Occidental Seeks to Buy Anadarko for $38 Billion -- 3rd Update

April 24 2019 - 9:31AM

Dow Jones News

By Micah Maidenberg

Occidental Petroleum Corp. offered to buy Anadarko Petroleum

Corp. for $38 billion, launching a potential bidding war for a

company that previously agreed to be purchased by Chevron Corp. for

about $33 billion.

The Houston-based company said it has made overtures to Anadarko

since late March, including two offers that were higher than what

the company agreed to with Chevron, according to a letter

Occidental Chief Executive Vicki Hollub sent to Anadarko's

board.

"We were surprised and disappointed that your board did not

engage with us on that proposal," Ms. Hollub wrote in the

letter.

Occidental is offering a cash-and-stock deal of $76 a share,

about $11 per share more than the value of the Chevron transaction

on the day it was announced April 12. The offer, $38 in cash and

0.6094 share of Occidental stock, represents a 20% premium to the

Chevron agreement as of Tuesday's close. Occidental's offer was

valued at $57 billion including debt.

Anadarko has prized assets from Texas to Mozambique, and

Occidental is seeking to expand its footprint in the booming

Permian basin, an area where it is already one of the largest

operators.

Earlier this month, Chevron said it would buy Anadarko in a

cash-and-stock deal valued at $33 billion. In that agreement,

shareholders would receive 0.3869 share of Chevron and $16.25 in

cash per share.

On Wednesday, Occidental expressed frustration with Anadarko,

which agreed to pay a $1 billion breakup fee with Chevron if that

deal doesn't go through.

"It is unfortunate that Anadarko agreed to pay a break up fee of

$1 billion, representing approximately $2 per share, without even

picking up the phone to speak to us after we made two proposals

during the week of April 8 that were at a significantly higher

value to the transaction you were apparently negotiating with

Chevron," Ms. Hollub said in her letter.

Chevron and Anadarko couldn't immediately be reached for comment

Wednesday morning. A Chevron spokesman earlier said the company

wasn't aware of any Occidental discussions with Anadarko during its

negotiations with the company.

Shares of Anadarko jumped 11% in premarket trading Wednesday on

the news, while Occidental's stock fell 5%. Chevron shares ticked

0.1% lower.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 24, 2019 09:16 ET (13:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

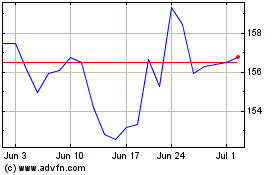

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

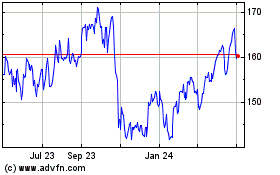

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024