Earnings Misses Hurt More This Season -- WSJ

April 25 2019 - 3:02AM

Dow Jones News

By Corrie Driebusch

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 25, 2019).

Many companies are beating expectations this earnings season,

helping push major indexes to record levels. But for those that

miss, the punishment has been more severe than usual.

That means the stakes are high during a busy earnings week in

which nearly 150 companies in the S&P 500 are reporting

results.

On average this earnings season, shares of companies whose

results have fallen short of analysts' estimates have declined 3.2%

from two trading days ahead of earnings to two sessions after the

report, FactSet data through Wednesday morning show. That is more

than the 2.5% average drop over the past five years.

A possible cause for the underperformance is that companies have

been giving guidance either in line with or below analysts'

expectations, according to Bank of America Merrill Lynch. BAML

analysts say mentions of "better" or "stronger" versus "worse" or

"weaker" are tracking at their lowest since the first quarter of

2016.

On Wednesday, satellite-radio company Sirius XM Holdings Inc.

became one of the latest to fall into the trend, with its stock

declining 7.2% after it reported a quarterly profit below

expectations.

Sirius joins others such as Intuitive Surgical Inc., whose stock

tumbled 7% Monday, its largest decrease since 2014, after the maker

of robotic systems used in surgery reported a slightly

smaller-than-expected increase in quarterly sales and missed profit

estimates. Last week, Bank of New York Mellon Corp.'s shares fell

nearly 10% after it reported earnings and revenue short of Wall

Street's expectations. Earlier this month, Walgreens Boots Alliance

Inc.'s shares lost 13% after the pharmacy chain also missed sales

and earnings estimates.

In its earnings call with analysts, BNY Mellon's chief

executive, Charles W. Scharf, referenced "weakness in investment

management and net interest income" as a reason for the custody

bank's performance during the quarter, according to transcripts of

the call.

Roughly one-third of S&P 500 companies are posting their

quarterly earnings this week. On Thursday, about 65 of those

quarterly reports will arrive, including from tech giants Intel

Corp. and Amazon.com Inc. as well as coffee chain Starbucks Corp.

That is after roughly 40 S&P 500 companies, including Facebook

Inc. and Microsoft Corp., reported Wednesday.

Stocks are coming off an impressive run. Following their steep

drop in late 2018, U.S. stocks have rebounded sharply this year.

Through Wednesday's close, the S&P 500 is up 17% in 2019, and

for the first quarter the broad index posted its largest percentage

gain in decades. On Tuesday, the Nasdaq Composite and S&P 500

closed at records.

This rise has come despite a potential first-quarter-earnings

slowdown because of worries about the potential impact of rising

wage and commodities costs and a stronger dollar. Those worries

became more acute as the first quarter progressed. At the end of

December, analysts anticipated S&P 500 companies' earnings

would grow 2.8% from a year earlier, according to FactSet. By the

end of January, they were predicting earnings would decline. By the

end of the first quarter, they estimated profits had contracted 4%

from a year earlier, according to FactSet. That could also be good

news for stock prices, as lowered expectations make it easier for

companies to beat them.

With a little more than one-quarter of companies reporting

results, first-quarter S&P 500 earnings are on pace to register

a contraction of 3% from the year-ago period, according to FactSet.

If that holds, it would mark the first time quarterly earnings have

contracted since 2016.

Through Wednesday morning, nearly 80% of S&P 500 companies

that had reported earnings had surpassed analysts' estimates,

FactSet data show. Among the big winners Tuesday were

social-networking platform Twitter Inc., whose shares jumped 16% ,

their largest percentage rise since October 2017, and industrial

conglomerate United Technologies Corp., whose stock rose 2.3%.

Write to Corrie Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

April 25, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

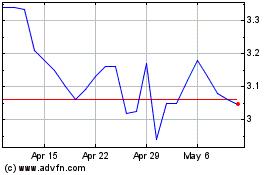

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

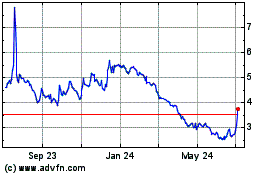

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Apr 2023 to Apr 2024