Walmart to Develop Its Own Supply Chain for Angus Beef--Update

April 24 2019 - 4:10PM

Dow Jones News

By Micah Maidenberg

Walmart Inc. is pushing into the meat business, the latest

retailer to seek greater control and profits in the steaks and

rotisserie chickens that fill grocery-aisle meat cases.

The Arkansas-based chain will develop a network of cattle

ranches and meat-processing plants to provide Angus beef products

exclusively for its stores, a move Walmart said will provide the

company and its customers better visibility into their food

supply.

Walmart's move follows rival Costco Wholesale Corp.'s effort to

develop a poultry processing plant and dozens of supplier farms to

provide the chain's signature $4.99 rotisserie chickens. Walmart

and other chains already operate their own milk-processing plants

and bakeries.

Retailers' moves to take greater control of some commodity

processing come partly in response to consumers' growing focus on

how food is produced, with shoppers scrutinizing everything from

the fertilizer used on grain fields to drugs fed to chickens. The

efforts follow years of low crop prices, making it cheaper to raise

livestock and poultry.

"To answer our customer's demands, we need visibility into every

step in the supply chain," Scott Neal, a Walmart senior vice

president, said in prepared remarks.

Beyond reducing costs by handling processing and packaging

themselves, the retailers could also gain greater leverage in

negotiating supply deals with major U.S. meat companies like Tyson

Foods Inc., Cargill Inc. and Pilgrim's Pride Corp., analysts said.

The investments could also expose retailers to new risks, ranging

from animal diseases to meat plant worker safety.

Walmart's move "is definitely going to create some waves and may

change up the game a bit on the beef side, because traceability is

the next big thing," said Jeremy Scott, an analyst with Mizuho

Securities.

Tyson shares were down slightly in afternoon trading. Tyson

estimated that Walmart contributed 17% of its fiscal 2018 sales and

was the meat company's biggest single customer, according to a

November regulatory filing.

"Walmart is a great business partner of Tyson Foods, and we are

fully supportive of the project," a Tyson spokeswoman said.

Walmart's effort will focus on Angus beef cuts like steaks,

roasts and rib-eyes and will supply 500 stores in the

Southeast.

The company is partnering with Bob McClaren of 44 Farms and

Prime Pursuits, who will help Walmart find cattle; Creekstone

Farms, which will butcher the cattle at a Kansas facility, and FPL

Foods, which will pack the meat at a Georgia facility for delivery

to stores.

Costco is building a $450 million chicken slaughtering and

processing facility In Fremont, Neb., capable of processing two

million birds a week, churning out rotisserie chickens and other

poultry products to be sold under Costco's Kirkland brand. The

plant is slated to open in September, and will be supplied by 100

to 125 farms, according to a spokeswoman for Lincoln Premium

Poultry, which will manage the plant.

Building the plant will ensure a steady supply of chickens in

the specific sizes Costco sells, she said.

Executives for Pilgrim's, a chicken supplier to Costco, have

said Costco's move doesn't represent a threat and that the chain

had increased its business with Pilgrim's.

Such moves by retailers have bruised some suppliers. Walmart in

2018 opened its own milk-processing plant in Indiana, supplying

more than 600 stores previously supplied by U.S. milk company Dean

Foods Co. The move by Dean's biggest customer cost Dean roughly 100

million gallons of annual milk sales, at a time when milk

consumption generally has been declining.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 24, 2019 15:55 ET (19:55 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

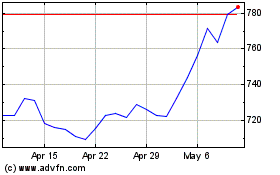

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

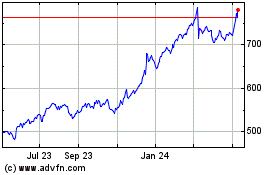

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024