IBM's Expectations Propel Its Shares, But Revenue Is Off -- WSJ

January 23 2019 - 2:03AM

Dow Jones News

By Jay Greene

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 23, 2019).

International Business Machines Corp. said revenue fell 3.5% in

the fourth quarter, another setback in its yearslong quest to

recapture growth, but its signal that faster-growing businesses

would help boost profit this year sent shares higher.

IBM's stock jumped more than 6% after hours, driven in part by

the company's outlook for 2019. It expects adjusted per-share

earnings of $13.90, compared with $13.81 for the prior year. IBM

doesn't provide a forecast for revenue.

Chief Executive Ginni Rometty has struggled to turn around Big

Blue since taking over in 2012. Just a year ago, IBM triumphantly

returned to growth following nearly six years of shrinking

revenue.

Along the way, the company said a long-awaited turnaround was

coming as it built up faster-growing businesses. For several

quarters, it seemed it had gotten there. But IBM reported a

second-consecutive quarterly revenue drop in the final months of

2018.

IBM faced a tough comparison to year-ago results, when it

benefited from the recent introduction of a new mainframe system.

That business dropped 44% in the fourth quarter after growing 71% a

year ago, finance chief James Kavanaugh said in an interview. The

mainframe refresh had played a significant role in helping IBM to

return to revenue growth a year ago.

IBM's so-called strategic imperatives, a cluster of businesses

including cloud computing and data analytics, are Ms. Rometty's

antidote as she refashions the legacy technology vendor to compete

against Amazon.com Inc., Microsoft Corp. and Alphabet Inc.'s Google

in the cloud. Those businesses grew 5% to $11.5 billion, Mr.

Kavanaugh said.

Three years ago, IBM said it expected strategic imperatives,

which at the time accounted for only 25% of its revenue, to

generate $40 billion in revenue in 2018.

For the year, IBM posted $39.8 billion in revenue for the

businesses, up 9%. Mr. Kavanaugh added that those businesses are

"consistently 50% of our portfolio overall."

The 2019 outlook, meanwhile, was enough to sate investors

because their expectations are modest, said KeyBanc Capital Markets

analyst Arvind Ramnani. Given IBM's struggles in recent years,

however, it still has to show consistent progress in its

faster-growing markets, he said. "In order to say things have

turned, you need to see two to three quarters of execution," Mr.

Ramnani said, adding that he expects revenue to decline again

during the current quarter.

IBM moved to rev up its cloud-computing businesses in October,

announcing plans to buy Red Hat Inc. for about $33 billion.

IBM is counting on the deal, its largest ever, to increase its

business of selling so-called hybrid services in which companies

run programs that use computing resources from their own servers

and web services from IBM and others at the same time.

Mr. Kavanaugh said IBM still expects the Red Hat deal to close

in the second half of this year.

For the fourth quarter, revenue came in at $21.76 billion,

compared with $22.54 billion a year ago.

IBM swung to a profit of $1.95 billion from a $1.05 billion net

loss a year earlier, when it took a $5.5 billion charge related to

the U.S. Tax Cuts and Jobs Act of 2017.

Adjusted profit, which excludes some acquisition-related

expenses and other items, came to $4.87 a share.

Analysts surveyed by Refinitiv had expected revenue of $21.71

billion and adjusted profit of $4.82 a share.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

January 23, 2019 01:48 ET (06:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

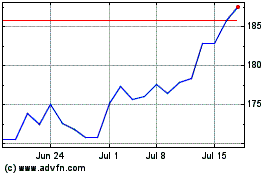

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024