By Heather Haddon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 10, 2019).

Yogurt's big sales run has expired.

Chobani LLC helped make yogurt one of the most fashionable foods

of the past decade, championing a natural and healthy aesthetic

that won over consumers. That became a model for other big food

companies that have since remade products across the supermarket to

include fewer artificial additives and more natural

ingredients.

Danone SA and General Mills Inc. overhauled yogurt recipes and

branding to match the wholesome trend. Startups have recently

broadened the category to include "yogurts" made from plants, not

dairy.

The changes have left some consumers confused. U.S. yogurt sales

have fallen in each of the past two years after a decade of growth,

according to Euromonitor International, a market-research firm.

"I don't even know what I'm looking for most of the time," said

Sara Gray, a 47-year-old teacher and mother in McKinney, Texas. She

said she was stumped by the blizzard of yogurts that confronted her

at her local Kroger Co. store. "Can I just get some

strawberry?"

The average U.S. supermarket carries 306 different yogurt

varieties, according to brand sales and marketing agency Acosta, up

4% since 2015. Overall yogurt sales fell 6% by volume in the year

through February, Nielsen data shows. Sales of Greek yogurt, which

kick-started the category's explosive growth, fell 11%.

The decline of the yogurt boom is a troubling sign for

packaged-food companies that have struggled for years to grow

sales. Many of their decades-old brands are losing market share to

more health-oriented startups and cheaper store-branded

alternatives.

Peter McGuinness, Chobani's chief marketing officer, said yogurt

makers undermined their own sales by introducing too many new

flavors and styles. "It's self-inflicted," he said.

French dairy company Danone, the biggest yogurt maker in the

U.S. with brands that include Dannon and Oikos, saw unit sales

decline through March, according to Nielsen data provided by a

packaged-food company. Yogurt sales from General Mills, Fage

International SA and Noosa Yoghurt LLC also dropped during the

period, according to the same Nielsen data.

General Mills Chief Executive Jeff Harmening said in an

interview that food producers had made the category too confusing.

"The shelf has become more difficult to shop," he said.

General Mills is eyeing weaker food brands in its portfolio for

a sale, but Mr. Harmening said he views its yogurt division as core

to its business. "Yogurt is a priority," he said.

Some kinds of yogurt are gaining ground even as the category

shrinks overall. Thicker "Icelandic" styles, known as skyr, and

nondairy versions made out of coconut, almonds and other plants

have grown rapidly. They contain less sugar than many traditional

yogurts, a factor that analysts and executives said pushed some

customers away from those brands.

"That's an Achilles' heel," said Mark Alexander, chief executive

of New York-based Icelandic Provisions, a startup that offers

yogurt with less sugar than traditional U.S. varieties.

Sales of Icelandic-style yogurt grew 23% by volume in the past

year, according to Nielsen. Icelandic and plant-based yogurts tend

to be more expensive than traditional styles and occupy just a

sliver of the overall market despite their rapid growth. Bigger

companies also are working to reduce the sugar content in their

yogurt.

General Mills introduced a French-style, lower-sugar variety

sold in glass jars, called Oui by Yoplait, in 2017. It notched more

than $100 million in sales in its first year, General Mills

said.

Chobani started selling a coconut-based product this year and

recently introduced yogurts with less sugar and a line aimed at

children. Chobani, which said sales are up this year through March

in both dollar and volume terms, also is spending more on marketing

and pruning products with weaker sales, Mr. McGuinness said.

Danone this year introduced a low-sugar, Greek yogurt line

called Two Good and more nondairy options under its Good Plants

brand. The company also recently released a more indulgent,

full-fat Oikos yogurt marketed as a dessert.

Food companies say retailers have hurt yogurt sales by cutting

prices and shelf space. Some grocery sellers also are promoting

lower-priced yogurts sold under their own brands.

Taken together, some consumers say all that choice is giving

them yogurt fatigue.

Anne Gardner Darku, a 40-year-old community organization

director from Jeffersonville, Ind., recently found herself

overwhelmed by the French, Greek and organic options as well as

varieties aimed at children with "cartoon characters and galactic

names" at her local Kroger store.

"It feels like way too many choices, for yogurt," she said.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

April 10, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

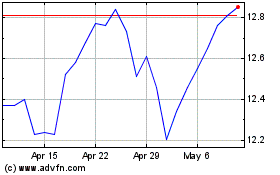

Danone (QX) (USOTC:DANOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Danone (QX) (USOTC:DANOY)

Historical Stock Chart

From Apr 2023 to Apr 2024