PG&E to Restructure Board In Settlement With Activist -- WSJ

April 23 2019 - 3:02AM

Dow Jones News

By Katherine Blunt

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 23, 2019).

PG&E Corp. on Monday settled a dispute with an activist

investor by restructuring its board to include another director

with utility experience, and adding a safety specialist to advise

its chief executive.

The company said former utilities executive Fred Buckman will

replace former chairman Richard Kelly, who has resigned from the

board. Chris Hart, former chairman of the National Transportation

Safety Board, will serve as a special adviser to incoming chief

executive Bill Johnson.

The appointments end an activist campaign by BlueMountain

Capital Management, which owns 2.5% of PG&E shares. The hedge

fund last month nominated 13 candidates to PG&E's board,

including Messrs. Hart and Buckman.

PG&E earlier this month appointed its own slate of directors

after working with three hedge funds that together own 10% of the

company's shares. They included former Federal Energy Regulatory

Commissioner Nora Mead Brownell, who is now chairman of the board.

It also appointed several restructuring experts and financiers.

The appointments received pushback from California Gov. Gavin

Newsom, who criticized the board for its "large representation of

Wall Street interests." Michael Picker, president of the California

Public Utilities Commission, expressed similar concerns at a

meeting last week.

As part of the settlement, BlueMountain agreed to vote all of

its shares in favor of each of PG&E's nominees at the annual

meeting this year. PG&E announced last week that it would

reschedule the meeting from May 21 to sometime in June to allow

additional time to restructure the board.

"We believe the changes and other undertakings announced today

reflect the Boards' commitment to improving their governance and

oversight," BlueMountain co-founder and chief investment officers

Andrew Feldstein said in a statement.

The new board faces steep challenges. PG&E sought bankruptcy

protection earlier this year following a series of deadly wildfires

in its service territory, many tied by state investigators to its

equipment, that it estimates have triggered more than $30 billion

in potential liability claims against the company. PG&E has

pledged to spend billions of dollars to improve the safety of its

electric equipment before the next fire season.

Mr. Hart was involved in an assessment of the natural gas

distribution system in Massachusetts following a series of pipeline

explosions north of Boston last year. He is the founder of Hart

Solutions LLC, a consulting firm focused on safety and

reliability.

"As we enter another fire season, we can't overemphasize the

importance of safety," PG&E interim CEO John Simon said in a

statement. "Retaining a former industry regulator with Mr. Hart's

expertise reflects that commitment to strengthening our safety

culture."

Mr. Buckman previously served as chief executive of Consumers

Energy. He also has served as chief executive of PacifiCorp, a

utility owned by Warren Buffett's Berkshire Hathaway Inc. that

operates in Northern California and five other states.

PG&E said it will hold a vote at the annual meeting to

expand its board to include 15 members. It plans to appoint another

independent director with clean-tech expertise in the future.

Write to Katherine Blunt at Katherine.Blunt@wsj.com

(END) Dow Jones Newswires

April 23, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

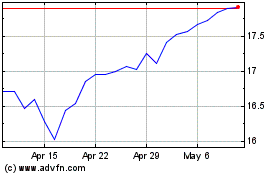

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

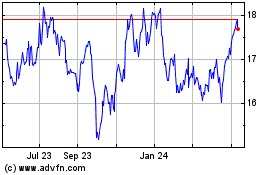

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024