AXA to Raise $1.4 Billion From Sale of AXA Equitable Holdings Shares

March 21 2019 - 6:21AM

Dow Jones News

By Pietro Lombardi

AXA SA (CS.FR) expects to raise roughly $1.4 billion from the

sale of shares in its U.S. subsidiary AXA Equitable Holdings Inc.

(EQH).

The French insurance giant has been reducing its stake in the

U.S. company since last year's IPO, using the money it raised to

partially finance its $15 billion acquisition of insurer XL Group.

The latest sale will take AXA's stake in AXA Equitable to below

50%, it said late Wednesday.

About $800 million should come from the sale of 40 million

shares in AXA Equitable at $20.50 per share, which should be

completed by March 25. The French insurer has granted the option

for underwriters to acquire a further 6 million shares, whose value

isn't included in the $1.4 billion estimate.

A further $600 million should come from the sale of 30 million

shares in AXA Equitable back to the U.S. company.

AXA's stake in the company should decline to about 49.5% from

about 60.1% after the transactions, and the remaining holdings will

be deconsolidated and accounted for under the equity method.

The French company's half-year results should take a hit of

roughly 700 million euros ($795.8 million) from the deal, stemming

from the difference between the offering price and the book value

of AXA Equitable.

"This does not reflect management's expectations on the future

evolution of EQH's share price or of the price at which potential

future transactions might take place," AXA said.

The deal should also lead to a decline in AXA's debt

gearing.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

March 21, 2019 06:06 ET (10:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

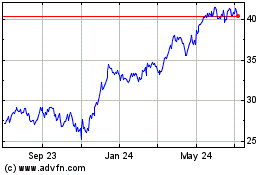

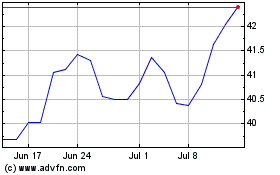

Equitable (NYSE:EQH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Equitable (NYSE:EQH)

Historical Stock Chart

From Apr 2023 to Apr 2024