Current Report Filing (8-k)

December 21 2018 - 5:27PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported):

December 18, 2018

ONCOSEC

MEDICAL INCORPORATED

(Exact

Name of Registrant as Specified in Charter)

|

Nevada

(State

or Other Jurisdiction

of

Incorporation)

|

|

000-54318

(Commission

File

Number)

|

|

98-0573252

(IRS

Employer

Identification

No.)

|

3565

General Atomics Court, Suite 100

San

Diego, California 92121

24

North Main Street

Pennington,

NJ 08534-2218

(Address

of Principal Executive Offices)

(855)

662-6732

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act.

|

|

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act.

|

|

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2b under the Exchange Act.

|

|

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act.

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

December 21, 2018, OncoSec Medical Incorporated (the “Company”) received a letter from the Nasdaq Stock Market

LLC (“Nasdaq”) indicating that the Company’s consolidated closing bid price has been below $1.00 per share for

30 consecutive business days, and that, therefore, the Company is not in compliance with Nasdaq Listing

Rule 5550(a)(2), which is the minimum bid price requirement for continued listing on the Nasdaq Capital Market.

Pursuant

to Nasdaq Listing Rule 5810(c)(3)(A), the Company has automatically been afforded a 180-calendar day grace period, or until June

19, 2019, to regain compliance. The continued listing standard will be met if the consolidated closing bid price of the

Company’s common stock is at least $1.00 per share for a minimum of ten consecutive business days during the 180-calendar

day grace period.

If

the Company is not in compliance by June 19, 2019, the Company may be afforded a second 180-calendar day period to regain

compliance if it meets certain requirements. As of the date of this filing, the Company believes that it would be eligible for

a second 180-day grace period; however, such determination would not be made until June 19, 2019, and it is possible that

the Company will not meet those requirements at that time.

The

Company intends to monitor the closing bid price of its common stock and consider its available options to resolve the noncompliance

with the minimum bid price requirement.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement

of Certain Officers.

Effective

December 20, 2018, the Company appointed Mr. Joon Kim (“Mr. Kim”) as a director on the Company’s Board of Directors

(the “Board”), effective as of December 20, 2018. Mr. Kim was appointed to the Board in conjunction with the second

closing of shares purchased by Alpha Holdings, Inc. (“Alpha”) on December 7, 2018. The Company previously announced

that it entered into a stock purchase agreement (the “Agreement”) with Alpha on August 31, 2018, pursuant to which

the Company agreed to issue and sell to Alpha shares of its common stock equal to an aggregate amount of up to $15,000,000 at

a market purchase price of $1.50 per share (the “Shares”). Pursuant to the Agreement, Alpha received the option to

nominate a director to the Board and nominated Mr. Kim. Upon such nomination, the Board examined his credentials, experience,

and background and determined that Mr. Kim would be a valuable addition to the Board. Following such determination, the Board

unanimously agreed to appoint Mr. Kim to the Board, effective as of December 20, 2018.

Mr.

Kim, age 53, is an accomplished litigator and criminal law lawyer with extensive experience in both criminal and civil

litigation matters. As a partner in Lee & Ko’s International Litigation and Dispute Resolution and White Collar

Crime Practice Groups, Mr. Kim advises clients, both domestic and international, on a broad range of litigation

and dispute-resolution matters. With a particularly strong background in representing clients in court proceedings, Mr. Kim

has a comprehensive understanding of every stage of the litigation process, including all aspects of initial

investigatory/discovery proceedings, settlement negotiations, hearings, motions, trials, evidentiary issues and the handling

of post-judgment challenges and appeals.

Prior

to joining Lee & Ko, Mr. Kim worked for several years as litigation lawyer and served from 2008 to 2017

as a public prosecutor in California. Mr. Kim has first-chaired both jury and non-jury trials, and has been trained in all aspects

of litigation. During his time as a public prosecutor, Mr. Kim also had the experience of serving in 2016 as a research fellow

in Korea at the Institute of Justice, under the auspices of the Korean Ministry of Justice, where he worked closely with Korean

public prosecutors. Mr. Kim received his J.D. from Berkeley School of Law and his B.S. from the Berkeley School of Business.

Upon

his appointment as a director, Mr. Kim’s compensation for his services as a director, including his services on any committees

of the Company’s Board, will consist of a stock option award to purchase up to 100,000 shares of the Company’s common

stock, which vests in equal monthly installments over a 12-month period subject to continued service as a director on each vesting

date. No family relationships exist between Mr. Kim and any of the Company’s directors or other executive officers.

Item

5.07. Submission of Matters to a Vote of Security Holders.

The

2018 annual meeting of stockholders of Company was held on December 18, 2018. The following matters were voted on by the stockholders:

(i) the election of six directors; (ii) the ratification of the appointment of Mayer Hoffman McCann P.C. as Company’s independent

registered public accounting firm for the year ending July 31, 2019; (iii) the approval of an amendment to the Company’s

Articles of Incorporation to authorize the Company to issue up to 10,000,000 shares of blank check preferred stock, par value

$0.0001 per share, in one or more series as determined by the Board, with such rights, privileges, preferences and limitations

as the Board may, in its sole discretion, determine; and (iv) to approve, on an advisory basis, the compensation of Company’s

named executive officers. The results of the vote are summarized below.

Item

1: Election of directors:

|

Nominee

|

|

Total

Votes For

|

|

|

Total

Votes Withheld

|

|

|

Broker

Non-Votes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dr. Avtar

Dhillon

|

|

|

11,339,788

|

|

|

|

2,978,572

|

|

|

|

29,412,067

|

|

|

Dr. James DeMesa

|

|

|

13,323,880

|

|

|

|

994,480

|

|

|

|

29,412,067

|

|

|

Daniel J. O’Connor

|

|

|

12,306,383

|

|

|

|

2,011,977

|

|

|

|

29,412,067

|

|

|

Punit S. Dhillon

|

|

|

11,545,960

|

|

|

|

2,772,400

|

|

|

|

29,412,067

|

|

|

Gregory Mayes

|

|

|

13,154,409

|

|

|

|

1,163,951

|

|

|

|

29,412,067

|

|

|

Robert E. Ward

|

|

|

13,444,863

|

|

|

|

873,497

|

|

|

|

29,412,067

|

|

Item

2: Ratification of the appointment of Mayer Hoffman McCann P.C. as the Company’s independent registered public accounting

firm for the year ending July 31, 2019:

|

Total

Votes For

|

|

Total

Votes Against

|

|

Abstention

|

|

Broker

Non-Votes

|

|

41,558,156

|

|

1,081,705

|

|

1,090,566

|

|

N/A

|

Item

3: Vote to approve an amendment to the Company’s Articles of Incorporation to authorize the Company to issue up to 10,000,000

shares of blank check preferred stock, par value $0.0001 per share, in one or more series as determined by the Board, with such

rights, privileges, preferences and limitations as the Board may, in its sole discretion, determine:

|

Total

Votes For

|

|

Total

Votes Against

|

|

Abstention

|

|

Broker

Non-Votes

|

|

7,957,743

|

|

6,026,195

|

|

334,422

|

|

29,412,067

|

Item

4: Vote to approve on an advisory basis, the compensation of the Company’s named executive officers:

|

Total

Votes For

|

|

Total

Votes Against

|

|

Abstention

|

|

Broker

Non-Votes

|

|

9,880,538

|

|

3,560,190

|

|

877,632

|

|

29,412,067

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

ONCOSEC

MEDICAL INCORPORATED

|

|

|

(Registrant)

|

|

|

|

|

|

Date:

December 21, 2018

|

By:

|

/s/

Daniel J. O’Connor

|

|

|

Name:

|

Daniel

J. O’Connor

|

|

|

Title:

|

Chief

Executive Officer and President

|

OncoSec Medical (NASDAQ:ONCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

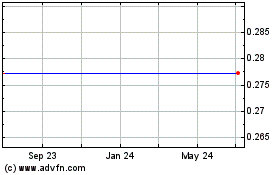

OncoSec Medical (NASDAQ:ONCS)

Historical Stock Chart

From Apr 2023 to Apr 2024