Current Report Filing (8-k)

March 04 2019 - 6:08AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

______________

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported):

February 25, 2019

PARKERVISION,

INC.

(Exact

Name of Registrant as Specified in Charter)

|

|

|

|

|

Florida

|

000-22904

|

59-2971472

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File

Number)

|

(IRS Employer Identification

No.)

|

|

7915 Baymeadows Way, Jacksonville,

Florida

|

32256

|

|

(Address of Principal

Executive Offices)

|

(Zip Code)

|

(904)

732-6100

(Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (

see

General Instruction A.2. below):

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e 4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter.

Emerging

growth company [ ]

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

|

Item 1.01.

|

Entry

into a Material Definitive Agreement.

|

On

February 25, 2019, ParkerVision, Inc. (the “

Company

”) entered into a securities purchase agreement (the

“

Purchase Agreement

”) with accredited investors identified on Exhibit 10.4 hereof (the

“

Holders

”) which provides for the sale of convertible promissory notes (the “

Notes

”)

with an aggregate face value of $1,000,000. On February 28, 2019, we consummated the sale of Notes for aggregate proceeds of

$800,000. We anticipate consummating the sale of up to an additional $200,000 in aggregate principal amount of Notes on or

about March 5, 2019. The Notes are convertible at any time and from time to time by the Holders into shares (the

“

Shares

”) of the Company’s common stock, par value $0.01 per share

(“

Common Stock

”) at a fixed conversion price of $0.25 per share. Any unconverted, outstanding principal

amount of the Notes is payable on the five year anniversary of the Note issuance date (the “

Issuance

Date

”).

At

any time following the one-year anniversary of the Issuance Date, the Company may prepay the then outstanding principal amount

of the Note, along with any accrued interest, at cash premium of 125% prior to the two-year anniversary, 120% prior to the three-year

anniversary, 115% prior to the four-year anniversary or 110% thereafter.

Interest

accrues at a rate of 8% per annum on each Note, and is payable quarterly either in cash, shares of Common Stock, or a

combination thereof at the Company’s option, subject to certain equity conditions, beginning on the earlier of (i) the

ninety (90) day anniversary of the Issuance Date, provided that a registration statement for the underlying shares has

been declared effective, or (ii) the first quarterly anniversary of the Issuance Date following the effective date of

registration of the underlying shares.

The

Notes provide for events of default that include (i) failure to pay principal or interest when due, (ii) any breach of any

of the representations, warranties, covenants or agreements made by the Company in the Purchase Agreement or Notes, (iii)

events of liquidation or bankruptcy, and (iii) a change in control. In the event of default, the interest rate increases to

12% per annum and the outstanding principal balance of the Notes plus all accrued interest due may be declared immediately

payable by the holders of a majority of the then outstanding principal balance of the Notes.

The

Company also entered into a registration rights agreement (the “

Registration Rights Agreement

”) with

the Holders pursuant to which the Company will register the shares of Common Stock underlying the Notes. The Company

has committed to file the registration statement by the 60

th

calendar day following the Issuance Date and to cause

the registration statement to become effective by the 120

th

calendar day following the Issuance Date. The

Registration Rights Agreement provides for liquidated damages upon the occurrence of certain events including failure by the

Company to file the registration statement or cause it to become effective by the deadlines set forth above. The amount of

the liquidated damages is 1.0% of the aggregate subscription amount paid by the Holders for the Notes upon the occurrence of

the event, and monthly thereafter, up to a maximum of 6%.

The

Notes were offered and sold solely to accredited investors on a private placement basis under Section 4(a)(2) of the Securities

Act of 1933, as amended, and Rule 506 promulgated thereunder.

The

foregoing summaries of the Purchase Agreement, the Notes and the Registration Rights Agreement are qualified in their entirety

by reference to the full text of the agreements, which are attached as part of Exhibits 10.1, 10.2 and 10.3 hereto and are incorporated

herein by reference

.

|

|

Item 3.02.

|

Unregistered

Sales of Equity Securities.

|

The

disclosure included in Item 1.01 is incorporated herein by reference to the extent required.

Forward-Looking

Statements

This Current Report on Form 8-K (this “Current Report”) contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995, including, in particular, statements about the

Company’s future plans, objectives, and expectations. When used in this Current Report, the words or phrases “expects”,

“will likely result”, “will continue”, “is anticipated”, “estimated” or similar

expressions are intended to identify “forward-looking statements.” Readers are cautioned not to place undue reliance

on such forward-looking statements, each of which speaks only as of the date made. Such statements are subject to certain

risks and uncertainties that could cause actual results to differ materially from historical results and those presently anticipated

or projected. Although the Company may from time to time voluntarily update its prior forward-looking statements, the Company

disclaims any commitment to do so whether as a result of new information, future events, changes in assumptions or otherwise

except as required by applicable securities laws.

|

|

Item 9.01.

|

Financial

Statements and Exhibits.

|

|

Exhibit No.

|

Description

|

|

10.1

|

Securities Purchase Agreement

|

|

10.2

|

Form of Note

|

|

10.3

|

Form of Registration Rights Agreement

|

|

10.4

|

List of Holders

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Dated: March 1, 2019

|

|

|

|

|

|

PARKERVISION, INC.

|

|

|

|

|

|

|

|

By /s/ Cynthia

L. Poehlman

|

|

|

|

Cynthia L. Poehlman

|

|

|

|

Chief Financial Officer

|

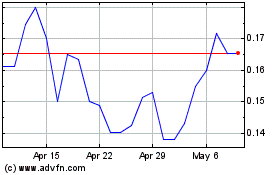

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Apr 2023 to Apr 2024