CannabisNewsWire

Editorial Coverage: As the cannabis market grows, companies are

seizing the opportunity to make strategic investments in the sector

and establish a foothold in the promising space.

- Cannabis and related products are legal in an ever-increasing

number of jurisdictions.

- Businesses have responded with an increasingly diverse range of

products.

- Companies making the smartest investments, such as carefully

selected mergers and acquisitions, are in the best position to

profit from this while minimizing risks.

SinglePoint Inc. (OTCQB: SING) (SING

Profile) has invested in a number of other cannabis

companies to grow its portfolio and leverage its position in the

market. Marijuana Company of America Inc. (OTCQB: MCOA)

(MCOA

Profile), with its hemp-oriented business, is

expecting a surge in profits following the crop’s federal

legalization in the United States in December. Medical

Marijuana Inc. (OTC: MJNA), the first publicly traded

cannabis company in the United States, has seen record sales.

PotNetwork Holdings Inc. (OTC: POTN) is reaching

out to new customers with a CBD-infused slushy machine. And

American Premium Water Corp. (OTC: HIPH) is also

pushing CBD into the soft drinks market with its infused water.

To view an infographic of this editorial, click here.

A Big Year for Big Investment in Cannabis

This year looks to be an important year in the development of

the cannabis market. The legal groundwork for those changes was

laid last year, with significant legislation moving forward in

Canada, the United States and elsewhere. With the legal aspects in

place, fresh opportunities for the market to grow and for companies

to make bold moves within the sector have become more frequent —

and look to be more profitable.

This momentum is fueling the ongoing development of two

important trends. One is product diversification, as cannabis

companies and the businesses supporting them develop a wider range

of products for an increasingly varied market. The other is big

investment, as both the larger cannabis companies and outside

businesses with big bank balances move to carve out chunks of the

market. Money is flowing in, making the most of the opportunities

that legal and product changes provide.

A Changing Global Context

Things have been looking rosy for cannabis for some time, and

last year saw significant growth in the sector continue. SinglePoint Inc.

(OTCQB: SING), a young tech company that has moved into the

cannabis sector, saw its revenue hit

the $1 million mark. In addition, like many cannabis companies,

the company ended the year expecting even better things to come,

with a prediction that revenue will dramatically increase over the

next 12 months.

How can companies in a relatively untried sector make such bold

claims?

The answer lies in the changing attitude of lawmakers to

cannabis. The prohibitory model for managing the drug that has

dominated for half a century is increasingly recognized as not just

ineffective but harmful to public health. Consequently, governments

are legalizing cannabis for medical use. And in the most

forward-looking cases, they are creating regulated markets for

recreational cannabis, most significantly in Canada, which made the

trade legal nationally last October.

For American companies such as SinglePoint, change has come on a

state-by-state basis. Though the majority of

Americans favor legalization, the federal government has been

too reliant on conservative voters to support nationwide change.

Instead, individual states have created legal markets, with

Michigan becoming one of the most recent when cannabis went legal

there in December. Two-thirds of U.S. states now allow medical

cannabis, and one in five have legalized its recreational use, with

more expected to follow over the next few years. This has allowed

SinglePoint to begin investing in cannabis without having to

consider a national cannabis business.

December saw a significant step towards wider legalization.

Following months of wrangling, the 2018 Farm Bill passed into law,

making industrial hemp legal on the federal level. This

nonpsychoactive from of cannabis has provided many companies,

including SinglePoint, with an important entry point into the

sector, as the chemical cannabidiol (CBD), which can be derived

from hemp, can be more widely sold than other forms of cannabis.

CBD’s meteoric rise has given a further boost to the sector,

especially to companies entering via this route.

The Farm Bill will allow cannabis businesses to grow

significantly through hemp and provide a precedent as federal

politicians reconsider the wider cannabis industry.

Product Diversification

Now that they have more opportunities to produce cannabis,

companies are doing what companies always do — finding new ways to

sell their products and services. This has led to a wave of

innovation and an increasingly diverse range of cannabis-based

products.

Two of the biggest areas for innovation are the creation of confectionaries and beauty products. The

former have obvious appeal as a way to consume cannabis without

smoking it. The latter are a natural fit given the suggested

well-being benefits of CBD and THC, along with the willingness of

customers to try new plant-based beauty products. But even more

innovative products are hitting the market, such as Phyto-Bites, a product SinglePoint distributes on its

website SingleSeed.com, designed to improve the health and

well-being of pets.

Human health and well-being remain a huge driver for innovation

in cannabis. Aware of that, SinglePoint has also been adding health

and wellness products to its sales lines. Its SingleSeed store

recently unveiled a range of TorusMed Hemp CBD products to its

offerings. The new products include treatments such as Sport Relief

Topical Cream, an ointment designed to provide pain relief for

professional and amateur athletes.

Smart Investing in the Cannabis Sector

The growth of the cannabis sector has inevitably led to some

instability. Companies are operating in a space that didn’t even

exist 20 years ago. The sector is evolving quickly, with the last

few years triggering a wave of consolidation, and of course in a

fast-changing market, there will be challenges and bumps along the

way. Amid all this, working out how to investment smartly has

become critical.

A lot of the secrets to smart investing in cannabis are the same

as for any sector: do research, understand the businesses being

invested in, have a plan and stick with it. Understanding the

specific circumstances of the cannabis market is essential, and the

big trend within the industry over the past year has been mergers

and acquisitions, as companies such as SinglePoint have expanded

through investment in promising companies that provide products and

services that will complement and support its strategy.

SinglePoint’s most recent investment has been in

TorusMed, a company developing new ways to optimize CBD output

from hemp and therefore increase the profitability of this part of

the cannabis sector. With hemp on the verge of a new boom thanks to

the Farm Bill, SinglePoint has used its understanding of the market

to invest in a company that appears to offer great potential to

make the most of this moment.

Moves like this can put a company in a strong position heading

into what looks to be a big year for cannabis. “[This year] will be

a banner year for SinglePoint,” said SinglePoint CEO

Greg Lambrecht. “We are equipped with the proper funding,

partners and opportunities to be firing on all cylinders. We as a

team expect to position SingleSeed and SinglePoint as market leads

in the CBD market while continuing to enable the founders of the

companies we have acquired to grow their businesses. We are well

diversified and have large opportunities across many emerging

markets that should enable us to be successful into 2019 and

beyond.”

New Year, Fresh Growth

Marijuana Company of America Inc. (OTCQB: MCOA)

is also making the most of the opportunity provided by the Farm

Bill and is expecting

significant growth off the back of this legal change. The

company has a vertically integrated range of cannabis interests,

including a hemp farm in Oregon and its hempSMART range of

products. The legal changes should allow the company to more easily

produce CBD-rich plants and sell the products derived from them

without worrying about legal complications for crossing state

lines. MCOA will also face lower federal income tax, thanks to the

change in hemp’s status, allowing it to keep more profits.

Federal legislation against cannabis production and distribution

has hampered the ability of companies to raise funds through public

investment in the past, but some have found ways. Medical

Marijuana Inc. (OTC: MJNA) was the first cannabis company

in the United States to be publicly traded, a move that put it in a

strong position both financially and for its public profile. It has

recently experienced record sales, buoyed up by

the growth of the cannabis market in the U.S. and beyond.

PotNetwork Holdings Inc. (OTC: POTN) has worked

hard to develop a wide range of products, answering the increasing

demand for product diversity in the cannabis market. The latest of these is the Brain Chill Slushy Machine,

provided through its subsidiary Diamond CBD Inc. Initially

launching in South Florida, these machines serve slushies in a

variety of flavors, all infused with CBD. With millions of gallons

of slushies consumed every year, these new machines are designed to

provide an appealing introduction to CBD.

Also working on drinkable CBD is American Premium Water

Corp. (OTC: HIPH), a diversified luxury consumer products

company that bases its range of health and beauty products on

biotech research. Its Lalpina CBD water is infused with CBD and

features in several recently announced

distribution deals, as the company extends its reach in the

U.S. and beyond.

Legal changes are encouraging an increasingly diverse cannabis

market, in which companies that make smart investments are primed

for profit.

For more information on SinglePoint, visit SinglePoint Inc.

(OTCQB: SING)

About CannabisNewsWire

CannabisNewsWire (CNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

CannabisNewsBreaks that summarize

corporate news and information, (3) enhanced press release

services, (4) social media distribution and optimization services,

and (5) a full array of corporate communication solutions. As a

multifaceted financial news and content distribution company with

an extensive team of contributing journalists and writers, CNW is

uniquely positioned to best serve private and public companies that

desire to reach a wide audience of investors, consumers,

journalists and the general public. CNW has an ever-growing

distribution network of more than 5,000 key syndication outlets

across the country. By cutting through the overload of information

in today’s market, CNW brings its clients unparalleled visibility,

recognition and brand awareness. CNW is where news, content and

information converge.

Receive Text Alerts

from CannabisNewsWire: Text "Cannabis" to

21000

For more information please visit https://www.CannabisNewsWire.com and

or https://CannabisNewsWire.News

Please see full terms of use and disclaimers on the

CannabisNewsWire website applicable to all content provided by CNW,

wherever published or re-published: http://CNW.fm/Disclaimer

CannabisNewsWire (CNW)

Denver, Colorado

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.net

DISCLAIMER: CannabisNewsWire (CNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by CNW are

solely those of CNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable CNW for any investment

decisions by their readers or subscribers. CNW is a news

dissemination and financial marketing solutions provider and is NOT

registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, CNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

CNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and CNW undertakes no

obligation to update such statements.

Source:

CannabisNewsWire

Contact:

CannabisNewsWire (CNW)

Denver, Colorado

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.net

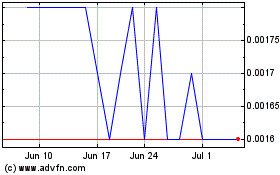

Medical Marijuana (PK) (USOTC:MJNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

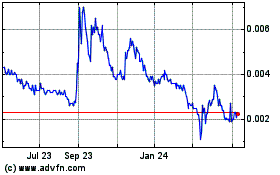

Medical Marijuana (PK) (USOTC:MJNA)

Historical Stock Chart

From Apr 2023 to Apr 2024