Hecla Mining Company (NYSE:HL) today announced it is filing a

National Instrument (NI) 43-101 Technical Report on the Greens

Creek Mine in Alaska and the Casa Berardi Mine in Quebec.

REPORT HIGHLIGHTS

Greens Creek

- Reserves are calculated at price

assumption of $14.50 per ounce silver.

- The current Proven and Probable Reserve

of 107.1 million silver ounces is the highest since 2008, the year

Hecla acquired 100% of the mine.

- The Life of Mine Plan (LOM) extends

production to 2030 without including any resources.

- Measured and Indicated Resources are

97.4 million silver ounces.

- Significant exploration potential.

- At approximately current prices and

based only on reserves, the mine is expected to generate $802

million of free cash flow over the LOM with an after-tax Net

Present Value (NPV) of $638 million at a 5% discount rate.1

- Expect about 20% more cash flow in the

next five years than the $72 million averaged in the past five

years.

Casa Berardi

- Reserves are calculated at price

assumption of $1,200 per gold ounce.

- Gold Proven and Probable Reserves

increased approximately 28% to 1.91 million ounces.

- Substantial reserve increases occurred

in the proposed West Mine Crown Pillar and Principal pits, Casa

Berardi’s highest-grade pits.

- The LOM extends production to 2034

without including any resources.

- Measured and Indicated Resources are

1.2 million gold ounces.

- Significant exploration potential.

- At approximately current prices and

based only on reserves, the mine is expected to generate $535

million (CAN$712 million) of free cash flow over the LOM with an

after-tax NPV of $325 million (CAN$432 million) at a 5% discount

rate.2

“The economic engine and two largest mines of Hecla, Greens

Creek (50% of Hecla’s revenues) and Casa Berardi (35% of Hecla’s

revenues), have made a remarkable achievement in materially

increasing reserves in mines that have operated for decades,” said

Phillips S. Baker, Jr., Hecla’s President and CEO. “These Technical

Reports highlight the thoughtful work that has gone into

documenting the resources, building the mine plans, optimizing each

mine’s reserves and providing strong cash flow. The analysis of

capital and operating costs shows these mines are very robust, and

that a 15% increase in metals prices could mean about 60% higher

Life of Mine cash flow based on reserves at conservative

assumptions. We have substantial resources, which, when combined

with the exploration potential outlined in the report, highlight

significant opportunities to further improve and extend the reserve

LOM at both mines.”

Additional detail regarding the reserves and resources at Greens

Creek and Casa Berardi are contained in Table A accompanying this

news release. The Greens Creek and Casa Berardi Mine reserves and

resources were reported in the February 14, 2019 news release

entitled “Hecla Reports Record Silver, Gold and Lead Reserves.”

Both mines were large contributors to record Hecla silver and gold

reserves and due to the material increases in reserves, triggered

new NI 43-101 Technical Reports.

Footnotes

1 $1,303.70/oz gold, $15.32/oz silver, $0.91/lb lead and

$1.30/lb zinc price assumptions for Greens Creek Technical Report.2

$1,300/oz gold and $15.50/oz silver price assumptions for Casa

Berardi Technical Report.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE:HL) is a leading

low-cost U.S. silver producer with operating mines in Alaska, Idaho

and Mexico, and is a growing gold producer with operating mines in

Quebec, Canada and Nevada. The Company also has exploration and

pre-development properties in eight world-class silver and gold

mining districts in the U.S., Canada and Mexico.

Cautionary Statements Regarding Forward

Looking Statements

Statements made or information provided in this news release

that are not historical facts are "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995 and "forward-looking information" within the meaning of

Canadian securities laws. Words such as “may”, “will”, “should”,

“expects”, “intends”, “projects”, “believes”, “estimates”,

“targets”, “anticipates” and similar expressions are used to

identify these forward-looking statements. Such forward-looking

statements or forward-looking information include statements about

future performance, the timing of mining of high-grade stopes and

Net Asset Values. The material factors or assumptions used to

develop such forward-looking statements or forward-looking

information include that the Company’s plans for development and

production will proceed as expected and will not require revision

as a result of risks or uncertainties, whether known, unknown or

unanticipated, to which the Company’s operations are subject.

Forward-looking statements involve a number of risks and

uncertainties that could cause actual results to differ materially

from those projected, anticipated, expected or implied. These risks

and uncertainties include, but are not limited to, metals price

volatility, volatility of metals production and costs, litigation,

regulatory and environmental risks, operating risks, project

development risks, political risks, labor issues, ability to raise

financing and exploration risks and results. Refer to the Company's

Form 10K and 10-Q reports for a more detailed discussion of

factors that may impact expected future results. The Company

undertakes no obligation and has no intention of updating

forward-looking statements other than as may be required by

law.

Cautionary Statements to Investors on

Reserves and Resources

Reporting requirements in the United States for disclosure of

mineral properties are governed by the SEC and included in the

SEC’s Securities Act Industry Guide 7, entitled “Description of

Property by Issuers Engaged or to be Engaged in Significant Mining

Operations” (Guide 7). Although the SEC has recently issued new

rules rescinding Guide 7, the new rules are not binding until

January 1, 2021, and at this time the Company still reports in

accordance with Guide 7. However, the Company is also a “reporting

issuer” under Canadian securities laws, which require estimates of

mineral resources and reserves to be prepared in accordance with

Canadian National Instrument 43-101 (NI 43-101). NI 43-101 requires

all disclosure of estimates of potential mineral resources and

reserves to be disclosed in accordance with its requirements. Such

Canadian information is included herein to satisfy the Company’s

“public disclosure” obligations under Regulation FD of the SEC and

to provide U.S. holders with ready access to information publicly

available in Canada.

Reporting requirements in the United States for disclosure of

mineral properties under Guide 7 and the requirements in Canada

under NI 43-101 standards are substantially different. This

document contains a summary of certain estimates of the Company,

not only of proven and probable reserves within the meaning of

Guide 7, but also of mineral resource and mineral reserve estimates

estimated in accordance with the definitional standards of the

Canadian Institute of Mining, Metallurgy and Petroleum referred to

in NI 43-101. Under Guide 7, the term “reserve” means that part of

a mineral deposit that can be economically and legally extracted or

produced at the time of the reserve determination. The term

“economically”, as used in the definition of reserve, means that

profitable extraction or production has been established or

analytically demonstrated to be viable and justifiable under

reasonable investment and market assumptions. The term “legally”,

as used in the definition of reserve, does not imply that all

permits needed for mining and processing have been obtained or that

other legal issues have been completely resolved. However, for a

reserve to exist, Hecla must have a justifiable expectation, based

on applicable laws and regulations, that issuance of permits or

resolution of legal issues necessary for mining and processing at a

particular deposit will be accomplished in the ordinary course and

in a timeframe consistent with Hecla's current mine plans. The

terms “measured resources”, “indicated resources”, and “inferred

resources” are Canadian mining terms as defined in accordance with

NI 43-101. These terms are not defined under Guide 7 and are not

normally permitted to be used in reports and registration

statements filed with the SEC in the United States, except where

required to be disclosed by foreign law. The term “resource” does

not equate to the term “reserve”. Under Guide 7, the material

described herein as “indicated resources” and “measured resources”

would be characterized as “mineralized material” and is permitted

to be disclosed in tonnage and grade only, not ounces. The category

of “inferred resources” is not recognized by Guide 7. Investors are

cautioned not to assume that any part or all of the mineral

deposits in such categories will ever be converted into proven or

probable reserves. “Resources” have a great amount of uncertainty

as to their existence, and great uncertainty as to their economic

and legal feasibility. It cannot be assumed that all or any part of

such a “resource” will ever be upgraded to a higher category or

will ever be economically extracted. Investors are cautioned not to

assume that all or any part of a “resource” exists or is

economically or legally mineable. Investors are also especially

cautioned that the mere fact that such resources may be referred to

in ounces of silver and/or gold, rather than in tons of

mineralization and grades of silver and/or gold estimated per ton,

is not an indication that such material will ever result in mined

ore which is processed into commercial silver or gold.

Qualified Person (QP) Pursuant to

Canadian National Instrument 43-101

Dean McDonald, PhD. P.Geo., Senior Vice President – Exploration

of Hecla Mining Company, who serves as a Qualified Person under

National Instrument 43-101, supervised the preparation of the

scientific and technical information concerning Hecla’s mineral

projects in this news release. Information regarding data

verification, surveys and investigations, quality assurance program

and quality control measures and a summary of sample, analytical or

testing procedures for the Greens Creek Mine are contained in a

technical report prepared for Hecla titled “Technical Report for

the Greens Creek Mine, Juneau, Alaska, USA” effective date December

31, 2018, and for the Casa Berardi Mine are contained in a

technical report prepared for Hecla titled “Technical Report for

the Casa Berardi Mine, Northwestern Quebec, Canada” effective date

December 31, 2018 (the “Casa Berardi Technical Report”), and for

the Lucky Friday Mine are contained in a technical report prepared

for Hecla titled “Technical Report on the Lucky Friday Mine

Shoshone County, Idaho, USA” effective date April 2, 2014, and for

the San Sebastian Mine are contained in a technical report prepared

for Hecla titled “Technical Report for the San Sebastian Ag-Au

Property, Durango, Mexico” effective date September 8, 2015.

Information regarding data verification, surveys and

investigations, quality assurance program and quality control

measures and a summary of sample, analytical or testing procedures

for the Fire Creek Mine are contained in a technical report

prepared for Klondex Mines titled “Technical Report for the Fire

Creek Project, Lander County, Nevada”, dated March 31, 2018;

the Hollister Mine dated May 31, 2017, amended August 9, 2017; and

the Midas Mine dated August 31, 2014, amended April 2, 2015. Also

included in these technical reports is a description of the key

assumptions, parameters and methods used to estimate mineral

reserves and resources and a general discussion of the extent to

which the estimates may be affected by any known environmental,

permitting, legal, title, taxation, socio-political, marketing or

other relevant factors. Copies of these technical reports are

available under Hecla's profile on SEDAR at www.sedar.com.

Dr. McDonald reviewed and verified information regarding drill

sampling, data verification of all digitally-collected data, drill

surveys and specific gravity determinations relating to the Casa

Berardi mine. The review encompassed quality assurance programs and

quality control measures including analytical or testing practice,

chain-of-custody procedures, sample storage procedures and included

independent sample collection and analysis. This review found the

information and procedures meet industry standards and are adequate

for Mineral Resource and Mineral Reserve estimation and mine

planning purposes.

Table A: Reserves and Resources

– 12/31/18(1)

Proven Reserves Tons

Silver Gold

Lead Zinc Copper

Silver Gold

Lead Zinc Copper

Asset (000)

(oz/ton) (oz/ton)

% % %

(000 oz) (000 oz)

(Tons) (Tons)

(Tons)

Greens Creek(2)

6 13.8 0.10

2.8 7.0 - 86

1 180 440 -

Lucky Friday(2)

4,230 15.4 -

9.6 4.1 - 65,234

- 406,080 174,630

-

Casa Berardi(3)

6,790 - 0.08

- - - -

563 - - -

San Sebastian(2)

22 3.9 0.08

- - - 85 2

- - -

Fire Creek(2,4)

24 1.1 1.21

- - - 27 29

- - -

Hollister(2,5)

2 7.0 0.73

- - - 17 2

- - -

Total

11,074

65,448 596 406,260

175,070 -

Probable Reserves Tons Silver

Gold Lead Zinc Copper Silver

Gold Lead Zinc Copper Asset

(000) (oz/ton)

(oz/ton) %

% % (000 oz)

(000 oz) (Tons)

(Tons) (Tons)

Greens Creek(2)

9,270 11.5 0.09

2.8 7.6 -

106,972

840 262,760 706,040

-

Lucky Friday(2)

1,387 11.4 -

7.6 3.7 - 15,815

- 104,720 50,640

-

Casa Berardi(3)

16,954 - 0.08

- - - -

1,343 - - -

San Sebastian(2)

206 13.1 0.10

- - - 2,705

21 - - -

Fire Creek(2,4)

91 0.3 0.44

- - - 30 40

- - -

Hollister(2,5)

9 7.2 0.65

- - - 66 6

- - -

Total

27,917

125,588 2,250 367,480

756,680 -

Proven and Probable Reserves Tons

Silver Gold Lead Zinc Copper

Silver Gold Lead Zinc Copper

Asset (000)

(oz/ton) (oz/ton)

% % %

(000 oz) (000 oz)

(Tons) (Tons)

(Tons)

Greens Creek(2)

9,277 11.5 0.09

2.8 7.6 - 107,058

840 262,940 706,470

-

Lucky Friday(2)

5,617 14.4 -

9.1 4.0 - 81,049

- 510,800 225,260

-

Casa Berardi(3)

23,743 - 0.08

- - - -

1,907 - - -

San Sebastian(2)

228 12.3 0.10

- - - 2,790

23 - - -

Fire Creek(2,4)

115 0.5 0.60

- - - 57

69 - - -

Hollister(2,5)

11 7.2 0.67

- - - 82 8

- - -

Total

38,991

191,036 2,846 773,740

931,730 -

(1) The term “reserve” means that part of

a mineral deposit that can be economically and legally extracted or

produced at the time of the reserve determination. The term

“economically,” as used in the definition of reserve, means that

profitable extraction or production has been established or

analytically demonstrated to be viable and justifiable under

reasonable investment and market assumptions. The term “legally,”

as used in the definition of reserve, does not imply that all

permits needed for mining and processing have been obtained or that

other legal issues have been completely resolved. However, for a

reserve to exist, Hecla must have a justifiable expectation, based

on applicable laws and regulations, that issuance of permits or

resolution of legal issues necessary for mining and processing at a

particular deposit will be accomplished in the ordinary course and

in a timeframe consistent with Hecla’s current mine plans.

(2) Mineral reserves are based on $1200 gold, $14.50 silver, $0.90

lead, $1.15 zinc, unless otherwise stated. (3) Mineral reserves are

based on $1200 gold and a US$/CAN$ exchange rate of 1:1.33 Reserve

diluted to an average of 34.7% to minimum width of 9.8 feet (3 m)

Reserves at Casa Berardi were determined by Jonathan

Archambault-Giroux, P. Geo., Que., Real Parent, P.Geo. Que., and

Alain Quenneville, P. Eng., Que. unless otherwise stated. Open pit

mineral reserves of the Principal Mine were estimated in September

2018 by Hecla Quebec and Mine Development Associates based on $1225

gold and a US$/CAN$ exchange rate of 1:3. Hecla Mining Company,

Principal Deposit Open Pit Mining Study – 2018 September 1, 2018,

by Mine Development Associates, Thomas L. Dyer, P.E. Open pit

mineral reserves of the 160 and 134 Zones were estimated in January

2018 by Hecla Quebec and Mine Development Associates based on $1225

gold and a US$/CAN$ exchange rate of 1.3. Hecla Mining, Casa

Berardi 160 and 134 Zones, Open Pit Mining Study – 2017 January 12,

2018, by Mine Development Associates, Thomas L. Dyer, P.E. Open pit

mineral reserves of the West Mine Crown Pillar were estimated in

January 2019 by Hecla Quebec and Mine Development Associates based

on $1225 gold and a US$/CAN$ exchange rate of 1.3. Hecla Mining

Company, West Mine Crown Pillar Deposit, Open Pit Mining Study –

2018 January 10, 2019, by Mine Development Associates, Thomas L.

Dyer, P.E. Open pit mineral reserves of the East Mine Crown Pillar

Expansion were estimated in August 2018 by Hecla Quebec and Mine

Development Associates based on $1225 gold and a US$/CAN$ exchange

rate of 1.3. Hecla Mining Company, East Mine Crown Pillar

Expansion, Open Pit Mining Study – 2018 August 22, 2018, by Mine

Development Associates, Thomas L. Dyer, P.E. (4) Recoveries at Fire

Creek for gold and silver are 94% and 92%. Cutoff grade of 0.339 Au

Equivalent oz/ton and incremental cutoff grade of 0.11 Au

Equivalent oz/ton. Unplanned dilution of 10% to 17% included

depending on mining method. (5) Recoveries at Hollister for gold

and silver are 87% and 80%. Cutoff grade of 0.396 Au Equivalent

oz/ton and incremental cutoff grade of 0.07 Au Equivalent oz/ton.

Unplanned dilution of 10% to 17% and 5% mining loss included.

Measured Resources Tons

Silver Gold

Lead Zinc Copper

Silver Gold

Lead Zinc Copper

Asset (000)

(oz/ton) (oz/ton)

% % %

(000 oz) (000 oz)

(Tons) (Tons)

(Tons)

Greens Creek(6)

339 9.5 0.11

2.6 9.4 - 3,233

36 8,800 31,700

-

Lucky Friday(6,7)

7,587 7.6 -

4.9 2.7 - 57,314

- 370,240 204,490

-

Casa Berardi(8)

1,952 - 0.15

- - - -

299 - - -

San Sebastian(6,9)

- - - -

- - - -

- - -

Fire Creek(6,10)

64 0.7 0.92

- - - 47 58

- - -

Hollister(6,11)

104 4.0 0.92

- - - 420

96 - - -

Midas(6,12)

183 6.7 0.45

- - - 1,235

82 - - -

Heva(14)

5,480 - 0.06

- - - -

304 - - -

Hosco(14)

33,070 - 0.04

- - - -

1,296 - - -

Rio Grande Silver(15)

- - - -

- - - -

- -

Star(16)

- - - -

- - - -

- - -

Total

48,778

62,249 2,172 379,040

236,190 -

Indicated Resources Tons Silver

Gold Lead Zinc Copper Silver

Gold Lead Zinc Copper Asset

(000) (oz/ton)

(oz/ton) %

% % (000 oz)

(000 oz) (Tons)

(Tons) (Tons)

Greens Creek(6)

7,128 13.2 0.10

3.1 8.1 - 94,197

690 218,950 577,650

-

Lucky Friday(6,7)

2,498 8.0 -

5.2 2.5 - 20,049

- 128,830 61,480 -

Casa Berardi(8)

10,797 - 0.08

- - - -

906 - - -

San Sebastian(6,9)

2,243 6.5 0.05

2.5 3.5 1.6 14,690

115 30,410 42,710

19,780

Fire Creek(6,10)

307 0.5 0.54

- - - 158

164 - - -

Fire Creek - Open Pit(13)

42,877 0.1 0.03

- - - 2,350

1,093 - -

Hollister(6,11)

135 2.6 0.64

- - - 350

86 - - -

Midas(6,12)

722 4.5 0.37

- - - 3,228

267 - - -

Heva(14)

5,570 - 0.07

- - - -

369 - - -

Hosco(14)

31,620 - 0.04

- - - -

1,151 - - -

Rio Grande Silver(15)

516 14.8 -

2.1 1.1 - 7,620

- 10,760 5,820 -

Star(16)

1,126 2.9 -

6.2 7.4 - 3,301

- 69,900 83,410 -

Total 105,538

145,944 4,841

458,850 771,070 19,780

Measured &

Indicated Resources Tons Silver Gold

Lead Zinc Copper Silver Gold

Lead Zinc Copper Asset

(000) (oz/ton)

(oz/ton) % %

% (000 oz)

(000 oz) (Tons)

(Tons) (Tons)

Greens Creek(6)

7,467 13.0 0.10

3.1 8.2 - 97,430

726 227,740 609,350

-

Lucky Friday(6,7)

10,084 7.7 -

4.9 2.6 - 77,363

-- 499,070 265,970

-

Casa Berardi(8)

12,749 - 0.09

- - - -

1,205 - - -

San Sebastian(6,9)

2,243 6.5 0.05

2.5 3.5 1.6 14,690

115 30,410 42,710

19,780

Fire Creek(6,10)

371 0.6 0.60

- - - 205

222 - -

Fire Creek - Open Pit(13)

42,877 0.1 0.03

- - - 2,350

1,093 - - -

Hollister(6,11)

239 3.2 0.76

- - - 770

182 - - -

Midas(6,12)

905 4.9 0.39

- - - 4,463

349 - - -

Heva(14)

11,050 - 0.06

- - - -

672 - - -

Hosco(14)

64,690 - 0.04

- - - -

2,447 - - -

Rio Grande Silver(15)

516 14.8 -

2.1 1.1 - 7,620

- 10,760 5,820 -

Star(16)

1,126 2.9 -

6.2 7.4 - 3,301

- 69,900 83,410

Total 154,316

208,193 7,012

837,880 1,007,260 19,780

Inferred Resources Tons Silver

Gold Lead Zinc Copper Silver

Gold Lead Zinc Copper Asset

(000) (oz/ton)

(oz/ton) %

% % (000 oz)

(000 oz) (Tons)

(Tons) (Tons)

Greens Creek(6)

2,470 14.6 0.09

3.0 7.3 - 35,982

219 74,410 181,400

-

Lucky Friday(6,7)

2,861 8.7 -

6.3 2.6 - 24,809

- 181,180 74,430 -

Casa Berardi(8)

6,222 - 0.10

- - - -

652 - - -

San Sebastian(6,17)

3,487 6.6 0.04

1.7 2.5 1.3 22,948

143 12,110 17,440

8,890

Fire Creek(6,10)

565 0.5 0.53

- - - 288

299 - - -

Fire Creek - Open Pit(13)

31,707 0.1 0.03

- - - 2,882

1,085 - - -

Hollister(6,11,18)

550 3.1 0.40

- - - 1,716

223 - - - Midas

(6,12) 573 3.0 0.34

- - - 1,723

198 - - -

Heva (14) 4,210 - 0.08

- - - -

350 - - -

Hosco (14) 7,650 - 0.04

- - - -

314 - - -

Rio Grande Silver(19)

3,078 10.7 0.01

1.3 1.1 - 33,097

36 40,990 34,980

-

Star(16)

3,157 2.9 -

5.6 5.5 - 9,432

- 178,670 174,450

-

Monte Cristo(20)

913 0.3 0.14

- - - 271

131 - - -

Rock Creek(21)

100,086 1.5 -

- - 0.7 148,736

- - -

658,680

Montanore(22)

112,185 1.6 -

- - 0.7 183,346

- - -

759,420

Total 279,714

465,229 3,648

487,360 482,700 1,426,990

Note: All estimates are in-situ except for the proven

reserves at Greens Creek and San Sebastian which are in surface

stockpiles. Resources are exclusive of reserves. (6) Mineral

resources are based on $1350 gold, $21 silver, $1.10 lead, $1.20

zinc and $3.00 copper, unless otherwise stated. (7) Measured and

indicated resources from Gold Hunter and Lucky Friday vein systems

are diluted and factored for expected mining recovery. (8)

Measured, indicated and inferred resources are based on $1,350 gold

and a US$/CAN$ exchange rate of 1:1.33 Underground resources are

reported at a minimum mining width of 6.6 to 9.8 feet (2 m to 3 m).

Resources at Casa Berardi were determined by Jonathan

Archambault-Giroux, P. Geo., Que., Real Parent, P.Geo. Que., and

Alain Quenneville, P. Eng., Que. unless otherwise stated. (9)

Indicated resources reported at a minimum mining width of 5.9 feet

(1.8 m) for Hugh Zone, Middle Vein, North Vein, and East Francine

Vein and 4.9 feet (1.5 m) for Andrea Vein. San Sebastian lead, zinc

and copper grades are for 1,224,900 tons of indicated resource

within the Middle Vein and the Hugh Zone of the Francine Vein. (10)

Recoveries at Fire Creek for gold and silver are 94% and 92%. Au

equivalent cutoff grade of 0.297 oz/ton. The minimum mining width

is defined as four feet or the vein true thickness plus two feet,

whichever is greater. (11) Recoveries at Hollister for gold and

silver are 87% and 80%. Au equivalent cutoff grade of 0.352 oz/ton.

The minimum mining width is defined as four feet or the vein true

thickness plus two feet, whichever is greater. (12) Recoveries at

Midas for gold and silver are 93% and 88% Au equivalent cutoff

grade of 0.217 oz/ton. The minimum mining width is defined as four

feet or the vein true thickness plus two feet, whichever is

greater. (13) Indicated and inferred open-pit resources for Fire

Creek were calculated November 30, 2017 using recoveries for gold

and silver of 65% and 30% for oxide material and 60% and 25% for

mixed oxide-sulfide material. Open pit resources are calculated at

$1400 gold and $19.83 silver and cut-off grade of 0.01 Au

Equivalent oz/ton and is inclusive of 10% mining dilution and 5%

ore loss. Open pit mineral resources exclusive of underground

mineral resources. NI43-101 Technical Report for the Fire Creek

Project, Lander County, Nevada; Effective Date March 31, 2018;

prepared by Practical Mining LLC, Mark Odell, P.E. for Hecla Mining

Company, June28, 2018 (14) Measured, indicated and inferred

resources were estimated in by Goldminds Geoservices Inc. with

effective date 12-July-2013, and are based on $1,300 gold and a

US$/CAN$ exchange rate of 1:1. The resources are in-situ without

dilution and material loss. NI43-101 Technical Report, Mineral

Resource Update, Heva-Hosco Gold Projects, Rouyn-Noranda, Quebec,

Hecla Quebec, December 2013 Prepared by: Claude Duplessis, Eng.

Project Manager - Goldminds Geoservices Inc.; Maxime Dupéré, P.Geo

- SGS Canada Inc. (Geostat) (15) Indicated resources reported at a

minimum mining width of 6.0 feet for Bulldog; resources based on

$26.5 Ag, $0.85 Pb, and $0.85 Zn. (16) Indicated and Inferred

resources reported using $21 silver, $0.95 lead, $1.10 zinc minimum

mining width of 4.3 feet. (17) Inferred resources reported at a

minimum mining width of 5.9 feet (1.8 m) for Hugh Zone, Middle

Vein, North Vein, and East Francine Vein and 4.9 feet (1.5 m) for

Andrea Vein. San Sebastian lead, zinc and copper grades are for

702,600 tons of inferred resource within the Middle Vein and the

Hugh Zone of the Francine Vein. (18) Inferred resources for the

Hatter Project at the Hollister Mine calculated using recoveries

for gold and silver of 82.7% and 71.8% and an Au equivalent cutoff

grade of 0.27 oz/ton. (19) Inferred resources reported at a minimum

mining width of 6.0 feet for Bulldog, 5.0 feet for Equity &

North Amethyst veins; resources based on $1400 Au, $26.5 Ag, $0.85

Pb, and $0.85 Zn. (20) Inferred resource reported at a minimum

mining width of 5.0 feet; resources based on $1400 Au, $26.5 Ag.

(21) Inferred resource at Rock Creek reported at a minimum

thickness of 15 feet and adjusted given mining restrictions as

defined by U.S. Forest Service, Kootenai National Forest in the

June 2003 'Record of Decision, Rock Creek Project'. (22) Inferred

resource at Montanore reported at a minimum thickness of 15 feet

and adjusted given mining restrictions defined by U.S. Forest

Service, Kootenai National Forest, Montana DEQ in December 2015

'Joint Final EIS, Montanore Project'. and the February 2016 U.S

Forest Service - Kootenai National Forest 'Record of Decision,

Montanore Project'.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190401005920/en/

For further information, please contact:Mike WesterlundVice

President – Investor Relations800-HECLA91 (800-432-5291)Investor

RelationsEmail: hmc-info@hecla-mining.comWebsite:

www.hecla-mining.com

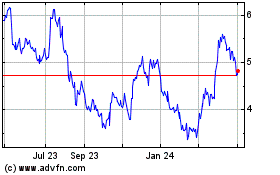

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Apr 2023 to Apr 2024