agreement, which included a prepayment fee of 4%, a repayment

fee of 4% and other fees and expenses payable to MidCap and the lenders under the MidCap Agreement.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On

April 24, 2019, the Company entered into the Financing Agreement. The description of the Financing Agreement set forth under Item

1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03 as if fully set forth herein.

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

The

description of the termination of the MidCap Agreement set forth under Item 1.02 of this Current Report on Form 8-K is hereby

incorporated by reference into this Item 2.04 as if fully set forth herein.

Item

7.01 Regulation FD Disclosure.

On

April 24, 2019, the Company issued a press release announcing that it had entered into the Financing Agreement. A copy of the

press release is attached as Exhibit 99.1 hereto.

The

information being furnished pursuant to Item 7.01 of this Current Report on Form 8-K and in Exhibit 99.1 hereto shall not be deemed

to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject

to the liabilities of that section, nor will any of such information or exhibits be deemed incorporated by reference into any

filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set

forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

Exhibit

Index

|

Exhibit

Number

|

|

Description

|

|

|

99.1

|

|

Press Release, dated April 24, 2019, issued

by TherapeuticsMD, Inc., titled TherapeuticsMD Closes $300 Million Non-Dilutive Term Loan Financing Facility with TPG Sixth

Street Partners.

|

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated:

April 25, 2019

|

|

|

|

|

|

|

|

THERAPEUTICSMD, INC.

|

|

|

|

/s/

Daniel A. Cartwright

|

|

|

|

Name:

|

|

Daniel A. Cartwright

|

|

|

|

Title:

|

|

Chief Financial Officer

|

|

|

|

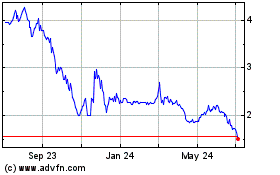

TherapeuticsMD (NASDAQ:TXMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

TherapeuticsMD (NASDAQ:TXMD)

Historical Stock Chart

From Apr 2023 to Apr 2024