Pearson Shares Fall on U.S. Weakness -- Update

January 16 2019 - 6:54AM

Dow Jones News

--Pearson expects revenue from its key U.S. higher-education

business to be flat or fall by up to 5% in 2019, after hitting the

low end of guidance last year

--Higher-than-planned cost savings boosted the company's

adjusted operating profit in 2018, which is estimated to top

analysts' forecasts

--Shares traded 7.2% lower on the back of the news, in their

biggest one-day drop since January 2017

By Adria Calatayud

Shares in Pearson PLC (PSON.LN) took a hit Wednesday after the

company said its key U.S. higher-education business will remain

under pressure this year, although cost-savings boosted adjusted

earnings in 2018.

The London-based education publisher expects revenue from U.S.

higher education courseware to be flat or fall by up to 5% in 2019,

as underlying pressures continue. This would follow a 5% drop in

2018, at the low end of the company's guidance.

Pearson in recent years underwent a major revamp, involving

multibillion-dollar asset sales, to become an education pure play.

However, continued weakness in the U.S.--as demand for academic

textbooks moves online and competition increases--highlights the

challenges facing the company's digital transition.

Digital revenue from Pearson's U.S. higher-education courseware

grew 2% in 2018 to represent 55% ot its sales, but total underlying

revenue was down 1%, the company said. This missed analyst

forecasts of a 0.4% decline, according to a consensus provided by

the company.

In North America, which accounted for 65% of the group's total

sales in 2017, underlying revenue fell 1%, the company said.

Despite the revenue decline, Pearson anticipates adjusted

operating profit for 2018 of between 540 million and 545 million

pounds ($694.2 million-$700.6 million), ahead of analyst

expectations, it said.

The company previously guided for adjusted operating profit of

between GBP520 million and GBP560 million. Analysts expected

Pearson to report adjusted operating profit of GBP533 million,

according to a company-provided consensus.

Pearson said its simplification program is on track to deliver

annualized cost savings of around GBP330 million by the end of

2019, ahead of its original plan of GBP300 million.

Liberum analyst Ian Whittaker attributes this to

higher-than-planned cost savings and said revenue fell short of

expectations dragged by a weak U.S. higher-education

performance.

"There is only so much cost cutting you can do to mask the

underlying problems facing the business, a lesson the newspapers

know well," Mr. Whittaker said.

For 2019, adjusted operating profit is forecast at between

GBP590 million and GBP640 million, Pearson said.

Shares at 1038 GMT topped the FTSE 100 fallers trading 7.2%

lower at 906.80 pence, making it their biggest one-day percentage

drop since January 2017.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

January 16, 2019 06:39 ET (11:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

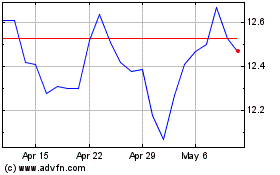

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

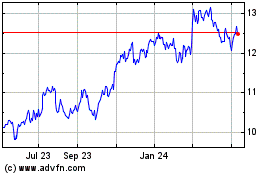

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024