Got Junk? Self-Storage Investors Hope So

December 21 2018 - 8:29AM

Dow Jones News

By Ryan Dezember

Storing people's stuff may have become too profitable a business

for its own good in recent years.

Analysts and investors are worried that the self-storage

industry has attracted so much investment during a yearslong bull

run that America's for-rent storage space may be outpacing the

volume of country's excess belongings.

Self-storage stocks have surged since the economy began bouncing

back from 2008's housing collapse. Shares of the four largest

self-storage owners have each quadrupled or better since bottoming

out in early 2009. Public Storage, CubeSmart, Life Storage Inc. and

Extra Space Storage Inc. have each outpaced the S&P 500 on a

total-return basis over the last decade, counting price changes and

dividend payments.

The 10-year total return on Extra Space, the sector's

second-largest player by locations and stock market value, is

1,182%. CubeSmart, which has a heavy presence around New York, has

returned 794%.

These real-estate investment trusts are beating the market again

this year, but concerns are mounting that billions of dollars'

worth of competing facilities under construction will challenge for

market share and prevent rents from rising like they have in recent

years.

"The fundamentals had been phenomenal for years during the

economic recovery, much better than any other sector," said Eric

Frankel, senior analyst at Green Street Advisors. "Developers and

institutional investors caught on to it so there's been a lot of

supply coming online."

Many of the new projects are being built by private developers.

So it is hard to tell exactly how many new square feet are on the

horizon.

Executives with Public Storage, the industry's

161-million-square-foot behemoth, told investors on a recent

conference call that they estimate about $4 billion worth of new

facilities have been built this year and that there will probably

be about that much added again in 2019. In the decade leading up to

2016, they said, about $1 billion worth of new construction a year

was typical.

The good news is that demand for storage doesn't seem to be

slowing. Green Street estimates that 8% of the U.S. population uses

self storage, up from 3% three decades ago, even as technology has

eliminated a lot of household clutter, like compact discs and video

tapes.

Analysts have struggled to peg storage-demand to particular

macroeconomic factors, like housing starts or retail sales. The

sector seemed to get a boost from the foreclosure crisis, which

seems reasonable given that millions of people who lost homes

probably had to move into smaller rentals or share housing.

Demand tends to be driven by death, divorce, downsizing and the

like. A cultural aversion to parting with possessions has also

helped storage owners thrive. Facility owners have shown they can

raise rents much more aggressively than in other segments of real

estate, such as apartments or offices.

"People always need some place to store their junk," said Alice

Chung, a commercial real-estate analyst at Moody's Investors

Service. "No one is going to start moving their stuff out just to

save $3 or $4 a month."

To receive our Markets newsletter every morning in your inbox,

click here.

Write to Ryan Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

December 21, 2018 08:14 ET (13:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

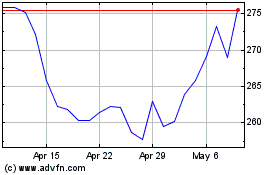

Public Storage (NYSE:PSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Public Storage (NYSE:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024