UPS Reports Drop in Profit, Says Weather Hurt Results in U.S. -- Update

April 25 2019 - 9:59AM

Dow Jones News

By Paul Ziobro

United Parcel Service Inc. posted a lower profit in the first

quarter as upgrades to its parcel delivery network proved no match

for Mother Nature.

The delivery giant said it incurred about $80 million in extra

costs associated with dealing with severe winter weather in the

U.S., causing operating profit to fall 12% in its main business

unit.

Overall profit fell about 17% to $1.11 billion compared with the

same period last year, while revenue rose slightly to $17.16

billion.

UPS is spending billions of dollars to upgrade its delivery

network with more capacity, automated facilities and new technology

that can reroute packages around congestion. The company says those

measures are helping to control costs as it handles the vast

amounts of e-commerce packages that move through its facilities and

on its trucks.

"We are bending the cost curve in our U.S. domestic segment as

highly automated hubs come online, producing improved productivity

benefits," Chief Executive David Abney said.

UPS's new strategy also includes chasing business that yields

greater profits, including small- and medium-size business and

health-care shipments. In the latest period, UPS said it grew its

business-to-business deliveries, which are generally more

profitable, once again. It also said that the small- and

medium-size shippers increased returns by a double-digit percent

range in the months after the December holidays.

Mr. Abney said that while Amazon.com Inc. is bringing some of

its delivery volume in-house, it's not affecting the company's

shipping volume. "While we continue to focus on servicing their

needs, there is so much more to e-commerce than Amazon," Mr. Abney

said.

In the company's international business, operating profit fell

11% on a 2.1% decline in revenue. Its smaller supply chain and

freight unit logged a 17.6% increase in profit, even as revenue

fell nearly 4%.

While UPS backed its guidance for the year, the company said

that its adjusted per-share earnings growth will be relatively flat

in the current quarter compared with a year earlier due to pension

financing costs. It will also open about 30% of its new network

capacity for the year in the second quarter, causing startup

costs.

That will push most of UPS's earnings growth into the back half

of the year. Citi analyst Christian Wetherbee said that "will

likely not resonate well with investors as it appears we need to

wait further for transformation, placing increasing risk on the

always challenging holiday quarter."

UPS will have less of a tailwind from growing economies to back

its business. Mr. Abney said that global economies, including the

U.S., are growing at a slower rate than last year. Trade

uncertainty is also causing jitters and some companies are

adjusting their supply chains as a result.

"The China-U.S. trade uncertainty is prompting softer industry

forecasts in the region," Mr. Abney said.

For the period, UPS reported earnings of $1.28 a share, down

from $1.55 a share. On an adjusted basis, UPS said earnings were

$1.39 a share. Analysts polled by Refinitiv were expecting $1.41 a

share.

--Allison Prang contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

April 25, 2019 09:44 ET (13:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

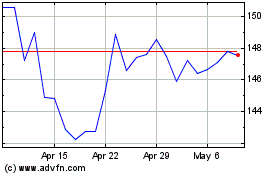

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

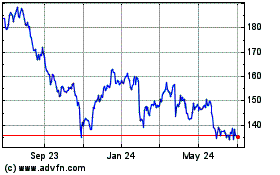

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024