|

PROSPECTUS SUPPLEMENT

|

Filed Pursuant to Rule 424(b)(5)

|

|

To prospectus dated July 5, 2018

|

Registration No. 333-226024

|

184,800

Shares

of Series B Preferred Stock (Including Shares of Series B Preferred Stock Underlying the Series F-1 Preferred Stock Purchase Warrants,

Series F-2 Preferred Stock Purchase Warrants and Placement Agent Warrants);

Series F-1 Preferred Stock Purchase

Warrants to Purchase 59,760 Shares of Series B Preferred Stock;

Series F-2 Preferred Stock Purchase

Warrants to Purchase 60,240 Shares of Series B Preferred Stock;

Placement Agent

Warrants to Purchase 4,800 Shares of Series B Preferred Stock;

3,080,061,600

Shares of Common Stock Underlying the Series B Preferred Stock (Including Shares of Series B Preferred Stock Issuable Upon

Exercise of the Series F-1 Preferred Stock Purchase Warrants, Series F-2 Preferred Stock Purchase Warrants and Placement Agent

Warrants)

We are offering on a “best-efforts”

basis 60,000 shares of our Series B Preferred Stock, par value $0.01 per share (“Series B Preferred Stock”),

together with Series F-1 Preferred Stock Purchase Warrants (the “Series F-1 Warrants”) to purchase an aggregate of

59,760 shares of our Series B Preferred Stock and Series F-2 Preferred Stock Purchase Warrants (the “Series F-2 Warrants”,

and together with the Series F-1 Warrants, the “Series F Warrants”) to purchase an aggregate of 60,240 shares of our

Series B Preferred Stock, at a combined offering purchase price of $100.00 per fixed combination of (i) one share of Series B

Preferred Stock, (ii) one Series F-1 Warrant to purchase 0.996 shares of our Series B Preferred Stock, (iii) one Series F-2 Warrant

to purchase 1.004 shares of our Series B Preferred Stock. The shares of Series B Preferred Stock, the Series F-1 Warrants and

the Series F-2 Warrants will be issued separately but can only be purchased together in this offering.

Each share of Series B Preferred Stock

will be convertible by the holder into 16,667 shares of our common stock, subject to adjustment. Each share of Series B Preferred

Stock is convertible at any time at the option of the holder, provided that the holder will be prohibited from converting Series

B Preferred Stock into shares of our common stock if, as a result of such conversion, the holder, together with its affiliates,

would beneficially own more than 9.99% of the total number of shares of our common stock then issued and outstanding after giving

effect to such conversion.

Subject to the applicable law and the rights

of the holders of any outstanding series of our preferred stock, our Series B Preferred Stock will rank pari passu on an as-converted

to common stock basis with all of our common stock as to dividends, distributions of proceeds upon certain asset sales, mergers

or consolidations and distributions of assets upon our liquidation, dissolution or winding up. Shares of our Series B Preferred

Stock will be entitled to vote on an as-converted to common stock basis on all matters on which stockholders are generally entitled

to vote (provided that no holder of Series B Preferred Stock will be entitled to such number of votes in excess of such holder’s

beneficial ownership limitation). Additionally, the vote or written consent of holders of a majority of the outstanding shares

of our Series B Preferred Stock, voting separately as a single class, will be required for certain amendments to our certificate

of incorporation.

The Series F-1 Warrants will entitle the holders

thereof to purchase 59,760 shares of our Series B Preferred Stock in the aggregate, and the Series F-2 Warrants will entitle the

holders thereof to purchase 60,240 shares of our Series B Preferred Stock in the aggregate (we refer to shares of our Series B

Preferred Stock issuable upon exercise of the Series F Warrants and Placement Agent Warrants, as “Warrant Preferred Shares”),

in each case, at an exercise price of $100.00 per share of Series B Preferred Stock. The Series F-1 Warrants will be exercisable

at any time on or after the issuance date until the five-year anniversary of such initial exercise date. The Series F-2 Warrants

will be exercisable at any time on or after the date on which we obtain stockholder approval for a reverse stock split or to increase

our authorized common stock to allow for the reservation in full of all shares of common stock issuable upon conversion of the

Warrant Preferred Shares issuable upon exercise of the Series F-2 Warrants until the five-year anniversary of such initial exercise

date.

Pursuant to this prospectus supplement

and the accompanying prospectus, we will also issue the Placement Agent Warrants described below, as part of the compensation

payable to the placement agent in connection with this offering. This prospectus supplement also relates to the offering of the

shares of common stock issuable from time to time upon conversion of the Series B Preferred Stock (including the Warrant Preferred

Shares).

For a more detailed description of our

common stock, the Series B Preferred Stock, the Series F Warrants and the Placement Agent Warrants, see the section entitled “Description

of the Securities We are Offering” beginning on page S-29 of this prospectus supplement.

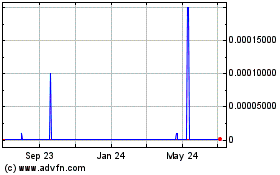

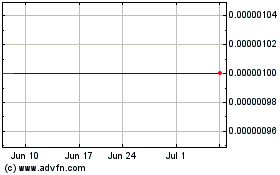

Our common stock is quoted on the OTC

Pink Market operated by OTC Markets Group Inc. under the symbol “HMNY”. The closing sales price of our common stock

on March 22, 2019, was $0.012 per share. There is no public trading market for the Series B Preferred Stock, Series F Warrants

or Placement Agent Warrants, we do not expect a market to develop, and holders may not be able to resell the Series B Preferred

Stock, Series F Warrants or Placement Agent Warrants or the shares of common stock underlying the Series B Preferred Stock (including

those underlying the Warrant Preferred Shares) purchased under this prospectus supplement. In addition, we do not intend to apply

for a listing of the Series B Preferred Stock, Series F Warrants or Placement Agent Warrants or the shares of common stock underlying

the Series B Preferred Stock (including those underlying the Warrant Preferred Shares) on the Nasdaq Capital Market, any other

national securities exchange, or any nationally recognized trading system. This may affect the pricing of the Series B Preferred

Stock, Series F Warrants or Placement Agent Warrants and the shares of common stock underlying the Series B Preferred Stock (including

those underlying the Warrant Preferred Shares) in the secondary market, the transparency and availability of trading prices, and

the liquidity of the Series B Preferred Stock, Series F Warrants or Placement Agent Warrants and the shares of common stock underlying

the Series B Preferred Stock (including those underlying the Warrant Preferred Shares).

We have retained H.C. Wainwright & Co.,

LLC as our exclusive placement agent in connection with the securities offered by this prospectus supplement and the accompanying

prospectus. The placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities offered

by this prospectus supplement and the accompanying prospectus. The placement agent has no obligation to buy any of the securities

from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. We have agreed to pay

the placement agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities we

are offering. Because there is no minimum offering amount required as a condition to closing in this offering, the actual offering

amount, placement agent’s fees, and proceeds to us, if any, are not presently determinable and may be substantially less

than the total maximum offering amounts set forth below.

Investing in our securities involves

a high degree of risk. See “Risk Factors” beginning on page S-9 of this prospectus supplement and page 2 of the accompanying

prospectus.

|

|

|

Combined

Price per

Share

of Series B Preferred Stock

and Series F Warrants

|

|

|

Total

(2)

|

|

|

Offering price

|

|

$

|

100.00

|

|

|

$

|

6,000,000.00

|

|

|

Placement

agent fees

(1)

|

|

$

|

7.33

|

|

|

$

|

440,000.00

|

|

|

Proceeds to us before expenses

|

|

$

|

92.67

|

|

|

$

|

5,560,000.00

|

|

|

(1)

|

In addition, we have

agreed to reimburse the placement agent for certain of its expenses and to issue warrants to purchase shares of our Series

B Preferred Stock to the placement agent as described under the “Plan of Distribution” section (the “Placement

Agent Warrants”).

|

|

|

(2)

|

Total proceeds does not give effect to the sale or exercise,

if any, of the Series F Warrants or the Placement Agent Warrants.

|

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this

prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Delivery of the securities to the purchaser

is expected to be made on or about March 25, 2019, subject to the satisfaction of certain closing conditions.

H.C. Wainwright & Co.

The date of this prospectus supplement

is March 25, 2019.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

In this prospectus supplement, unless the

context otherwise requires, references to “we,” “us,” “our,” “our company,” the

“Company” or “Helios” refer to Helios and Matheson Analytics Inc. and its subsidiaries. On July 24, 2018,

we effected a reverse stock-split of our issued and outstanding common stock at a ratio of one-for-250 (“Reverse Stock Split”).

This prospectus supplement gives retroactive effect to the Reverse Stock Split for all periods presented.

This prospectus supplement and the accompanying

prospectus relate to the offering of shares of our Series B Preferred Stock, Series F Warrants, Placement Agent Warrants and the

shares of common stock issuable from time to time upon conversion of such Series B Preferred Stock (including upon conversion

of the Warrant Preferred Shares). Before buying any of the shares of our Series B Preferred Stock and Series F Warrants offered

hereby, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information

incorporated herein by reference as described under the headings “Where You Can Find More Information” and “Information

Incorporated by Reference”. These documents contain important information that you should consider when making your investment

decision. This prospectus supplement contains information about the Series B Preferred Stock and Series F Warrants offered hereby

and may add, update or change information in the accompanying prospectus.

You should rely only on the information

that we have provided or incorporated by reference in this prospectus supplement and the accompanying prospectus. Neither we nor

the placement agent (nor any of the placement agent’s affiliates) have authorized any other person to provide you with different

information. If anyone provides you with different or inconsistent information, you should not rely on it.

We and the placement agent are not making

offers to sell or solicitations to buy our securities in any jurisdiction in which an offer or solicitation is not authorized or

in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an

offer or solicitation. You should assume that the information in this prospectus supplement and the accompanying prospectus or

any related free writing prospectus is accurate only as of the date on the front of the document and that any information that

we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the

time of delivery of this prospectus supplement, the accompanying prospectus or any related free writing prospectus, or any sale

of a security.

This document is in two parts. The first

part is this prospectus supplement, which adds to and updates information contained in the accompanying prospectus. The second

part is the accompanying prospectus which provides more general information, some of which may not apply to this offering. Generally,

when we refer to this prospectus supplement, we are referring to both parts of this document combined. To the extent there is a

conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus,

you should rely on the information in this prospectus supplement.

This prospectus supplement and the accompanying

prospectus contain summaries of certain provisions contained in some of the documents described herein, but reference is made to

the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies

of some of the documents referred to herein have been or will be filed as exhibits to the registration statement of which this

prospectus supplement is a part or as exhibits to documents incorporated by reference herein, and you may obtain copies of those

documents as described below under the headings “Where You Can Find More Information” and “Information Incorporated

by Reference”.

The industry and market data and other statistical

information contained in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference

are based on management’s estimates, independent publications, government publications, reports by market research firms

or other published independent sources, and, in each case, are believed by management to be reasonable estimates. Although we believe

these sources are reliable, we have not independently verified the information. None of the independent industry publications used

in this prospectus supplement, the accompanying prospectus or the documents we incorporate by reference were prepared on our or

our affiliates’ behalf and none of the sources cited by us consented to the inclusion of any data from its reports, nor have

we sought their consent.

DISCLOSURE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement and the accompanying

prospectus, including the documents that we incorporate by reference, may contain forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

Forward-looking statements in this

prospectus supplement and the accompanying prospectus include, without limitation, statements related to our financial and operating

performance, our plans, strategies, objectives, expectations, intentions and adequacy of resources. Certain important risks, including

those discussed in the risk factors set forth under “Risk Factors” of this prospectus supplement, could cause results

to differ materially from those anticipated by some of the forward-looking statements. Some, but not all, of these risks include,

among other things:

|

|

●

|

the impact of the delisting of our common stock from the Nasdaq Capital Market;

|

|

|

●

|

our ability to successfully develop the business model of MoviePass Inc. (“MoviePass”), Moviefone, MoviePass Films

LLC (“MoviePass Films”) and MoviePass Ventures, LLC (“MoviePass Ventures”);

|

|

|

●

|

our ability to integrate

the operations of MoviePass, Moviefone, MoviePass Films and MoviePass Ventures;

|

|

|

●

|

our capital requirements and whether or not we will

be able to raise capital when we need it;

|

|

|

●

|

consumer acceptance

of the new MoviePass Uncapped subscription plan;

|

|

|

●

|

our ability to fulfill our payment obligations to MoviePass’ merchant processors in a timely manner to prevent MoviePass

service interruptions;

|

|

|

●

|

audience acceptance of the films and acquired content of MoviePass Films;

|

|

|

●

|

delays, cost overruns, cancellation or abandonment of the completion or release of MoviePass Films’ films; failure of

third party distributors to distribute MoviePass Films’ films and their failure to perform or promote such films;

|

|

|

●

|

changes in consumer discretionary spending;

|

|

|

●

|

the inability of MoviePass, MoviePass Films and Moviefone to compete effectively;

|

|

|

●

|

the risk that increased monthly usage by MoviePass’ subscribers may cause MoviePass to incur losses and negative cash

flow;

|

|

|

●

|

risk of attempts at unauthorized or improper use of MoviePass’ services;

|

|

|

●

|

the inability to maintain or rebuild the value of the MoviePass brand;

|

|

|

●

|

the inability to successfully respond to rapid technological changes and alternative forms of delivery or storage to remain

competitive;

|

|

|

●

|

the inability to maintain relationships with program suppliers and vendors;

|

|

|

●

|

the ability of Moviefone to obtain advertising revenues; consumer acceptance of Moviefone services; the ability of Moviefone

to develop and offer compelling content, products and services and attract new users or maintain existing users;

|

|

|

●

|

breaches of network and data security measures;

|

|

|

●

|

a disruption or failure of networks and information systems;

|

|

|

●

|

changes in local, state or federal regulations that will adversely affect our business;

|

|

|

●

|

our ability to retain our existing clients and subscribers and market and sell our services to new clients and subscribers;

|

|

|

●

|

the success of our cost-reduction and subscription revenue increase measures;

|

|

|

●

|

the impact of legal proceedings or governmental action against us;

|

|

|

●

|

our ability to attract brokers and investors who do not trade in lower priced stock;

|

|

|

●

|

the risk that the conditions to the completion of the creation of MoviePass Entertainment Holdings Inc. are not satisfied,

including the inability of MoviePass Entertainment Holdings Inc. to complete the necessary audited financial statements and to

file and have its registration statement on Form S-1 declared effective by the Securities and Exchange Commission, and the risk

that we may not have the required surplus or cash flow solvency under Delaware law to effect a distribution of shares of MoviePass

Entertainment Holdings Inc. to our security holders;

|

|

|

●

|

whether we will continue to receive the services of certain officers and directors;

|

|

|

●

|

our ability to protect our intellectual property and operate our business without infringing upon the intellectual property

rights of others;

|

|

|

●

|

our ability to effectively react to other risks and uncertainties described from time to time in our filings with the Securities

and Exchange Commission, such as fluctuation of quarterly financial results, reliance on third party consultants, litigation or

other proceedings and stock price volatility;

|

|

|

●

|

other uncertainties, all of which are difficult to predict and many of which are beyond our control; and

|

|

|

●

|

the risk factors described in this prospectus supplement under “Risk Factors”.

|

In some cases, you can identify forward-looking

statements by terminology such as “may,” “will,” “should,” “could,” “expects,”

“plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,”

“potential,” or “continue” or the negative of such terms or other comparable terminology. Although we believe

that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of

activity, performance or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date hereof. We do not undertake any obligation to publicly update or review any forward-looking statement.

PROSPECTUS SUPPLEMENT SUMMARY

OUR BUSINESS

This is only a summary and may not contain

all the information that is important to you. You should carefully read both this prospectus supplement and the accompanying prospectus

and any other offering materials, together with the additional information described under the heading “Where You Can Find

More Information”.

About Helios and Matheson Analytics Inc.

Overview

On December 11, 2017, we acquired a

majority interest in MoviePass, whose primary product offering is the MoviePass™ movie theater subscription service. MoviePass

now allows its subscribers to see an uncapped number of 2D movies in MoviePass’ theater network, subject to managing network

demand and availability as set forth in its new terms of use, at most theaters nationwide for a fixed price, which varies depending

on whether the subscriber chooses to pay monthly or annually. Since December 2017, we have acquired additional shares of MoviePass

common stock and as of the date of this prospectus supplement, we own approximately 92% of MoviePass’ outstanding common

stock (excluding shares underlying MoviePass options and warrants).

We formed MoviePass Ventures in January

2018 to collaborate with film distributors to share in film revenues while using the data analytics MoviePass offers for marketing

and targeting services for MoviePass’ paying subscribers using the platform. In March 2018, MoviePass Ventures acquired a

stake in the now award-winning film

American Animals

by Bart Layton. In April 2018, MoviePass Ventures acquired a stake

in the movie

Gotti

. In May 2018, we formed MoviePass Films and subsequently, Emmett Furla Oasis Films LLC, or EFO Films,

acquired a 49% membership interest in MoviePass Films. MoviePass Films focuses on studio-driven content and new film production

for theatrical release and other distribution channels. Following this acquisition of interests in MoviePass Films by EFO

Films, we are conducting our film business, including that of MoviePass Ventures, through MoviePass Films. We plan to capitalize

on the capabilities of MoviePass to market future MoviePass Films productions to MoviePass subscribers.

We believe that by utilizing the MoviePass

subscriber base to drive a positive impact at the box office, MoviePass Films can then leverage the higher box office to obtain

additional downstream revenues, such as international distribution rights, streaming rights, DVD rights, transactional rights (iTunes),

on demand and foreign movie rights.

On April 4, 2018, we acquired the Moviefone

TM

brand and related assets from Oath Inc. (formerly, AOL Inc.), an entertainment service owned by Oath Inc., a wholly-owned

subsidiary of Verizon Communications Inc. Moviefone provides over 6 million monthly unique visitors full access to the entertainment

ecosystem, from movie theaters to streaming content. Moviefone delivers movie show times and tickets, trailers, TV schedules,

streaming information, cast and crew interviews, photo galleries and more. Moviefone’s editorial coverage includes up-to-date

entertainment news, trailers and clips, red-carpet coverage and celebrity features. We believe Moviefone will help MoviePass continue

to grow its subscriber base and expand its marketing and advertising platform for its studio and brand partners. We also believe

Moviefone will allow MoviePass to provide relevant and appealing content to moviegoers while simultaneously increasing the value

of the Moviefone brand.

On March 6, 2019, we announced a new

business strategy that prioritizes self-generated revenues without dependence on studios or exhibitors, to build more reliable

revenue streams. We plan to focus on technological innovation and high-quality content production through our three key channels:

MoviePass; MoviePass Films and Moviefone. We believe the MoviePass subscription service will enhance box office results of MoviePass

Films’ productions, and that revenues from our MoviePass Films’ productions will help contribute to an expansion of

our MoviePass subscription service, with the Moviefone multimedia information and advertising service supporting the entire group

of companies. By seeking to generate new revenues and profit centers within our own ecosystem, we believe we can accelerate our

overall growth in the U.S. market. MoviePass, MoviePass Films, and Moviefone plan to work together in a more interconnected fashion

and share resources across each company. MoviePass Films will seek to optimize its platform to accelerate content production for

theatrical release as well as expand distribution deals for in-home video, and retail, transactional and international sales.

On March 19, 2019, MoviePass announced a new version of its uncapped subscription

plan, called MoviePass Uncapped. Under the new MoviePass Uncapped subscription plan, subscribers can see an uncapped number of

2D movies in MoviePass’ theater network, subject to managing network demand and availability as set forth in its new terms

of use, at most theaters nationwide for a fixed price, which varies depending on whether the subscriber chooses to pay monthly

or annually. Under its new terms of use, MoviePass may limit the availability of movies for an individual subscriber if such subscriber’s

use adversely impacts MoviePass’ system-wide capacity or availability for other subscribers, and a subscriber cannot see

a particular movie more than once. MoviePass will allow subscribers under its previous “Select”, “All Access”

and “Red Carpet” plans, which allow subscribers to see up to three movies a month, at most theaters nationwide for

a fixed price, which varies depending on the subscription plan selected by the subscriber, and additional movies at a discounted

price, to remain on such plans. However, the “Select”, “All Access” and “Red Carpet” plans

will no longer be available for purchase.

Financial Update

As of March 21, 2019, we had cash on

hand of approximately $2.8 million and approximately $13.1 million on deposit with our merchant and fulfillment processors related

to subscription revenues. The funds held by these processors represent a portion of the payments received for annual and other

extended term MoviePass subscription plans and future ticket fulfillment, which we classify as current assets on our balance sheet

and which we expect to be disbursed to us or utilized during 2019.

Corporate Information

Our executive offices are located at The

Empire State Building, 350 Fifth Avenue, New York, New York 10118, and our telephone number is (212) 979-8228. Additional information

about us is available on our website at

www.hmny.com

. The information contained on or that may be obtained from our website

is not, and shall not be deemed to be, a part of this prospectus supplement. Our common stock, par value $0.01 per share, currently

is quoted on the OTC Pink Market operated by OTC Markets Group Inc. under the symbol “HMNY”.

For a description of our business, financial

condition, results of operations and other important information regarding us, we refer you to our filings with the SEC incorporated

by reference in this prospectus supplement. For instructions on how to find copies of these documents, see “Where You Can

Find More Information.”

THE OFFERING

|

Series B Preferred Stock offered by us

|

60,000 shares of Series B Preferred Stock will be offered

in this offering.

This prospectus also relates to the issuance of

Warrant Preferred Shares issuable upon exercise of the Series F Warrants and the Placement Agent Warrants and shares of our common

stock issuable upon conversion of our Series B Preferred Stock (including upon conversion of the Warrant Preferred Shares).

See “Description of the Securities We are Offering”

for additional information.

|

|

|

|

|

Conversion

|

Each share of our

Series B Preferred Stock is convertible into 16,667 shares of our common stock, subject to adjustment (the “Conversion

Rate”); provided, that the holder will be prohibited from converting Series B Preferred Stock into shares of our common

stock if, as a result of such conversion, the holder, together with its affiliates, would beneficially own more than 9.99%

of the total number of shares of our common stock then issued and outstanding after giving effect to such conversion.

|

|

|

|

|

Ranking; Liquidation preference

|

Subject to the applicable law and the rights of the holders of any outstanding series of our preferred stock, our Series B Preferred Stock will rank pari passu on an as-converted to common stock basis with all of our common stock as to distributions of assets upon our liquidation, dissolution or winding up.

|

|

|

|

|

Voting rights

|

Shares of our Series B Preferred Stock will be entitled to vote

on an as-converted to common stock basis on all matters on which stockholders are generally entitled to vote (provided that no

holder of Series B Preferred Stock will be entitled to such number of votes in excess of such holder’s beneficial ownership

limitation as set forth in the Certificate of Designation). Additionally, the vote or written consent of holders of a majority

of the outstanding shares of our Series B Preferred Stock, voting separately as a single class, will be required to:

●

amend,

alter or repeal any provision of our certificate of incorporation if such amendment, alteration or repeal would increase or decrease

the aggregate number of authorized shares of the Series B Preferred Stock;

●

amend,

alter or repeal any provision of our certificate of incorporation if such amendment, alteration or repeal would increase or decrease

the par value of the shares of the Series B Preferred Stock; or

●

amend,

alter or repeal any provision of our certificate of incorporation, whether by merger, consolidation or otherwise, if such amendment,

alteration or repeal would alter or change the powers, preferences or special rights of the holders of shares of Series B Preferred

Stock so as to affect them adversely.

|

|

Dividends

|

Subject to the applicable law and the rights of the holders of any outstanding series of our preferred stock, shares of Series B Preferred Stock will be entitled to receive dividends equal, on an as-converted to common stock basis, to and in the same form as dividends actually paid on shares of common stock when, as and if such dividends are paid on shares of common stock.

|

|

|

|

|

Rights in connection with certain fundamental transactions

|

In the event of any merger or consolidation which

results in 50% or more of the surviving entity being held by persons other than persons that, immediately prior to such merger

or consolidation, owned 50% or more of our capital stock, subject to the rights of the holders of any outstanding series of our

preferred stock, shares of Series B Preferred Stock will be entitled to receive consideration from such merger or consolidation

equal, on an as-converted to common stock basis, to and in the same form as consideration actually paid on shares of common stock.

In the event of any sale, lease or exchange of all

or substantially all of our property and assets, subject to the rights of the holders of any outstanding series of our preferred

stock, shares of Series B Preferred Stock will be entitled to receive cash consideration from such sale, lease or exchange equal,

on an as-converted to common stock basis, to the consideration actually paid on shares of common stock. Following payment of the

foregoing amounts in connection with such a sale, lease or exchange, we may, at our election, repurchase each outstanding shares

of Series B Preferred Stock for a repurchase price of $0.0001 per share.

|

|

Warrants offered by us

|

Series F-1 Warrants to purchase up to an aggregate of 59,760 shares

of our Series B Preferred Stock at an exercise price of $100.00 per share of Series B Preferred Stock, subject to adjustment. The

Series F-1 Warrants will be exercisable at any time on or after the issuance date until the five-year anniversary of such initial

exercise date.

Series F-2 Warrants to purchase up to an aggregate of 60,240

shares of our Series B Preferred Stock at an exercise price of $100.00 per share of Series B Preferred Stock, subject to adjustment. The

Series F-2 Warrants will be exercisable at any time on or after the date on which we obtain stockholder approval for a reverse

stock split or to increase our authorized common stock to allow for the reservation in full of all shares of common stock issuable

upon conversion of the Warrant Preferred Shares issuable upon exercise of the Series F-2 Warrants until the five-year anniversary

of such initial exercise date.

Pursuant to this prospectus supplement and the accompanying

prospectus, we will also issue the Placement Agent Warrants described under “Plan of Distribution,” as part of the

compensation payable to the placement agent in connection with this offering.

This prospectus supplement also relates to the offering

of shares of our common stock issuable upon conversion of the Warrant Preferred Shares.

See “Description of the Securities We are Offering––Warrants.”

|

|

Offering price

|

$ 100.00 per

fixed combination of one share of Series B Preferred Stock, one Series F-1 Warrant and one Series F-2 Warrant.

|

|

|

|

|

Series B Preferred Stock outstanding after the offering

|

60,000 shares

of Series B Preferred Stock (excluding Warrant Preferred Shares).

|

|

|

|

|

Common stock outstanding after the offering

|

2,001,541,260 shares of common stock (excluding shares of common stock issuable upon

conversion of shares of Series B Preferred Stock (including Warrant Preferred Shares)).

(1)

|

|

|

|

|

Best efforts

|

We have retained H.C. Wainwright & Co., LLC as our exclusive placement

agent in connection with the securities offered by this prospectus supplement and the accompanying

prospectus. The placement agent has agreed to use its reasonable best efforts to solicit offers to

purchase the securities offered by this prospectus supplement and the accompanying prospectus. The

placement agent has no obligation to buy any of the securities from us or to arrange for the purchase

or sale of any specific number or dollar amount of the securities. See “Plan of Distribution”

on page S-33.

|

|

|

|

|

Dividend policy

|

We have not declared or paid any cash dividends on our common stock since February 18, 2014. We do not anticipate paying any cash dividends in the foreseeable future.

|

|

|

|

|

Amendments to certain outstanding warrants

|

In connection with the offering, we will enter into amendments with holders of certain of

our outstanding warrants to purchase an aggregate of 666,666,668 shares of common stock, to reduce the exercise price

of each such warrants from $0.0163 to $0.01 per share of common stock.

|

|

|

|

|

Risk factors

|

Investing in our securities involves a high degree of risk. See “Risk Factors”

beginning on page S-9, as well as the other information included in or incorporated by reference in this prospectus supplement

and the accompanying prospectus, for a discussion of risks you should carefully consider before investing in our securities.

|

|

|

|

|

Use of proceeds

|

We will use approximately $870,000 of the net proceeds from the sale

of the Series B Preferred Stock and the Series F Warrants offered by us under this prospectus supplement to redeem a portion

of our outstanding indebtedness and the remaining proceeds for general corporate purposes of the Company and its subsidiaries

and transaction expenses. See “Use of Proceeds” on page S-25.

|

|

|

|

|

OTC Pink Market Symbol

|

“HMNY”

|

|

|

|

|

No public trading market for the Series B Preferred Stock or Warrants

|

There is no public trading market for the

Series B Preferred Stock, Series F Warrants or Placement Agent Warrants, we do not expect a market to develop, and holders

may not be able to resell the Series B Preferred Stock, Series F Warrants or Placement Agent Warrants or the shares of common

stock underlying the Series B Preferred Stock (including those underlying the Warrant Preferred Shares) purchased under this

prospectus supplement. In addition, we do not intend to apply for a listing of the Series B Preferred Stock, Series F Warrants

or Placement Agent Warrants or the shares of common stock underlying the Series B Preferred Stock (including those underlying

the Warrant Preferred Shares) on the Nasdaq Capital Market, any other national securities exchange, or any nationally recognized

trading system. This may affect the pricing of the Series B Preferred Stock, Series F Warrants or Placement Agent Warrants

and the shares of common stock underlying the Series B Preferred Stock (including those underlying the Warrant Preferred Shares)

in the secondary market, the transparency and availability of trading prices, and the liquidity of the Series B Preferred

Stock, Series F Warrants or Placement Agent Warrants and the shares of common stock underlying the Series B Preferred Stock

(including those underlying the Warrant Preferred Shares).

|

|

(1)

|

The number of shares of common stock to be outstanding after this offering is based on 2,001,541,260

shares of common stock outstanding as of March 20, 2019, and excludes, in each case as of March 20, 2019:

|

|

|

●

|

10,440 shares of common stock available and reserved for issuance pursuant to the Helios and Matheson Analytics Inc. 2014 Equity Incentive Plan;

|

|

|

●

|

29,364 shares of common stock that may be issued upon the exercise of warrants by Palladium Capital Advisors LLC;

|

|

|

●

|

18,545 shares of common stock reserved for issuance to various officers, directors, employees and consultants;

|

|

|

●

|

16,000 shares of common stock issuable to MoviePass upon receipt of stockholder approval and unrestricted conversion of the convertible promissory note in the principal amount of $12 million that we issued to MoviePass upon the closing of the Securities Purchase Agreement, dated August 15, 2017, between the Company and MoviePass;

|

|

|

●

|

50,886 shares of common stock issuable upon the exercise of warrants issued in public offerings in December 2017, February 2018 and April 2018;

|

|

|

●

|

10,201 shares of common stock issuable upon the exercise of warrants, issued to Oath Inc. upon the closing of the acquisition of the Moviefone assets;

|

|

|

●

|

2,000 shares of common stock reserved for issuance to Helios and Matheson Information Technology

Ltd. in exchange for entering into prior lockup agreements;

|

|

|

|

|

|

|

●

|

1,026,666,669 shares of common stock that may be issued upon the exercise of warrants issued

to certain institutional investors and affiliates of H.C. Wainwright & Co., LLC on January 16, 2019 (the “January

2019 Offering”). In connection with this offering, the exercise price of warrants to purchase 666,666,668

shares of common stock issued to institutional investors in the January 2019 Offering will be reduced from $0.0163 to

$0.01 per share of common stock; and

|

|

|

|

|

|

|

●

|

3,080,061,600 shares

of common stock issuable upon the conversion of the Series B Preferred Stock (including the Warrant Preferred Shares).

|

RISK FACTORS

Investing in our securities involves

a high degree of risk. Please see the risk factors set forth in Part I, Item 1A of our most recent Annual Report on Form 10-K and

in Part II, Item 1A of our Quarterly Reports on Form 10-Q and other filings we make with the SEC, which are incorporated by reference

into this prospectus supplement, as well as the other risk factors listed in this prospectus supplement and underlying prospectus.

Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate

by reference in this prospectus supplement. The risks and uncertainties we have described are not the only ones we face. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations.

These risks could materially affect our business, results of operations or financial condition and cause the value of our securities

to decline.

Risks Related to our MoviePass Business

We have a limited operating history and our businesses

have a history of net losses, and it is likely that we will experience net losses for the foreseeable future.

We have experienced significant net losses

since inception and our businesses have a history of net losses. Given the significant operating and capital expenditures associated

with our business plans, we anticipate continuing to incur net losses and significant negative cash flows for the foreseeable future.

If we ever do achieve profitability, of which no assurances can be given, we may be unable to sustain or increase such profitability.

To achieve and sustain profitability, we

will need to accomplish numerous objectives, including substantially increasing the number of paying subscribers to MoviePass’

service and securing additional sources of revenue and economies of scale. There is a significant risk that we will be unable to

achieve these objectives, which would damage our business.

MoviePass currently spends more to retain a subscriber

than the revenue derived from that subscriber, and there is no assurance that we or MoviePass will be able to increase other sources

of revenue to offset the losses or achieve a positive gross profit margin.

MoviePass currently spends more to retain

a subscriber than the revenue derived from that subscriber, and other sources of revenue are currently inadequate to offset or

exceed the costs of subscriber retention. This results in a negative gross profit margin. We expect MoviePass’ negative gross

profit margin to remain significant until it can sufficiently increase our other sources of revenues to offset the losses or achieve

substantial economies of scale. There is no assurance that MoviePass or we will be able to sufficiently increase our other sources

of revenue or be able to achieve economies of scale that would reduce the cost of revenue sufficiently to generate a positive gross

profit margin. Failure to achieve positive gross profit margin in the foreseeable future could materially and adversely impact

our results of operations.

Due to recent changes to MoviePass’ subscription

plans, the number of its subscribers has decreased, and it may continue to lose subscribers or fail to attract new subscribers.

In an effort to reduce its monthly deficit

and improve profitability, MoviePass changed its monthly subscription plan to a three-movies-per-month plan, at a price of $9.95

per month and limited the available movies to those listed on a schedule. In August 2018, MoviePass began to convert subscribers

on an annual subscription plan to a three-movies-per-month subscription plan, by giving annual subscribers the option to either

cancel their annual subscription plan and receive a pro-rated refund or continue on the new three-movies-per-month subscription

plan. As a result of these changes, MoviePass has experienced subscriber losses. MoviePass may continue to lose subscribers, or

fail to attract new subscribers, and our business and operating results could be adversely affected.

In January 2019, MoviePass made available

updated pricing plans, featuring a three-tier pricing structure. Under the “Select” plan, subscribers will be able

to see up to three movies a month at some point during their theatrical run, other than opening weekends, based on a programming

schedule; under the “All Access” plan, subscribers will be able to see up to three movies of their choice per month

at any time during their theatrical run in standard 2D format; and under the “Red Carpet” plan, subscribers will be

able to see up to three movies of their choice per month at any time during their theatrical run, and may choose to use one of

their allotted three movies for IMAX 2D, IMAX 3D or supported Premium Large Format screenings, including RealD 3D. Prices for each

plan vary based on geographic areas designed to reflect the difference in average ticket prices in different areas of the country.

Subscribers may purchase plans for three-, six- and twelve-month terms, and receive discounts for buying multiple subscription

plans. In December 2018, MoviePass also announced two limited-time holiday offers to offer the “All Access” and “Red

Carpet” plans at a reduced rate for twelve months.

On March 19, 2019, MoviePass announced

a new version of its uncapped subscription plan, called MoviePass Uncapped. Under the new MoviePass Uncapped subscription plan,

subscribers can see an uncapped number of 2D movies in MoviePass’ theater network, subject to managing network demand and

availability as set forth in its new terms of use, at most theaters nationwide for a fixed price, which varies depending on whether

the subscriber chooses to pay monthly or annually. Under its new terms of use, MoviePass may limit the availability of movies

for an individual subscriber if such subscriber’s use adversely impacts MoviePass’ system-wide capacity or availability

for other subscribers, and a subscriber cannot see a particular movie more than once. MoviePass will allow subscribers under its

previous “Select”, “All Access” and “Red Carpet” plans, which allow subscribers to see up

to three movies a month, at most theaters nationwide for a fixed price, which varies depending on the subscription plan selected

by the subscriber, and additional movies at a discounted price, to remain on such plans. However, the “Select”, “All

Access” and “Red Carpet” plans will no longer be available for purchase.

These changes and future changes to MoviePass’ subscription plan

may not be favorably received by customers and MoviePass may not be able to attract or retain subscribers, and as a result, our

revenue and results of operations may be affected adversely. The number of recent changes to MoviePass’ subscription plans

may also make competitors’ subscription plans more attractive to customers, and MoviePass may be unable to successfully compete

with current and new competitors.

Increased monthly usage by MoviePass’ subscribers

may cause MoviePass to incur losses and negative cash flow.

MoviePass’ new MoviePass Uncapped

subscription plan allows subscribers to see an uncapped number of 2D movies in MoviePass’ theater network, subject to managing

network demand and availability, at most theaters nationwide for a fixed price, which varies depending on whether the subscriber

chooses to pay monthly or annually. MoviePass’ will also continue to allow subscribers on its previous “Select”,

“All Access” and “Red Carpet”, which allow subscribers to see up to three movies per month for a fixed

price, which varies depending on the subscription plan selected by the subscriber, and additional movies at a discounted price,

to remain on such plans. In most cases, MoviePass pays, and expects to continue to pay, the theaters the full cost for each movie

ticket that a subscriber uses. Accordingly, even though MoviePass’ new terms of use contains features that allow MoviePass

to manage network demand and availability and prevent abuse of its service, including the ability to limit the availability of

movies for an individual subscriber if such subscriber’s use adversely impacts MoviePass’ system-wide capacity or

availability for other subscribers, increased movie viewing by subscribers may result in significant and increasing losses per

subscriber and negative cash flow and adversely affects our financial condition and results of operations.

If MoviePass is not able to manage its growth, its business

could be affected adversely.

On March 19, 2019, MoviePass announced

a new version of its uncapped subscription plan, called MoviePass Uncapped. Under the new MoviePass Uncapped subscription plan,

subscribers can see an uncapped number of 2D movies in MoviePass’ theater network, subject to managing network demand and

availability as set forth in its new terms of use, at most theaters nationwide for a fixed price, which varies depending on whether

the subscriber chooses to pay monthly or annually. When MoviePass announced a similar uncapped plan in August 2017, MoviePass’

subscriber base expanded rapidly, which placed significant demands on its managerial, operational, administrative and financial

resources.

MoviePass may not be able, for many reasons,

including lack of financing or adequate personnel resources, to meet the demand to timely deliver MoviePass cards to its subscribers

or otherwise service its business in the event of another rapid expansion of its subscriber base. As such, MoviePass could experience

a significant slowdown or stoppage as it attempts to serve the expanding subscriber base.

MoviePass anticipates that further expansion

of its operations will be required to address any significant growth in its subscriber base and to take advantage of favorable

market opportunities. Any future expansion will likely place significant demands on its managerial, operational, administrative

and financial resources. If it is not able to respond effectively to new or increased demands that arise because of MoviePass’

growth, or, if in responding, MoviePass’ management is materially distracted from current operations, MoviePass’ business

may be affected adversely.

Any reduction in anticipated spending

by advertisers could harm our business.

Future advertising revenues are critical

to MoviePass’ business model and if advertisers’ spending on online or mobile advertising is significantly reduced

due to any political, economic, social or technological change or any other reason, our financial condition could be adversely

affected.

The MoviePass business depends on mobile technology and

continued, unimpeded access to internet and wireless services. Adverse changes to that access could harm our business.

A few large companies provide wireless

services to consumers. If MoviePass’ users’ access to Internet and wireless services is interfered with or limited

due to any political, economic, social or technological reason, MoviePass may not be able to make the MoviePass application readily

available to its users or may not be able to do so in an effective manner, including ensuring that the MoviePass application will

remain accessible within an acceptable load time. Failure to provide the MoviePass subscription service in a timely manner without

interruption could generate consumer complaints and adversely affect our business.

MoviePass’ failure or inability to protect its intellectual

property rights could diminish the value of its brand and weaken its competitive position.

MoviePass relies on a combination of trademark,

trade secret and unfair competition laws, as well as confidentiality agreements and procedures and licensing arrangements, and

where appropriate, patents and copyright to establish and protect its intellectual property rights. There is a risk that the steps

taken by MoviePass to protect its intellectual property rights will be inadequate to prevent infringement of such rights by others,

including imitation of its services and misappropriation of its brand. Additionally, the process of obtaining patent or trademark

protection is expensive and time-consuming, and we and MoviePass may not be able to prosecute all necessary or desirable patent

applications or apply for all necessary or desirable trademark applications at a reasonable cost or in a timely manner.

Moreover, costly and time-consuming litigation

could be necessary to enforce and determine the scope of MoviePass’ proprietary rights, and the failure or inability to obtain

or maintain trade secret protection or otherwise protect our proprietary rights could adversely affect our business. MoviePass

may be subject to intellectual property-related lawsuits in various jurisdictions, and there is a risk that its products or activities

violate the patents, trademarks, or other intellectual property rights of third-party claimants. We or MoviePass may also need

to institute litigation to protect MoviePass’ intellectual property from third party infringers. Costs of supporting such

litigation and disputes may be considerable, and there can be no assurances that a favorable outcome will be obtained. Patent infringement,

trademark infringement, trade secret misappropriation and other intellectual property claims and proceedings brought against or

by us or MoviePass, whether successful or not, could result in substantial costs, harm to our brand and the MoviePass brand, and

have an adverse effect on our business.

Risks Related to the Business of MoviePass

Films

MoviePass Films’ content production business requires

a substantial investment of capital, and failure to access sufficient capital while awaiting delayed revenues will have a material

adverse effect on our results of operation.

The production, acquisition and distribution

of film and other content requires significant capital. In addition, if a distributor does not provide the funds for the distribution

and marketing of our film, MoviePass Films will require additional capital to distribute and market the film. A significant amount

of time may elapse between MoviePass Films’ expenditure of funds and the receipt of revenues from MoviePass Films’

productions. MoviePass Films does not have a traditional credit facility with a financial institution on which to depend for its

liquidity needs, and a time lapse may require us to fund a significant portion of MoviePass Films’ capital requirements through

loans and additional issuances of our common stock, securities convertible into our common stock, debt securities or a combination

of such financing alternatives. There can be no assurance that any additional financing will be available to MoviePass Films as

and when required, or on terms that will be acceptable to MoviePass Films. MoviePass Films’ inability to raise capital necessary

to sustain its operations while awaiting delayed revenues would have a material adverse effect on our liquidity and results of

operations.

MoviePass Films’ success is highly dependent on

audience acceptance of its films and acquired content, which is extremely difficult to predict and, therefore, inherently risky.

We cannot predict the economic success of

any of films or acquired content of MoviePass Films or because the revenue derived from the distribution of a film (which does

not necessarily directly correlate with the production or distribution costs incurred) or other acquired content depends primarily

upon its acceptance by the public, which cannot be accurately predicted. The economic success of a film or other acquired content

also depends upon the public’s acceptance of competing films and content, the availability of alternative forms of entertainment

and leisure-time activities, general economic conditions and other tangible and intangible factors, all of which can change and

cannot be predicted with certainty.

The economic success of a film is largely

determined by MoviePass Films’ ability to produce content and develop stories and characters that appeal to a broad audience

and by the effective marketing of the film. The theatrical performance of a film is a key factor in predicting revenue from post-theatrical

markets. If we are unable to accurately judge audience acceptance of MoviePass Films’ film content or to have the film effectively

marketed, the commercial success of the film will be in doubt, which could result in costs not being recouped or anticipated profits

not being realized. Moreover, we cannot assure you that any particular feature film will generate enough revenue to offset its

distribution, fulfillment services and marketing or acquisition costs, in which case MoviePass Films would not receive any revenues

for such film.

We may incur significant write-offs if MoviePass Films’

feature films and other projects do not perform well enough to recoup production, marketing, distribution, acquisition and other

costs.

We are required to amortize capitalized

production costs over the expected revenue streams as we recognize revenue from MoviePass Films’ films or other projects.

The amount of production costs that will be amortized each quarter depends on, among other things, how much future revenue we expect

to receive from each project. Unamortized production costs are evaluated for impairment each reporting period on a project-by-project

basis. If estimated remaining revenue is not sufficient to recover the unamortized production costs, the unamortized production

costs will be written down to fair value. In any given quarter, if we lower our previous forecast with respect to total anticipated

revenue from any individual feature film or other project, we may be required to accelerate amortization or record impairment charges

with respect to the unamortized costs, even if we have previously recorded impairment charges for such film or other project. Such

impairment charges could have a material adverse impact on our business, operating results and financial condition.

MoviePass Films is substantially dependent upon the success

of a limited number of film releases and other productions, if any, in any given year and its inability to release any film or

other productions or the unexpected delay or commercial failure of any one of them could have a material adverse effect on our

financial results and cash flows

.

The content production business of MoviePass

Films is currently substantially dependent upon the success of a limited number of film releases and other productions in any given

year. The unexpected delay in release or commercial failure of just one of these films or productions, or MoviePass Films’

inability to release any productions at all, could have a significant adverse impact on our results of operations and cash flows

in both the year of release and in the future. Historically, feature films that are successful in the domestic theatrical market

are generally also successful in the international theatrical and ancillary markets, although each film is different and there

is no way to guarantee such results. If MoviePass Films’ films fail to achieve domestic box office success, their success

in the international box office and ancillary markets and our business, results of operations and financial condition could be

adversely affected. Further, we can make no assurances that the historical correlation between results in the domestic box office

and results in the international box office and ancillary markets will continue in the future. If MoviePass Films is unable to

release any film or other productions in a given year, or if the feature films it releases do not perform well in the domestic

or international theatrical markets and ancillary markets, or its other productions do not perform as anticipated, the failure

to release any productions, or the failure of any one of the productions it releases, could a material adverse effect on our financial

results and cash flows.

Delays, cost overruns, cancellation or abandonment of

the completion or release of MoviePass Films’ films may have an adverse effect on our business.

There are substantial financial risks relating

to production, completion and release of films. Actual costs may exceed their budgets due to factors such as labor disputes, unavailability

of a star performer, equipment shortages, disputes with production teams or adverse weather conditions, any of which may cause

cost overruns and delay or hamper film completion. MoviePass Films is typically responsible for paying all production costs in

accordance with a budget and receive a fixed producer’s fee for its services plus a portion of any project income. However,

to the extent that delays or cost overruns result in MoviePass Films not completing the film within budget, there may not be enough

funds left to pay MoviePass Films’ producer’s fee, to generate any project income or complete the project at all. If

this were to occur, it would significantly and adversely affect our revenue and results of operations.

MoviePass Films will rely on third party distributors

to distribute its films and their failure to perform or promote its films could negatively impact our ability to generate revenues

and have a material adverse effect on our operating results.

MoviePass Films’ films will be primarily

distributed and marketed by third party distributors. If any of these third-party distributors fails to perform under their respective

arrangements, such failure could negatively impact the success of MoviePass Films’ films and have a material adverse effect

on our business, reputation and ability to generate revenues.

MoviePass Films generally will not control

the timing and manner in which its distributors distribute its films; the distributors decisions regarding the timing of release

and promotional support are important in determining success. Any decision by those distributors not to distribute or promote one

of MoviePass Films’ films or to promote a competitors’ films or related products to a greater extent than they promote

MoviePass Films’ could have a material adverse effect on our business, cash flows and operating results. Additionally, because

third parties are the principal distributors of MoviePass Films’ movies, the amount of revenue that is recognized from films

in any given period is dependent on the timing, accuracy and sufficiency of the information received from its distributors. As

is typical in the film industry, MoviePass Films’ distributors may make adjustments in future periods to information previously

provided to it that could have a material impact on our operating results in later periods.

The popularity and commercial success of MoviePass Films’

films and acquired content are subject to numerous factors, over which we may have limited or no control.

The popularity and commercial success of

MoviePass Films’ films and acquired content depends on many factors including, but not limited to, the key talent involved,

the timing of release, the promotion and marketing of the film, the quality and acceptance of other competing productions released

into the marketplace at or near the same time, the availability of alternative forms of entertainment, general economic conditions,

the genre and specific subject matter of the film, its critical acclaim and the breadth, timing and format of its initial release.

We cannot predict the impact of such factors on any film or other acquired content, and many are factors that are beyond our control.

As a result of these factors and many others, MoviePass Films’ films and acquired content may not be as successful as we

anticipate, and as a result, our results of operations may suffer.

MoviePass Films must successfully respond to rapid technological

changes and alternative forms of delivery or storage to remain competitive.

The entertainment industry continues to

undergo significant developments as advances in technologies and new methods of product delivery and storage, and certain changes

in consumer behavior driven by these developments emerge. New technologies affect the demand for MoviePass Films’ content,

the manner in which its content is distributed to consumers, the sources and nature of competing content offerings and the time

and manner in which consumers acquire and view its content. MoviePass Films and its distributors must adapt their businesses to

shifting patterns of content consumption and changing consumer behavior and preferences through the adoption and exploitation of

new technologies. If MoviePass Films cannot successfully exploit these and other emerging technologies, it could have a material

adverse effect on our business, financial condition, operating results, liquidity and prospects.

MoviePass Films’ business may be affected by changes

in consumer discretionary spending in the U.S. or internationally.

MoviePass Films’ success depends

on its ability to distribute or otherwise generate income from its current and future motion pictures and other acquired content.

MoviePass Films’ industry is subject to discretionary consumer spending, which is influenced by general economic conditions,

consumer confidence and the availability of discretionary income. Changes in economic conditions affecting potential distributors

or viewers of motion pictures could reduce MoviePass Films’ ability to generate income from motion pictures. Furthermore,

weak economic conditions and geopolitical and economic uncertainties in international regions and countries where MoviePass Films’

movie productions are distributed could lead to lower consumer spending for its content, which could have a material adverse effect

on our financial condition and results of operations.

If MoviePass Films is unable to compete

effectively, our business will be affected adversely.

The business in which MoviePass Films engages

is highly competitive. Its primary business operations are subject to competition from companies which, in many instances, have

greater development, production and distribution and capital resources than MoviePass Films. MoviePass Films competes for the services

of writers, producers, directors, actors and other artists to produce its motion picture content, as well as for advertisement

dollars. Larger companies have a broader and more diverse selection of scripts than MoviePass Films does, which translates to a

greater probability that they will be able to more closely fit the demands and interests of advertisers than MoviePass Films can.

As a small independent producer, MoviePass

Films competes with major U.S. and international studios. Most of the major U.S. studios are part of large diversified corporate

groups with a variety of other operations that can provide both the means of distributing their products and stable sources of

earnings that may allow them better to offset fluctuations in the financial performance of their film and other operations. In

addition, the major studios have more resources with which to compete for ideas, storylines and scripts created by third parties,

as well as for actors, directors and other personnel required for production. Such competition for the industry’s talent

and resources may negatively affect MoviePass Films’ ability to acquire, develop, produce, advertise and distribute motion

picture content.

As a new entrant into film

distribution, MoviePass Films will have competitors with longer operating histories in the distribution of independent films, deeper

ties with industry executives and film producers, and greater financial, marketing and other resources than MoviePass Films. MoviePass

Films will also face competition from larger film distributors which focus on higher budget film production and distribution.

MoviePass Films may be adversely affected by union activity.

MoviePass Films retains the services of

actors who are covered by collective bargaining agreements with Screen Actors Guild – American Federation of Television and

Radio Artists, and it may also become signatories to certain guilds such as Directors Guild of America and Writers Guild of America

in order to allow it to hire directors and talent for its productions. Collective bargaining agreements are industry-wide agreements,

and MoviePass Films lacks practical control over the negotiations and terms of these agreements.

In addition, if negotiations to renew expiring

collective bargaining agreements are not successful or become unproductive, the union could take actions such as strikes, work

slowdowns or work stoppages. Strikes, work slowdowns or work stoppages or the possibility of such actions could result in delays

in production of MoviePass Films’ films. MoviePass Films could also incur higher costs from such actions, new collective

bargaining agreements or the renewal of collective bargaining agreements on less favorable terms. Depending on their duration,

union activity or labor disputes could have an adverse effect on our results of operations.

MoviePass Films may be unable to recoup advances paid

to secure exclusive distribution rights

.

MoviePass Films’ most significant

costs and cash expenditures relate to acquiring content for exclusive distribution. Most agreements to acquire content require

upfront advances against royalties or net profits participations expected to be earned from future distribution. The amount MoviePass

Films is willing to advance is derived from its estimate of net revenues that will be realized from its distribution of the title.

Although these estimates are based on management’s knowledge of competitive title performance, current events and actions

management may undertake in the future, actual results will differ from those estimates. If sales do not meet our original estimates,

MoviePass Films may (i) not recognize the expected gross margin or net profit, (ii) not recoup its advances or (iii) record

accelerated amortization and/or fair value write-downs of advances paid.

MoviePass Films’ inability to maintain relationships

with its program suppliers and vendors may adversely affect its business

.

MoviePass Films receives a significant amount

of its revenues from the distribution of content for which it already has exclusive agreements with program suppliers. However,

titles which have been financed by MoviePass Films may not be timely delivered as agreed or may not be of the expected quality.

Delays or inadequacies in delivery of titles, including rights clearances, could negatively affect the performance of any given

quarter or year. In addition, results of operations and financial condition may be materially adversely affected if:

|

|

●

|

MoviePass Films is unable to renew existing agreements as they expire;

|

|

|

|

|

|

|

●

|

MoviePass Films current program suppliers do not continue to support digital, DVD or other applicable format in accordance with its exclusive agreements;

|

|

|

|

|

|

|

●

|

MoviePass Films’ current content suppliers do not continue to license titles to it on terms acceptable to it; or

|

|

|

|

|

|

|

●

|

MoviePass Films is unable to establish new beneficial supplier relationships to ensure acquisition of exclusive or high-profile titles in a timely and efficient manner.

|

Others may assert intellectual property infringement claims

or liability claims for film content against MoviePass Films which may force us to incur substantial legal expenses.

There is a possibility that others may

claim that MoviePass Films’ productions and production techniques misappropriate or infringe the intellectual property rights

of third parties with respect to its previously developed web series, films, stories, characters, other entertainment or intellectual

property. In addition, as distributors of film content, MoviePass Films may face potential liability for such claims as defamation,

invasion of privacy, negligence, copyright or trademark infringement or other claims based on the nature and content of the materials

distributed. If successfully asserted, our insurance may not be adequate to cover any of the foregoing claims. Irrespective of

the validity or the successful assertion of such claims, we could incur significant costs and diversion of resources in defending

against them, which could have a material adverse effect on our operating results.

If MoviePass Films fails to protect its intellectual property

and proprietary rights adequately, our business could be adversely affected.

MoviePass Films’ ability to compete

depends, in part, upon successful protection of its respective intellectual property. MoviePass Films attempt to protect proprietary

and intellectual property rights to its productions and acquired content through available copyright and trademark laws and distribution

arrangements with companies for limited durations. Unauthorized parties may attempt to copy aspects of its intellectual property

or to obtain and use property that MoviePass Films regards as proprietary. We cannot assure you that MoviePass Films’ means

of protecting its proprietary rights will be adequate. In addition, the laws of some foreign countries do not protect these proprietary

rights to as great an extent as the laws of the United States. Intellectual property protections may also be unavailable, limited

or difficult to enforce in some countries, which could make it easier for competitors to steal MoviePass Films’ intellectual

property. The failure to protect adequately MoviePass Films’ intellectual property and proprietary rights could adversely

affect our business and results of operations.

Risks Related to the Moviefone Assets

Our focus on our online advertising-supported business

model involves significant risks.

Growth in Moviefone’s advertising

revenues depends on its ability to maintain and expand its existing relationships with advertisers and publishers and its ability

to develop new relationships with other advertisers and publishers. Growth in its advertising revenues also depends on its ability

to continue offering effective products and services for advertisers and publishers. As the advertising market generates and develops