Current Report Filing (8-k)

March 25 2019 - 5:27PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 22, 2019

REDHAWK HOLDINGS CORP.

(Exact name of registrant as specified in

its charter)

Nevada

(State or other jurisdiction of incorporation)

000-54323

(Commission file number)

20-3866475

(I.R.S. Employer Identification No.)

120 Rue Beauregard, Suite 206

Lafayette, Louisiana 70508

(Address of principal executive offices) (Zip Code)

(337) 269-5933

(Company's telephone number, including area

code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant

|

Litigation Settlement

As previously reported, on January 31,

2017, the registrant, RedHawk Holdings Corp. (“RedHawk”) and Beechwood Properties, LLC (“Beechwood”) filed

suit against Daniel J. Schreiber (“Mr. Schreiber”) and the Daniel J. Schreiber Living Trust – Dtd 2/08/95 (“Schreiber

Trust”) in the United States District Court for the Eastern District of Louisiana under Civil Action No. 2:2017cv819-B(3)

(the “Louisiana Lawsuit”).

Mr. Schreiber and the Schreiber Trust answered

the Louisiana Lawsuit and counter-claimed against RedHawk and Beechwood and made additional claims against Mr. G. Darcy Klug (“Mr.

Klug”) in the Louisiana Lawsuit. Mr. Klug is an officer and director of RedHawk and is sole owner of Beechwood. Mr. Klug

also holds voting control of RedHawk.

On April 24, 2017, Mr. Schreiber and the

Schreiber Trust also filed suit against RedHawk, Mr. Klug and six (6) other defendants in the United States District Court for

the Southern District of California under Civil Action No. 3:17-cv-00824-WQH-BLM which case was dismissed without prejudice on

September 26, 2017 (the “California Lawsuit” and along with the Louisiana Lawsuit, the "Litigations").

On March 22, 2019, the parties to the Litigations

have entered into a Settlement Agreement and General Release (“Settlement Agreement”) to resolve all issues arising

out of the subject matter of the Litigation.

In consideration of the mutual promises,

covenants and conditions contained in the Settlement Agreement, the parties to the Litigation agreed that (i) Mr. Schreiber and

the Schreiber Trust shall transfer all RedHawk stock they presently own (52,377,108 common shares) to RedHawk and (ii) Redhawk

shall (a) make to Mr. Schreiber and the Schreiber Trust a cash payment of Two Hundred Fifty Thousand and 00/100 Dollars (US$250,000.00)

and (b) issue two Promissory Notes, each in the principal amount of Two Hundred Thousand and 00/100 Dollars (US$200,000.00), one

of which shall be due and payable on or before September 6, 2020 and the other shall be due and payable on or before September

5, 2021.

Each Promissory Note shall be non-interest

bearing, however each (i) shall bear a $15,000 late penalty if the principal amount is not repaid by the due date and (ii) shall

bear interest at a rate of 18% per annum, from the issue date, if the principal is not repaid by the 30th date after the due date.

Pursuant to a Security Agreement between

the parties, Mr. Klug and Beechwood secured RedHawk’s obligations to the Schreiber Trust under the Settlement Agreement by

granting first-priority security interests in (i) 1,000 shares of Mr. Klug’s Series B Preferred RedHawk Stock; and 1,473

shares of Mr. Klug’s Series A Preferred RedHawk Stock, and (ii) Beechwood’s interest in the Tower Hotels Fund 2014,

LLC. RedHawk may repurchase both Promissory Notes for a single payment of Three Hundred Thousand Dollars (US$300,000.00) provided

such payment is tendered to the Schreiber Trust within 180 days of the execution of the Security Agreement.

A copy of the Settlement Agreement is filed

as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The description of the Settlement Agreement

does not purport to be a complete description and is qualified in its entirety by reference to the full text of the Settlement

Agreement.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits.

|

Exhibit

|

|

|

|

|

Number

|

|

Description

|

|

|

10.1

|

|

Settlement Agreement, dated as of March 22, 2019.

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Date: March 25, 2019

|

RedHawk Holdings Corp.

|

|

|

|

|

|

By:

|

/s/ G. Darcy Klug

|

|

|

Name:

|

G. Darcy Klug

|

|

|

Title:

|

Chairman of the Board, Chief Executive Officer and Chief Financial Officer

|

EXHIBIT INDEX

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

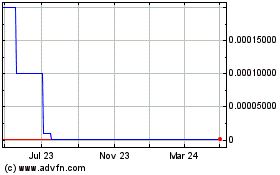

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Apr 2023 to Apr 2024