EBay Lifts Guidance as Revenue, Number of Buyers Rise -- Update

April 23 2019 - 8:44PM

Dow Jones News

By Patrick Thomas

EBay Inc. raised its revenue and profit outlook after posting

stronger-than-expected results in its first quarter, sending shares

up 5% in after-hours trading Tuesday.

The online marketplace said first-quarter revenue rose 2% from a

year earlier to $2.64 billion, as it benefited from more people

making purchases on its platforms. The number of active buyers, or

those who made a transaction within the last year, grew 4% to 180

million.

EBay, which also operates ticket platform StubHub, projected

revenue this year to be between $10.83 billion and $10.93 billion,

compared with its prior forecast of between $10.7 billion and $10.9

billion. It expects per-share earnings from continuing operations

to be between $1.94 and $2.04, up from a range of $1.83 to $1.93

previously.

The latest quarterly report comes as eBay is completing a

strategic review of its operations after facing pressure from

activist investors Elliott Management Corp. and Starboard Value LP.

In an agreement with Elliott and Starboard, eBay added two new

directors to its board in March, and pledged to add a third new

director later this year.

In recent years, eBay shares have languished as the company has

sought to distance itself from its reputation as an online auction

house and has battled the likes of Amazon.com Inc. in the

e-commerce arena. EBay's shares are up 30% this year, but still

down about 12% over the past 12 months through Tuesday's close.

Gross merchandise volume, the value of goods sold on its

websites, fell 4%. But eBay executives said on a conference call

with analysts it will benefit more from higher-quality product

listings and a more user-friendly website. The amount of money eBay

earned from transactions rose from a year earlier.

About 800,000 sellers also took advantage of eBay's promoted

listings in the quarter, more than doubling advertising revenue to

$65 million, the company said.

"What we're seeing is that what matters to our existing

customers is less a fully product-based experience, but more the

richness of listings that the catalog and structured data brings,"

Chief Executive Devin Wenig said on the call.

In the latest quarter the San Jose, Calif., company's profit

rose 27% to $518 million, or 57 cents a share. Earnings from

continuing operations were 67 cents a share, ahead of estimates

from analysts polled by FactSet of 63 cents a share.

EBay spent $125 million on dividends during the first quarter,

the first in the 24-year-old company's history. The company plans

to spend $5.5 billion on share buybacks and dividends this

year.

For the current quarter, eBay said it expects revenue between

$2.64 billion and $2.69 billion and earnings from continuing

operations between 61 cents a share and 63 cents a share.

Write to Patrick Thomas at Patrick.Thomas@wsj.com

(END) Dow Jones Newswires

April 23, 2019 20:29 ET (00:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

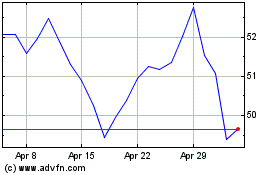

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

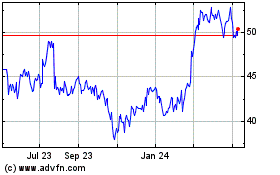

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024