InVivo Therapeutics Holdings Corp. (NVIV) today reported

financial results for the year ended December 31, 2018.

Richard Toselli, M.D., President and Chief Executive Officer of

InVivo, commented, “InVivo achieved many critical and exciting

milestones over the past year. Early in 2018 we received FDA

approval of our supplemental Investigational Device Exemption (IDE)

to initiate a second pivotal study of the company’s Neuro-Spinal

Scaffold™ in patients with acute spinal cord injury (SCI), the

INSPIRE 2.0 Study. In addition, we successfully raised net proceeds

of $16.5 million in 2018, which put us in a position to focus on

the initiation of the INSPIRE 2.0 Study, while implementing

significant cost saving measures, which resulted in an $11.8

million or a 48 percent decrease in our operating expenses year

over year. Finally, we continue work towards enrollment in the

INSPIRE 2.0 Study, and with five clinical sites recently activated

and now open for enrollment, we expect to begin enrollment in Q2 of

this year.”

Dr. Toselli concluded, “In addition to continued progress on the

INSPIRE 2.0 Study and our fundraising activities, we are encouraged

by the prospect of building a more diversified pipeline with

technologies that align with our core competencies and fundamental

interests.”

Financial Results

Operating expenses for the years ended December 31, 2018 and

2017 were $12,767,000 and $24,593,000 respectively, representing a

48% decrease in operating expenses. For the year ended December 31,

2018, the Company reported a net loss of approximately $23,423,000,

or $4.69 per share, compared to a net loss of approximately

$26,745,000, or $20.29 per share, for the year ended December 31,

2017. Included in results for the years ended December 31, 2018 and

2017 were non-cash losses of $12,165,000 and $2,267,000,

respectively. The loss of $12,165,000 for the year ended December

31, 2018 can be attributed to the issuance of the liability

classified warrants in 2018 and the subsequent change in fair value

through the date of warrant exercises or reclassification to

equity. The loss of $2,267,000 for the year ended December 31, 2017

can be attributed to the impact of the August 2017 warrant exchange

and the decrease in the fair value of derivative warrant liability

primarily due to the decrease in the fair value of the underlying

common stock. Excluding the impact of the derivative warrant

liability, adjusted net loss for the year ended December 31, 2018,

was $11,258,000, or $2.25 per share, compared to an adjusted net

loss of $24,478,000, or $18.57 per share, for the year ended

December 31, 2017. The Company ended the year with $16,660,000 of

cash and cash equivalents as of December 31, 2018.

Adjusted net loss and adjusted net loss per share are non-GAAP

financial measures that exclude the impact of the items noted. A

reconciliation of these measures to the comparable GAAP measures is

included with the tables contained in this release. The Company

believes a presentation of these non-GAAP measures provides useful

information to investors, enabling them to better understand the

Company’s operations, on a period-to-period comparable basis, with

financial amounts both including and excluding these identified

items.

About InVivo Therapeutics

InVivo Therapeutics Holdings Corp. is a research and

clinical-stage biomaterials and biotechnology company with a focus

on treatment of spinal cord injuries. The company was founded in

2005 with proprietary technology co-invented by Robert Langer,

Sc.D., Professor at Massachusetts Institute of Technology, and

Joseph P. Vacanti, M.D., who then was at Boston Children’s Hospital

and who now is affiliated with Massachusetts General Hospital. In

January 2018, the company announced updated clinical evidence,

including improvements in patients with acute spinal cord injury

(SCI), from its INSPIRE study of the Neuro-Spinal Scaffold™. The

publicly traded company is headquartered in Cambridge, MA. For more

details, visit www.invivotherapeutics.com.

Safe Harbor Statement

Any statements contained in this press release that do not

describe historical facts may constitute forward-looking statements

within the meaning of the federal securities laws. These statements

can be identified by words such as "believe," "anticipate,"

"intend," "estimate," "will," "may," "should," "expect" and similar

expressions, and include statements regarding the expected timing

for commencement of enrollment and completion of the Inspire 2.0

Study. Any forward-looking statements contained herein are based on

current expectations, and are subject to a number of risks and

uncertainties. Factors that could cause actual future results to

differ materially from current expectations include, but are not

limited to, risks and uncertainties relating to the Company’s

ability to successfully open additional clinical sites for

enrollment and to enroll additional patients; the timing of the

Institutional Review Board process; the Company’s ability to obtain

FDA approval to commercialize its products; the Company’s ability

to develop, market and sell products based on its technology; the

expected benefits and efficacy of the Company’s products and

technology in connection with spinal cord injuries; the

availability of substantial additional funding for the Company to

continue its operations and to conduct research and development,

clinical studies and future product commercialization; and other

risks associated with the Company’s business, research, product

development, regulatory approval, marketing and distribution plans

and strategies identified and described in more detail in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2018, and its other filings with the SEC, including the

Company’s Form 10-Qs and current reports on Form 8-K. The Company

does not undertake to update these forward-looking statements.

InVivo Therapeutics Holdings Corp

Consolidated Balance Sheets (In

thousands, except share and per-share data) December

31, 2018 2017 ASSETS:

Current assets: Cash and cash equivalents $ 16,660 $ 12,910

Restricted cash 4 361 Prepaid expenses and other current assets

461 535 Total current assets 17,125 13,806 Property,

equipment and leasehold improvements, net 100 157 Restricted cash

110 — Other assets 1,042 82 Total assets $ 18,377 $

14,045

LIABILITIES AND STOCKHOLDERS’ EQUITY: Current

liabilities: Accounts payable $ 815 $ 988 Loan payable, current

portion 100 452 Derivative warrant liability — 4 Deferred rent,

current portion — 30 Accrued expenses 1,290 1,638

Total current liabilities 2,205 3,112 Loan payable, net of current

portion — 400 Deferred rent, net of current portion — 367 Other

liabilities 61 56 Total liabilities 2,266

3,935 Commitments and contingencies (Note 15) Stockholders’

equity: Common stock, $0.00001 par value, authorized 25,000,000

shares;

9,309,255 shares issued and outstanding at

December 31, 2018;

1,370,992 shares issued and outstanding at

December 31, 2017

1 1 Additional paid-in capital 223,440 194,016 Accumulated deficit

(207,330) (183,907) Total stockholders’ equity

16,111 10,110 Total liabilities and stockholders’ equity $

18,377 $ 14,045

(Reflects the retrospective application of the 1-for-25 reverse

stock split effective April 16, 2018)

InVivo Therapeutics Holdings Corp

Consolidated Statements of Operations and

Comprehensive Loss (In thousands, except share and

per share data) Year Ended December 31,

2018 2017

Operating expenses: Research and development $ 4,931 $ 11,083

General and administrative 7,836 13,510

Total operating expenses 12,767 24,593

Operating loss (12,767 ) (24,593 ) Other income /

(expense): Interest income / (expense), net 206 115 Other income

1,303 — Derivatives (loss) (12,165 ) (2,267 ) Other

income / (expense), net (10,656 ) (2,152 ) Net loss $

(23,423 ) $ (26,745 ) Net loss per share, basic and diluted $ (4.69

) $ (20.29 ) Weighted average number of common shares outstanding,

basic and diluted 4,990,089 1,318,003

Other comprehensive loss: Net loss $ (23,423 ) $ (26,745 ) Other

comprehensive loss: Unrealized gain / (loss) on marketable

securities — — Comprehensive loss $

(23,423 ) $ (26,745 )

Reflects the retrospective application of the 1-for-25 reverse

stock split effective April 16, 2018

InVivo Therapeutics Holdings Corp

Reconciliation of GAAP to non-GAAP measures

(In thousands, except share and per-share data)

Year Ended December 31, 2018

2017 Reported GAAP net loss $ 23,423 $ 26,745 Derivative

loss 12,165 2,267 Adjusted net loss $ 11,258 $ 24,478

Reported GAAP net loss per diluted share $ 4.69 $ 20.29

Derivative loss per diluted share 2.44 1.72 Adjusted

net loss per diluted share $ 2.25 $ 18.57

(Reflects the retrospective application of the 1-for-25 reverse

stock split effective April 16, 2018)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190401005244/en/

IR CONTACT:Bret Shapiro, Managing PartnerCORE IRPhone:

(516) 222-2560brets@coreir.comMEDIA CONTACT:Jules

AbrahamCORE IRPhone: (917) 885-7378julesa@coreir.com

InVivo Therapeutics (NASDAQ:NVIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

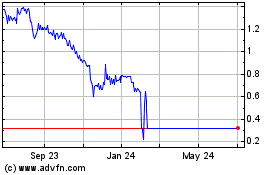

InVivo Therapeutics (NASDAQ:NVIV)

Historical Stock Chart

From Apr 2023 to Apr 2024