CRH Expands Buyback Program on Back of Earnings Growth

April 24 2019 - 3:03AM

Dow Jones News

By Carlo Martuscelli

CRH PLC (CRG.DB) said Wednesday that it is expanding its

share-buyback program by 350 million euros ($393.2 million), citing

a strong balance sheet and cash generation.

The Ireland-listed building materials group said it expects

earnings before interest, tax, depreciation and amortization in the

first half of the year in excess of EUR1.5 billion, ahead of the

EUR1.13 billion recorded in the comparable period in 2018. The

forecast reflects a mid-single-digit percentage increase in Ebitda

on a like-for-like basis, combined with a contribution from

acquisitions, CRH said.

CRH said it expects to complete the new EUR350 million tranche

of its buyback program before August.

In the first quarter, like-for-like sales were up 7% on year.

CRH said it benefited from mild weather and good momentum across

most of its major markets.

The company said that in the seasonally more important second

half of the year, Ebitda on a like-for-like basis is forecast ahead

of the EUR2.24 billion reported in the previous-year period. This

is due to growth in the U.S., supported by government

infrastructure funding, as well as encouraging conditions in

Europe.

CRH has also agreed to sell its European Shutters & Awnings

business to StellaGroup for more than EUR300 million.

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

April 24, 2019 02:48 ET (06:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

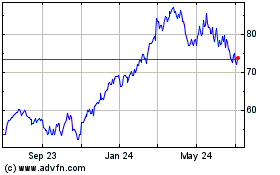

CRH (NYSE:CRH)

Historical Stock Chart

From Mar 2024 to Apr 2024

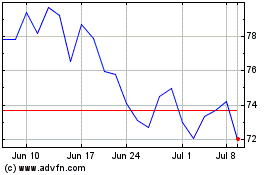

CRH (NYSE:CRH)

Historical Stock Chart

From Apr 2023 to Apr 2024