By Patricia Kowsmann

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 26, 2019).

FRANKFURT -- The idea behind merging two of Europe's weakest

financial institutions -- Deutsche Bank and Commerzbank -- is that

together, they can somehow lean on each other and steady their

fortunes.

Formal talks are continuing and there is no guarantee a deal

will happen. But a look at the numbers shows both the urgency and

the difficulty of the task.

Home Market Blues

Germany's banking market is fragmented. At nearly 1,600, the

country has more banks than the U.K., France, Italy and Spain

combined.

The banking system comprises three so-called pillars: about 200

commercial banks, including Deutsche Bank and Commerzbank, some 400

state-owned local savings banks and more than 900 cooperative banks

owned by their 18 million account holders -- one in four Germans.

As a result, Deutsche Bank and Commerzbank each have a small market

share in domestic lending.

Elusive Profits

The stiff competition has added to pressure on the banks'

profitability.

Both banks are among the least profitable in the eurozone.

Commerzbank's return on tangible equity, a key measure of

profitability, is only slightly higher than that of beleaguered

Italian bank Monte dei Paschi di Siena SpA. Deutsche Bank's is

sharply lower.

Unlike Commerzbank, Deutsche Bank has a big investment-banking

business, which has been hit by volatility and has lost market

share to healthier U.S. competitors.

Sizing Things Up

A combination of Deutsche Bank and Commerzbank would create the

eurozone's second-largest bank by assets, after France's BNP

Paribas SA.

Size is a driver in itself with the German government looking to

create a national banking champion.

Their market share on domestic lending and deposits would rise

to between 10% and 15%, according to Fitch Ratings.

Deutsche Bank, whose funding costs have increased on low

investor confidence in its business, would also benefit from

Commerzbank's additional pool of retail deposits and cheaper

funding.

But skepticism about the benefits of the merger is widespread.

"In our view, a combination of these two low return-on-equity

generating banks is unlikely to lead to improvement in earnings in

the short term, leading to a bigger balance sheet [and] higher

capital requirements," JPMorgan said in a recent note.

Just how much fresh capital the European Central Bank, which

supervises both lenders, would require to sustain such a big bank

is still unknown and will largely depend on what kind of bank were

created from any merger.

"If a merger is put forward to us, our sole focus is to access

the viability and the sustainability of the project," ECB banking

chief Andrea Enria told European Union lawmakers Thursday. "It

boils down to making sure that the resulting entity is able to

comply with the supervisory requirements."

What Do Shareholders Think?

Deutsche Bank and Commerzbank would have to convince their

shareholders that a tie-up, which would likely dilute their

holdings, would be good for them.

While Commerzbank has the blessing of its largest shareholder --

the German government -- Deutsche Bank must deal with Chinese

conglomerate HNA Group Co., which owns 6.3% of the bank, and the

Qatari royal family, which has a 6.1% stake through separate

Qatari-controlled vehicles.

Cerberus Capital Management LP, a top investor in both Deutsche

Bank and Commerzbank, has signaled it won't stand in the way of a

deal, according to a person familiar with the firm. BlackRock,

which also has stakes in both banks, is generally skeptical about

the benefits of combining the two banks, but like other investors

wants details of how a deal would look before making any decision,

according to a person briefed on the matter. Both have seen the

value of their stocks fall sharply overtime.

Jobs Matter

A vocal objector to a deal is services-sector labor union Verdi,

which has representatives in the supervisory board of both banks

and said up to 30,000 out of roughly 140,000 positions could

disappear under the merger.

"We reject a possible merger of both houses with a view to

endangering tens of thousands of jobs," said Jan Duscheck, a Verdi

representative.

While Berlin has signaled it would back job cuts, analysts are

skeptical that the banks will be able to deliver a leaner company

quickly. Germany's labor rules are notoriously stringent, making

layoffs difficult and costly. Both Deutsche Bank and Commerzbank

have struggled to absorb other banks they have bought in the

past.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

March 26, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

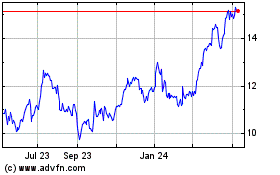

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

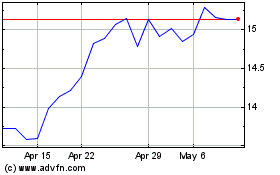

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Apr 2023 to Apr 2024