CVS Gives Downbeat Earnings Outlook for First Year as Merged Company -- 3rd Update

February 20 2019 - 2:07PM

Dow Jones News

By Anna Wilde Mathews and Aisha Al-Muslim

CVS Health Corp. offered a downbeat earnings projection for

2019, its first year as a merged health-care company, saying

results would be dragged down by challenges in areas including its

pharmacy-benefits and long-term-care businesses.

The Woonsocket, R.I.-based company, which in November completed

its nearly $70 billion acquisition of insurer Aetna Inc., said that

it was taking rapid steps to address the problems, including a

cost-cutting effort, and that its ambitious deal positioned it for

long-term growth.

CVS, which has said that its deal to bring together drugstores,

pharmacy-benefit management and insurance would help it cut

health-care costs and improve care, said it was building new

offerings.

For 2019, the company said it was projecting adjusted earnings

per share of $6.68 to $6.88, compared with analysts' estimates of

$7.41 a share, as polled by Refinitiv. CVS said its results are

being hurt by factors including smaller benefits from the rollout

of new generic drugs and the performance of Omnicare, its

long-term-care pharmacy business.

In its pharmacy-benefits business, CVS said it was experiencing

a squeeze related to rebates that it receives from drugmakers and

passes on to clients. It has guaranteed clients that it will

provide them certain rebate payments, but it is seeing slower

growth than it had expected in the prices of branded drugs. CVS

said it also will lose the PBM business of Centene Corp., beginning

in 2019.

"Many of these headwinds are transitory in nature," CVS Chief

Executive Larry Merlo said in a call with analysts. He said that

the rebate-guarantee impact would peak in 2019 and ease at the end

of 2020, and that Omnicare's results were expected to stabilize and

improve.

CVS's efforts to bolster its retail offerings, the rollout of a

new PBM contracting model and moves to build its Medicare Advantage

coverage business, among other efforts, will help improve results,

the company said.

CVS also said savings from its Aetna deal are expected to exceed

its previous goal of $750 million in 2020, and should be between

$300 million and $350 million in 2019.

Mr. Merlo said in an interview that 2019 is a transitional year,

and "the work is well under way in terms of the integration of

Aetna," with various pilots being rolled out. He said CVS hopes to

improve pharmacy margins partly by forging contracts that reward it

for taking on a broader role, with services such as helping

patients adhere to their prescriptions and filling gaps in their

care.

CVS swung to a loss for the fourth quarter of 2018, though it

beat analysts' estimates on an adjusted basis. The company reported

a fourth-quarter net loss of $421 million, or 37 cents a share,

down from a profit of $3.29 billion, or $3.22 a share, a year

earlier.

The net results were affected by a $2.2 billion charge related

to the struggling long-term-care business. Adjusted earnings were

$2.14 a share, beating the $2.05 a share analysts polled by

Refinitiv were projecting.

The stock was down 7.9% in afternoon trading Wednesday. Shares

are down 8.9% in the past year.

Mr. Merlo also said in the call that CVS had concerns about the

impact of a new federal proposal that would curb rebates from

drugmakers tied to plans offered under Medicare and Medicaid. He

suggested that the proposal, which could change before it is

finalized and isn't expected to take effect in 2019, might push up

premiums in Medicare's drug-benefit program and damp enrollment by

seniors. He said the proposal could result in a "profit windfall"

for the makers of branded drugs. Mr. Merlo also suggested that

employers and other commercial PBM clients weren't likely to

quickly adopt a model similar to the federal proposal.

Earlier this month, CVS unveiled pilots of a new store format it

called HealthHUB, which focuses more on health and wellness than

its traditional stores by offering health-care services, new

products and services and space for the company and community

groups to offer health-related events.

For the fourth quarter, CVS's revenue rose 12.5% to $54.42

billion, slightly missing the consensus forecast of $54.58 billion

from analysts polled by Refinitiv. Revenue growth was driven by

increased pharmacy network claims, increased prescription volume

and the addition of Aetna, the company said. Same-store sales grew

5.7%, ahead of the FactSet estimate of a 4.6% increase.

After the close of its Aetna deal, CVS created a new

health-care-benefits segment equivalent to the former Aetna

health-care segment, which includes insured and self-insured

medical, pharmacy, dental and behavioral health products and

services. From Nov. 28 to Dec. 31, the health-care-benefits segment

had revenue of $5.55 billion. Its medical membership as of Dec. 31

was 22.1 million, reflecting decreases in commercial insurance and

Medicaid products.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Aisha

Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

February 20, 2019 13:52 ET (18:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

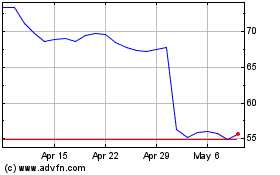

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

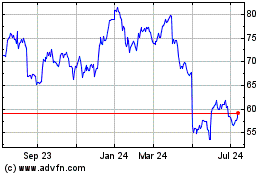

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024