3M to Cut 2,000 Jobs as Sales Fall--2nd Update

April 25 2019 - 12:04PM

Dow Jones News

By Austen Hufford

3M Co. said it would cut 2,000 jobs and restructure its

sprawling business after demand for its tapes and adhesives fell in

China and other important markets.

Shares in the manufacturer of Post-its and industrial products

fell 10% Thursday, knocking about 150 points off the Dow Jones

Industrial Average, after 3M said its net sales fell 5% to $7.86

billion in the first quarter, a worse-than-expected result.

The St. Paul, Minn., company said demand for its products was

particularly weak in China and among car makers. Revenue in the

quarter declined 4.3% in China in local-currency terms, excluding

acquisitions and spinoffs, after two years of growth. Sales in 3M's

car business were down 9% year-over-year.

"The first quarter was a disappointing start to the year," Chief

Executive Mike Roman told analysts in a call. The company's shares

were on track for their largest one-day decline in more than 30

years.

3M said it didn't cut expenses fast enough to reflect lower

demand from customers. While production fell more than 4% in the

quarter, factory spending fell just 1%.

"We didn't respond aggressively enough to what we were seeing,"

Mr. Roman said.

Other manufacturers have said recently that business in China is

improving. Caterpillar Inc. and PPG Industries Inc., both of which

saw weakening demand for their products in China in recent

quarters, said this month that demand there had improved.

Some of the equipment and chemicals those companies make take

longer to make and last a customer longer than 3M's tapes and

medical wrappings. That can make 3M a more-immediate barometer of

economic conditions, analysts say.

David Berge, a senior vice president for Moody's, called 3M's

results "unusual weakness at this point in the industrial cycle

compared to other larger manufacturers."

3M said sales volumes declined in all its regions, for a drop of

about 2% overall. The company also raised prices by about 0.9% on

average.

3M said it would cut capital expenditures this year and

accelerate other cost reductions.

Trimming about 2% of its 93,500 jobs would result in between

$225 million and $250 million of pretax savings, 3M said. The

company plans to eliminate positions in its corporate operations

and underperforming business lines -- including those making

products for the energy, electronics and automotive and aerospace

industries -- which helped lower the company's revenue.

3M said it would continue to invest in research and development.

The company has added to its stable of 60,000 products and

increased its research budget, even as other sprawling corporations

have broken up.

3M has said its presence in many countries and industries

exposes it to a wider range of customers and encourages its

researchers to think more ambitiously about new technologies. But

Thursday's results call that strategy into question.

3M lowered its adjusted profit outlook for 2019 to between $9.25

a share and $9.75 a share. The company had expected earnings

between $10.45 a share and $10.90 a share.

3M said it would record a pretax charge of about $150 million

this year in connection with the restructuring. The company will

spend $1.6 billion to $1.7 billion on capital investments in its

business, like manufacturing equipment, down from its expectations

of $1.7 billion to $1.9 billion previously.

Excluding one-time items, 3M's profit was $2.23 a share, down

from $2.50 a share. Analysts had been expecting $2.49 a share.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 25, 2019 11:49 ET (15:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

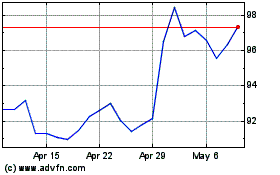

3M (NYSE:MMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

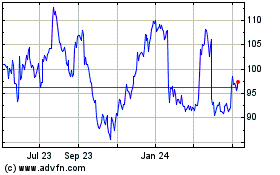

3M (NYSE:MMM)

Historical Stock Chart

From Apr 2023 to Apr 2024