Overheard -- WSJ

March 20 2019 - 3:02AM

Dow Jones News

By Charley Grant

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 20, 2019).

In a nearly 200-page presentation calling for investors to

reject Bristol-Myers Squibb's proposed acquisition of Celgene

released on Monday, activist hedge fund Starboard Value called

Celgene's pipeline of new drugs "unproven." The hedge fund said

relying on that pipeline "adds incredible risk" for Bristol-Myers

and could force additional acquisitions in the future. One example

Starboard cited is Merck & Co.'s $41.1 billion deal for

Schering-Plough back in 2009.

Don't tell that to Merck's shareholders. The company acquired

the cancer drug Keytruda as part of that deal and, while it wasn't

on most people's radar back then, things have most certainly

changed: Since the drug reached the market in 2014, Keytruda sales

have topped $13 billion. Wall Street analysts expect another $87

billion in cumulative sales through 2024, according to FactSet.

Given that history, Bristol-Myers shareholders ought to hope the

Celgene deal is similarly unwise.

Corrections & Amplifications Merck & Co. acquired

Schering-Plough for $41.1 billion in 2009. An earlier version of

the article incorrectly said the purchase price was $47 billion.

(March 19, 2019)

Write to Charley Grant at charles.grant@wsj.com

(END) Dow Jones Newswires

March 20, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

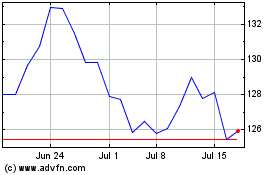

Merck (NYSE:MRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Merck (NYSE:MRK)

Historical Stock Chart

From Apr 2023 to Apr 2024