Current Report Filing (8-k)

April 18 2019 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported):

April 15, 2019

AYTU BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

001-38247

|

47-0883144

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

373 Inverness Parkway, Suite 206

Englewood, CO 80112

(Address

of principal executive offices, including Zip Code)

Registrant’s

telephone number, including area code:

(720) 437-6580

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On

April 15, 2019, the board of directors (the “

Board

”) of Aytu BioScience, Inc.

(the “

Company

”),

upon the recommendation of the Company’s compensation

committee, agreed to renew the employment agreements of Joshua R.

Disbrow and Jarrett T. Disbrow. The material terms of the

employment agreements are as follows.

Joshua R. Disbrow Employment Agreement

Pursuant to the

terms of Joshua R. Disbrow’s employment agreement (the

“

CEO Employment

Agreement

”), the Company agreed to the following

compensation package:

●

an annual base

salary of $330,000 per annum, which shall be reviewed at the end of

each fiscal year of the Company;

●

restricted stock or

options to be granted on or promptly after August 1, 2019 as

determined by the Committee at that time; and

●

an annual

discretionary bonus with a target amount of 125% of Mr.

Disbrow’s base salary.

The

term of the CEO Employment Agreement is 24-months beginning on the

Effective Date (as defined therein) (the “

CEO Term

”). The CEO Term shall end

immediately upon the occurrence of certain events named therein.

The Company can terminate Mr. Disbrow’s employment with or

without cause (as defined in the CEO Employment Agreement) or as a

result of disability (as defined in the CEO Employment Agreement).

Mr. Disbrow can terminate his employment with our without good

reason (as defined in the CEO Employment Agreement).

The

Company expects to file the CEO Employment Agreement as an exhibit

to its Quarterly Report on Form 10-Q for the quarter ending March

31, 2019. The foregoing description of the CEO Employment Agreement

is qualified in its entirety by reference to the text of the CEO

Employment Agreement, when filed.

Jarrett T. Disbrow Employment Agreement

Pursuant to the

terms of Jarrett T. Disbrow’s employment agreement (the

“

COO Employment

Agreement

”), the Company agreed to the following

compensation package:

●

an annual base

salary of $250,000 per annum, which shall be reviewed at the end of

each fiscal year of the Company;

●

restricted stock or

options to be granted on or promptly after August 1, 2019 as

determined by the Committee at that time; and

●

an annual

discretionary bonus with a target amount of 125% of Mr.

Disbrow’s base salary.

The

term of the COO Employment Agreement is 24-months beginning on the

Effective Date (as defined therein) (the “

COO Term

”). The COO Term shall end

immediately upon the occurrence of certain events named therein.

The Company can terminate Mr. Disbrow’s employment with or

without cause (as defined in the COO Employment Agreement) or as a

result of disability (as defined in the COO Employment Agreement).

Mr. Disbrow can terminate his employment with our without good

reason (as defined in the COO Employment Agreement).

The

Company expects to file the COO Employment Agreement as an exhibit

to its Quarterly Report on Form 10-Q for the quarter ending March

31, 2019. The foregoing description of the COO Employment Agreement

is qualified in its entirety by reference to the text of the COO

Employment Agreement, when filed.

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

Effective April 15,

2019, the Board appointed Steven J. Boyd, age 38, to the Board to

fill one of the two vacancies on the Board. Since July 2012 Mr.

Boyd has served as the Chief Investment Officer of Armistice

Capital, LLC, the investment manager of Armistice Capital Master

Fund Ltd. (“

Armistice

”), a hedge fund focused

on health care and consumer sectors based in New York City. Mr.

Boyd founded Armistice Capital, LLC in 2012.

Prior to

founding

Armistice

, Mr. Boyd was a senior

research analyst at Senator

Investment Group

, an associate at York

Capital, an analyst at

SAB Capital Management

and an

analyst at McKinsey &

Company

. Mr. Boyd is a

graduate of the University of Pennsylvania, with degrees in

economics and political science. He serves on the boards of

directors of each of Cerecor, Inc. and EyeGate Pharmaceuticals,

Inc. The

Board

believes that Mr.

Boyd’s experience in the capital markets and strategic

transactions, and his focus on the healthcare industry makes him a

valuable member of the

Board

.

Mr. Boyd has

elected to not receive

any compensation for his

Board

service. At the time of

his appointment it has not been determined which Board committees

Mr. Boyd will serve on.

Other

than the transactions disclosed pursuant to Item 404(a) of

Regulation S-K under Item 1.01 of the Company’s Current

Report on Form 8-K filed with the SEC on December 4, 2018 (the

“

Prior 8-K

”),

the Company is not aware of any other transactions that require

disclosure under Item 404(a) of Regulation S-K. The information set

forth in the Prior 8-K under Item 1.01 is incorporated herein by

reference.

Item 8.01 Other Events.

Effective April 15,

2019, Mr. Gary Cantrell resigned from the Company’s Audit

Committee and as Chairman of the Compensation Committee. Mr.

Cantrell will remain a member of the Compensation Committee. In

addition, effective April 15, 2019, the Board appointed Mr. Michael

Macaluso to the Company’s Audit Committee and the

Compensation Committee and appointed Mr. Macaluso as Chairman of

the Compensation Committee.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

AYTU

BIOSCIENCE, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

April

18, 2019

|

|

By:

|

/s/

Joshua R. Disbrow

|

|

|

|

|

|

Joshua

R. Disbrow

|

|

|

|

|

|

Chief

Executive Officer

|

|

|

|

|

|

|

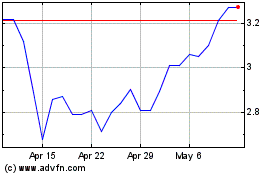

AYTU BioPharma (NASDAQ:AYTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

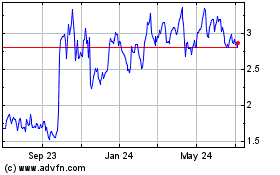

AYTU BioPharma (NASDAQ:AYTU)

Historical Stock Chart

From Apr 2023 to Apr 2024