Current Report Filing (8-k)

April 08 2019 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 5, 2019

Biohaven Pharmaceutical Holding Company Ltd.

(Exact name of registrant as specified in its charter)

|

British Virgin Islands

|

|

001-38080

|

|

Not applicable

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

c/o Biohaven Pharmaceuticals, Inc.

215 Church Street

New Haven, Connecticut 06510

(Address of principal executive offices, including zip code)

(203) 404-0410

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.01 Completion of Acquisition or Disposition of Assets.

Following the early termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, on April 2, 2019, Biohaven Pharmaceutical Holding Company Ltd. (the “

Company

”) completed its previously announced purchase from GW Research, Ltd (“

GW

”) of a Rare Pediatric Disease Priority Review Voucher (the “

PRV

”) for $105 million in cash (the “

Asset Purchase

”) on April 5, 2019. The Asset Purchase was pursuant to the terms of a PRV Transfer Agreement, dated March 15, 2019 (the “

PRV Transfer Agreement

”), previously disclosed by the Company in a Current Report on Form 8-K filed with the Securities and Exchange Commission on March 18, 2019. Pursuant to the PRV Transfer Agreement, the Company paid GW $105 million in cash upon the closing of the Asset Purchase.

Item 3.03. Material Modification to Rights of Security Holders.

The information included in Item 5.03 below is incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws.

Amendment and Restatement of Memorandum and Articles of Association

On April 5, 2019, the Company filed an Amended and Restated Memorandum and Articles of Association (the “

Restated M&A

”) with the Registry of Corporate Affairs of the British Virgin Islands in connection with the closing of the Company’s previously announced sale of 2,495 Series A Preferred Shares (the “

Initial Closing

”) pursuant to the Series A Preferred Share Purchase Agreement (the “

Preferred

Purchase Agreement

”), dated March 18, 2019, by and between the Company and RPI Finance Trust, a Delaware statutory trust (“

RPI

”). The Company’s board of directors approved the Restated M&A to be filed in connection with the Initial Closing.

The Restated M&A, among other things: (i) designate 3,992 of the Company’s preferred shares, no par value, as “Series A Preferred Shares” and (ii) set forth the rights and privileges of the Series A Preferred Shares. Set forth below is a summary of the material terms of the Series A Preferred Shares, as defined by the Restated M&A:

Redemption

If a Change of Control (as defined in the Restated M&A) is announced within six months following the Initial Closing, the Company shall have the option to redeem the Series A Preferred Shares for one point five times (1.5x) the original purchase price of the Series A Preferred Shares upon the closing of the Change of Control. If the Company does not elect to redeem the Series A Preferred Shares for 1.5x the original purchase price at the closing of such Change of Control, then the Company would be required to redeem the Series A Preferred Shares for two times (2x) the original purchase price, payable in equal quarterly installments following closing of the Change of Control through December 31, 2024.

If a Change of Control is announced more than six months following the Initial Closing and the Series A Preferred Shares have not previously been redeemed, the Company must redeem the Series A Preferred Shares for two times (2x) the original purchase price of the Series A Preferred Shares payable in a lump sum at the closing of the Change of Control or in equal quarterly installments following the closing of the Change of Control through December 31, 2024.

If an NDA for rimegepant is not approved by December 31, 2021, RPI has the option at any time thereafter to require the Company to redeem the Series A Preferred Shares for one point two times (1.2x) the original purchase price of the Series A Preferred Shares.

If no Change of Control has been announced, the Series A Preferred Shares have not previously been redeemed and (i) rimegepant is approved on or before December 31, 2024, following approval and starting one-year after approval, the Company must redeem the Series A Preferred Shares for two times (2x) the original purchase price, payable in a lump sum or in equal quarterly installments through December 31, 2024 (provided that if rimegepant is approved in 2024, the entire redemption amount must be paid by December 31, 2024) or (ii) rimegepant is not approved by December 31, 2024, the Company must redeem the Series A Preferred Shares for two times (2x) the original purchase price on December 31, 2024.

The Company may redeem the Series A Preferred Shares at its option at any time for two times (2x) the original purchase price, which redemption price may be paid in a lump sum or in equal quarterly installments through December 31, 2024.

2

Liquidation and Voting

The Series A Preferred Shares have a liquidation preference equal to two times (2x) the original purchase price therefor in the event of a voluntarily or involuntary liquidation, dissolution or winding up of the Company. The Series A Preferred Shares are entitled to vote with the Common Shares on matters submitted to a vote of the holders of Common Shares on the basis of 1,000 votes per share, which is the equivalent number of votes that could have been purchased in Common Shares based on the closing price of the Company’s Common Shares on March 15, 2019.

Protective Provisions

The Series A Preferred Shares have customary protective provisions which provide that, without the approval of holders of a majority of the Series A Preferred Shares, the Company may not adversely affect the rights of the Series A Preferred Shares or create, authorize or issue any class or series of equity securities of the Company senior to, or

pari passu

with, the Series A Preferred Shares. However, the Company is permitted to issue equity securities ranking junior to the Series A Preferred Shares, including Common Shares, as well as convertible and/or non-convertible debt.

Other

In the event the Company defaults on any obligation to redeem Series A Preferred Shares when required, the redemption amount shall accrue interest at the rate of eighteen percent (18%) per annum. If any such default continues for at least one year, the holders of such shares shall be entitled to convert, subject to certain limitations, such Series A Preferred Shares into Common Shares, with no waiver of their redemption rights. The Series A Preferred Shares are otherwise not convertible into Common Shares in any circumstances.

The foregoing description of the Restated M&A is qualified in its entirety by reference to the full text of the Restated M&A, which are filed as Exhibit 3.1 to this report and incorporated by reference herein.

Item 8.01.

Other Events.

On April 5, 2019, pursuant to the Preferred Purchase Agreement, the Company issued and sold, in a transaction exempt from registration under the Securities Act of 1933, 2,495 Series A Preferred Shares, of no par value, of the Company to RPI in the Initial Closing. RPI paid the Company $50,100.00 per Share, for gross proceeds to the Company of approximately $125 million before deducting fees and expenses incurred in connection with the transaction.

As previously described in the Current Report on Form 8-K filed by the Company on March 18, 2019 in connection with its entry into the Preferred Purchase Agreement, commencing upon the date on which the U.S. Food and Drug Administration, or any successor agency thereto (the “

FDA

”) has accepted both of (x) the New Drug Application (“

NDA

”) with respect to the oral dissolving tablet formulation of rimegepant and (y) the NDA with respect to the tablet formulation of rimegepant (the later of such dates, the “

Second NDA Acceptance Date

”), one of which NDAs shall have been accepted under the FDA’s Priority Review Designation pathway in accordance with Section 519(a)(1) of the Federal Food, Drug, and Cosmetic Act, 21 USC 301, et seq. as amended, and including any rules, regulations and requirements promulgated thereunder, and ending upon the first anniversary of the Second NDA Acceptance Date, the Company may issue and sell to RPI, and RPI will purchase from the Company, in up to three additional closings, up to an aggregate of $75 million of additional Series A Preferred Shares upon the same terms as the Initial Closing. Any subsequent closing will be, subject to customary closing conditions set forth in the Preferred Purchase Agreement.

3

Item 9.01. Financial Statements and Exhibits.

EXHIBIT INDEX

* Pursuant to Item 601(b)(2) of Regulation S-K promulgated by the SEC, certain exhibits and schedules to this agreement have been omitted. The Company hereby agrees to furnish supplementally to the SEC, upon its request, any or all of such omitted exhibits or schedules.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

Biohaven Pharmaceutical Holding Company Ltd.

|

|

|

|

|

|

|

|

|

|

Date: April 8, 2019

|

|

By:

|

/s/ Vlad Coric, M.D.

|

|

|

|

Name:

|

Vlad Coric, M.D.

|

|

|

|

Title:

|

Chief Executive Officer

|

5

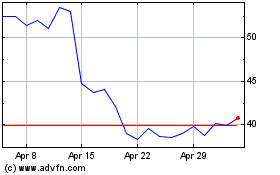

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

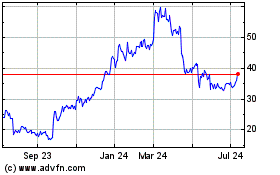

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Apr 2023 to Apr 2024