By Jennifer Maloney

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 23, 2019).

The head of the world's largest brewer has sharply curtailed the

time he spends poring over sales figures. Meetings that used to

last up to three hours now take 30 minutes. And the briefings sent

to the CEO a couple of days before a meeting must be short -- 20

pages instead of 200.

After 10 years at the helm of Anheuser-Busch InBev SA, Carlos

Brito has decided that in order to pivot the company toward the

future, he has to change with it. So the self-described numbers

junkie is pulling away from the minutiae of operations and trying

to check his micromanaging impulses.

That has freed up time for him to take crash courses in

artificial intelligence and robotics, and shepherd new ventures

such as a Keurig machine for cocktails. He has gone on so-called

consumer safaris, shadowing millennial shoppers in Shanghai and

Shenzhen, China. And he has paid visits to companies like Starbucks

Corp. and Harry's to pick executives' brains on mobile technology,

consumer insights and building disruptive brands.

"The only way to do this is to get out of your comfort zone,"

Mr. Brito said in an interview at AB InBev's New York office. "You

have to be exposed to things that make you uncomfortable because

you don't know about it, because it's new territory, because it's

new technology, because it's something you don't do well."

The 58-year-old Brazilian is at a critical moment. AB InBev has

struggled to pay down its $102.5 billion debt load as it deals with

declining beer consumption in key markets. The brewer last fall

halved its dividend, sending its stock price tumbling. Investors

question whether the company, which now makes one out of every four

beers sold world-wide, can boost revenue by building brands rather

than making blockbuster acquisitions.

In December, Mr. Brito gathered his top executives on a

conference call to give them new marching orders.

"We've been in a much tougher situation before," he told them.

He had rallied his lieutenants in a similar conference call in

2008, when the financial markets crashed as the Brazilian-Belgian

brewer InBev was closing its landmark acquisition of

Anheuser-Busch, putting Mr. Brito atop the combined company. This

time he told his team to simplify their priorities and home in on

their two most important targets: growing revenue and

deleveraging.

While he has urged executives to narrow their focus, the CEO has

been broadening his own.

Each time the beer giant has made a major acquisition, Mr. Brito

said, he has closely overseen its integration, including its most

recent takeover of SABMiller in 2016. Now, with that combination

complete, he said he is "leaning towards the future, not because

I'm better than anybody, but just because that's my job."

He has stopped asking questions, for example, about regional

sales numbers that happen to pique his interest -- "the numbers

that I should never have been talking about."

"I grew up in the operations, especially sales," he said, "and I

love the details, so I have to force myself to say, 'OK, I have

great people. I have a team I can trust so I can do the things I

need to do.'"

"This is a big change," said Michel Doukeris, head of the

company's North America business. In the abbreviated sessions, Mr.

Brito "doesn't have the time to ask all the questions, all the

details and everything." Mr. Doukeris said the shorter meetings

give him more time to focus on consumer trends in the U.S. and

Canada.

There are fewer people in the room, too. Gone are accountants,

controllers and individual brand managers who previously attended

in case they might be needed to answer a question.

The changes have trickled down, said David Kamenetzky, the

company's chief strategy officer: Zone presidents are holding

shorter meetings with their own teams, too.

Mr. Brito has shuffled his senior leadership team. Three years

ago, it was stacked with executives experienced in sales and

finance; now more than 40% of its members are marketers. He tapped

Mr. Doukeris, the new North America chief, to slow the decline of

Bud Light while growing its higher-priced beer brands and pushing

into other categories with hard seltzer, cold-brew coffee and

canned cocktails.

Amid pressure from employees, investors and board members, Mr.

Brito over the past two years has adopted changes to the company's

recruitment and promotions system to address the absence of women

in AB InBev's highest ranks, a situation that still persists. Now

he gets monthly or quarterly updates on companywide objectives such

as digital transformation and the diversity of the workforce.

An engineer by training, Mr. Brito was groomed by Brazilian

investment banker Jorge Paulo Lemann, who paid for his first year

at Stanford Business School. When Mr. Brito graduated in 1989, Mr.

Lemann offered him a job at a Brazilian beer company he and his

partners were acquiring called Brahma. By 2008, after a series of

mergers, it was the biggest brewer in the world and Mr. Brito was

its CEO.

When the company took over Anheuser-Busch that year, Mr. Brito

brought to St. Louis the stringent cost-cutting and budgeting

practices that were developed at Brahma and later became hallmarks

of companies controlled by Mr. Lemann and his partners at

private-equity firm 3G Capital. Those practices have fallen out of

favor in the consumer-goods industry after r ecent troubles at

3G-owned Kraft Heinz.

Mr. Brito defends the approach, saying there is no end to the

savings you can find to reinvest in the business.

The CEO recently spent three days with more than a dozen tech

experts assembled from top universities to learn about blockchain,

robotics and the applications of machine learning. AB InBev has

been experimenting with AI, drones and blockchain as it looks to

anticipate mechanical problems earlier, help retailers avoid

running out of stock and give Zambian farmers a record of their

financial transactions so they can establish a credit history.

Mr. Brito's takeaway from his three-day tutorial: "Now it's time

to scale up. Enough of pilots; enough of small initiatives."

Corrections & Amplifications Carlos Brito has visited

companies including Harry's to gain insight from other executives.

An earlier version of this article and subheadline incorrectly

referred to the company as Harry's Razor Co.

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

April 23, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

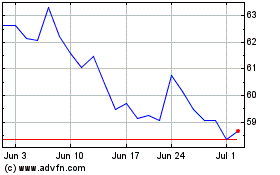

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

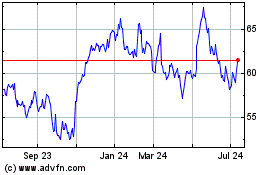

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024