Current Report Filing (8-k)

April 17 2019 - 4:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): April 16, 2019

|

TherapeuticsMD, Inc.

|

|

(Exact

Name of Registrant as Specified in its Charter)

|

|

Nevada

|

|

001-00100

|

|

87-0233535

|

|

(State

or Other

Jurisdiction

of Incorporation)

|

|

(Commission File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

6800

Broken Sound Parkway NW, Third Floor

Boca

Raton, FL 33487

|

|

(Address

of Principal Executive Office) (Zip Code)

|

Registrant's

telephone number, including area code: (561) 961-1900

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230-405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

April 16, 2019, TherapeuticsMD, Inc., a Nevada corporation (the “Company”), entered into a Commitment Letter (the

“Commitment Letter”) with TPG Sixth Street Partners, LLC, in its capacity as agent for and on behalf of its affiliated

funds, related funds and investment vehicles (“TSSP”).

The

Commitment Letter provides for a binding commitment from TSSP to provide a $300 million first lien secured term loan credit facility

(the “TSSP Facility”) to the Company, subject to (i) the execution of a financing agreement in the form attached thereto

as Exhibit A by the Company, its subsidiaries as guarantors and TSSP (the “Financing Agreement”), together with any

mutually agreed changes thereto reasonably requested by TSSP or the Company, and a fee letter in the form attached thereto as

Exhibit B, and (ii) satisfaction (or waiver) of customary initial conditions precedent to the effectiveness of the Financing Agreement

as set forth therein.

The

TSSP Facility will provide for availability to the Company in three tranches: (i) $200 million will be immediately available upon

the closing of the TSSP Facility; (ii) $50 million will be available upon the designation of the Company’s ANNOVERA

TM

product as a new category of birth control by the U.S. Food and Drug Administration on or prior to December 31, 2019; and

(iii) $50 million will be available upon the Company achieving $11 million in net revenues from the Company’s IMVEXXY®,

BIJUVA

TM

and ANNOVERA

TM

products for the fourth quarter of 2019.

Borrowings

under the TSSP Facility will accrue interest at 3-month LIBOR plus 7.75%, subject to a LIBOR floor of 2.70%. Interest on amounts

borrowed under the TSSP Facility will be payable quarterly. The outstanding principal amount of the TSSP Facility will be payable

in four equal quarterly installments beginning on June 30, 2023, with the TSSP Facility maturing on March 31, 2024. The Company

will also be required to pay TSSP certain facility, administrative and, if applicable, prepayment fees.

The

Financing Agreement contains customary restrictions and covenants applicable to the Company. Among other requirements, the Company

will be required to (i) maintain a minimum cash balance of $50 million, which will increase to $60 million if the Company draws

either the second or third tranche of the TSSP Facility, and (ii) achieve certain minimum consolidated net revenue amounts attributable

to commercial sales of the Company’s products beginning with the fiscal quarter ending December 31, 2020.

The

Company anticipates entering into the Financing Agreement and closing the TSSP Facility on or before May 10, 2019, subject to

the satisfaction of the conditions precedent in the Commitment Letter. If TSSP is ready, willing and able to provide the proceeds

of the TSSP Facility on the terms and conditions set forth in the Commitment Letter and the closing does not occur on or prior

to a specified date, the Company will be obligated to pay a break-up fee to TSSP in an amount equal to a specified percentage

of the initial tranche of the TSSP Facility.

Item

1.02 Termination of a Material Definitive Agreement.

On

April 17, 2019, the Company notified its existing lender, MidCap Financial Trust (“MidCap”), that the Company will

be terminating its existing Credit and Security Agreement, dated May 1, 2018, as amended, with MidCap (the “MidCap Agreement”).

A portion of the initial tranche of borrowing under the TSSP Facility in the amount of approximately $81 million will be used

to repay amounts outstanding under the MidCap Agreement, which includes a prepayment fee of 4% and other fees and expenses payable

to MidCap. The MidCap Agreement will terminate concurrent with the Company entering into the Financing Agreement and closing the

TSSP Facility on or before May 10, 2019.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On

April 17, 2019, the Company entered into the Commitment Letter. The description of the Commitment Letter set forth under Item

1.01 is hereby incorporated by reference into this Item 2.03 as if fully set forth herein.

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

The description

of the termination of the MidCap Agreement set forth under Item 1.02 is hereby incorporated by reference into this Item 2.04 as

if fully set forth herein.

Item

7.01 Regulation FD Disclosure.

On

April 17, 2019, the Company issued a press release announcing that it had entered into the Commitment Letter. A copy of the press

release is attached as Exhibit 99.1 hereto.

Also

on April 17, 2019, the Company issued a press announcing the commercial availability of BIJUVA (estradiol and progesterone capsules,

1 mg/100 mg) in the United States. BIJUVA is the first and only FDA-approved bio-identical hormone therapy combination of estradiol

and progesterone in a single, oral daily capsule for the treatment of moderate-to-severe vasomotor symptoms (commonly known as

hot flashes or flushes) due to menopause in women with a uterus. A copy of the press release is attached as Exhibit 99.2 hereto.

The

Company is furnishing as Exhibit 99.3 to this Current Report on Form 8-K an investor presentation which will be used, in whole

or in part, and subject to modification, on April 17, 2019 and at subsequent meetings with investors or analysts.

The

information being furnished pursuant to Item 7.01 of this Current Report on Form 8-K and in Exhibits 99.1, 99.2 and 99.3 hereto

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended,

or otherwise subject to the liabilities of that section, nor will any of such information or exhibits be deemed incorporated by

reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except

as expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

|

Exhibit

Number

|

|

Description

|

|

99.1

|

|

Press Release, dated April 17, 2019, issued

by TherapeuticsMD, Inc., titled TherapeuticsMD Signs Binding Commitment Letter for $300 Million Non-Dilutive Term Loan Financing

Facility with TPG Sixth Street Partners.

|

|

99.2

|

|

Press Release, dated April 17, 2019, issued

by TherapeuticsMD, Inc., titled TherapeuticsMD Announces Commercial Availability of BIJUVA™ in the U.S.

|

|

99.3

|

|

TherapeuticsMD, Inc. presentation dated April

17, 2019.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated:

April 17, 2019

|

|

|

|

|

|

|

|

THERAPEUTICSMD, INC.

|

|

|

|

/s/

Daniel A. Cartwright

|

|

|

|

Name:

|

|

Daniel A. Cartwright

|

|

|

|

Title:

|

|

Chief Financial Officer

|

|

|

|

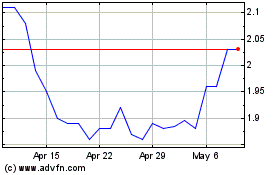

TherapeuticsMD (NASDAQ:TXMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

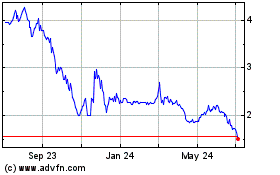

TherapeuticsMD (NASDAQ:TXMD)

Historical Stock Chart

From Apr 2023 to Apr 2024