Caterpillar Gains on Mining, Construction Strength -- 3rd Update

April 24 2019 - 1:19PM

Dow Jones News

By Austen Hufford and Micah Maidenberg

Caterpillar Inc. beat revenue expectations for the first

quarter, thanks to higher demand for its mining and construction

equipment.

The machinery giant's improved sales suggest that at least some

corners of the global economy may be stabilizing after signs of

slower growth earlier this year. Investors had been concerned in

recent quarters about demand, particularly in China, as well as

higher costs.

"The market's strong," Chief Executive Jim Umpleby said on a

call with analysts, referring to Caterpillar's mining business.

"We're ramping up production."

Despite the revenue gains, Caterpillar's shares fell more than

2% Wednesday as the company's costs continued to rise.

The company paid more for labor and freight in the quarter, as

well as some raw material in part due to U.S. tariffs on imported

steel and aluminum. Caterpillar had $70 million in costs related to

tariffs in the quarter, compared with $110 million for all of last

year following the implementation of those tariffs last March.

Caterpillar has raised prices to offset those costs. It said

prices were up just over 2 percentage points overall in the quarter

from a year ago. Higher prices and volumes added $557 million to

operating profit in the quarter, offsetting $375 million in higher

manufacturing costs. Profit margins fell in its construction

business because the increased material, labor and freight costs

weren't covered by higher prices.

Deerfield, Ill.-based Caterpillar on Wednesday reported sales,

including revenue from financial products, of $13.47 billion for

the quarter, up 5% from last year and more than the $13.27 billion

analysts predicted, according to FactSet.

Revenue from its mining business rose 18% in the first quarter,

while construction sales were up 3%. Energy and

transportation-equipment sales were flat.

In the U.S. and Canada, Caterpillar's largest market, sales rose

7%.

"That reflects the strong construction activity, as state and

local infrastructure builds are still going up," said Andrew

Bonfield, Caterpillar's financial chief, in an interview. "North

America seems to be going very well."

Caterpillar said it expects demand for its products in China to

rise slightly this year, compared with expectations for no growth

previously. The company also said it expected to lose some market

share in China to competitors. Other companies have said that

government stimulus in China appears to be stabilizing the world's

second-largest economy. Caterpillar has said it makes some 10% of

its sales in China.

The company reported a profit of $1.88 billion, or $3.25 a

share, up from $1.67 billion, or $2.74 a share, in the year-ago

period. After adjustments, the company said it earned $2.94 a

share, versus the $2.83 a share analysts predicted.

Caterpillar said 850,000 of its machines are now connected to

the internet world-wide, up from 700,000 connected last summer, the

latest indication of progress in expanding a services business the

company wants to use to smooth out its revenue stream.

Caterpillar boosted its profit forecast for the year due to new

guidance from the U.S. Treasury Department, as the details from the

2017 tax overhaul continue to filter through to corporate finance

departments. It now predicts $12.06 to $13.06 a share in earnings

this year, up from the previous expectations of $11.75 to $12.75 a

share. The company expects the additional profit to be excluded

from adjusted earnings in a coming quarter.

Write to Austen Hufford at austen.hufford@wsj.com and Micah

Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 24, 2019 13:04 ET (17:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

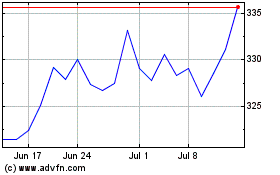

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

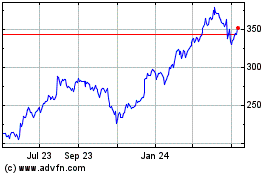

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024