Juul Looks to Marlboro Maker for More Sway in Washington--3rd Update

December 20 2018 - 2:16PM

Dow Jones News

By Jennifer Maloney

Altria Group Inc.'s $12.8 billion investment for a 35% stake in

Juul Labs Inc. gives the e-cigarette maker more marketing muscle,

expanded shelf space and a benefit that would have been unthinkable

from a cigarette company in the past: an easier path to

Washington's approval.

The tobacco giant has agreed to provide Juul with a range of

services expected to include help to smooth over the e-cigarette

maker's rocky relationship with the Food and Drug Administration.

Juul has come under scrutiny by regulators because of the

popularity of its products among children and teens. The agency

recently announced sharp restrictions on the sale of flavored

e-cigarettes such as Juul's. The startup's products accounted for

about three-quarters of the U.S. e-cigarette market before the FDA

announcement.

Juul is scheduled in February to meet with agency officials to

begin the application process for allowing its products to remain

on the market past a government-granted grace period ending in

2022, according to people familiar with the matter.

"It would not at all surprise me if we collaborated with their

regulatory team on their FDA filings," Altria Chief Executive

Howard Willard said on a conference call Thursday with analysts and

reporters. "We have years of experience."

Juul says its mission has always been to help adult cigarette

smokers switch to less harmful products. But it has stumbled along

the way, with marketing that appealed to young people, an aborted

antivaping program it created to present in schools, and a

continuing struggle to tamp down the proliferation of images on

social media posted by underage Juul users.

By contrast, Altria, the U.S. cigarette market leader, is expert

at reaching adult smokers. It now offers Juul improved access to

those consumers.

The tobacco giant brings "a level of sophistication that they

need," said a person familiar with the matter.

Juul ads could soon appear on packs of Marlboros. The company's

vaporizers will occupy retail shelf space alongside Altria's

cigarette brands. Juul now has the option of deploying Altria's

sales force to sell its products.

Some Juul employees were upset when they first learned that

their company was in talks to take an investment from the tobacco

giant, saying such a move was a betrayal of the startup's

mission.

"As counterintuitive as it may seem, Altria wants to support our

journey, " Juul Chief Executive Kevin Burns wrote Thursday in a

memo to staff. "We understand the doubt. We doubted as well. But if

we are true to our mission we believe we need to look through the

obvious negative headlines and doubters and take the opportunity to

accelerate the decline of cigarette smoking in the USA and around

the world."

Juul is using most of the cash from Altria to make payments to

shareholders and staff as well as retention packages to employees

who stay, according to people familiar with the matter. Fully $2

billion is allocated for payments to the company's 1,500 employees,

the people said.

The cash investment values Juul at about $38 billion, vaulting

the closely held company's valuation past well known companies such

as Ford Motor Co. and Target Corp.

Juul will stay independent for now. Altria's stake is limited to

35% for six years, and the agreement allows Altria to appoint a

third of Juul's board members if antitrust regulators approve the

deal.

The investment marks a change in tone for Altria, which Thursday

for the first time said it was preparing "for a future where adult

smokers overwhelmingly choose non-combustible products over

cigarettes."

Altria earlier this month said it would invest $1.8 billion in

Canadian marijuana grower Cronos Group Inc., pushing into a nascent

business that is illegal on the federal level in the U.S. but could

help Altria expand its reach overseas.

The Richmond, Va.-based tobacco company is taking out $14.6

billion in debt to finance the Juul stock purchase and its

investment in Cronos. Altria plans to cut its workforce and reduce

spending on third-party services to help offset the interest

expense from the debt. A spokesman for Altria said the company

hadn't yet determined the number of jobs it would cut.

Perella Weinberg Partners and JPMorgan Chase & Co. advised

Altria on the transaction. Goldman Sachs Group Inc. advised

Juul.

--Allison Prang and Dana Mattioli contributed to this

article.

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

December 20, 2018 14:01 ET (19:01 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

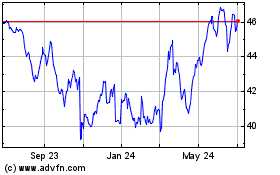

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

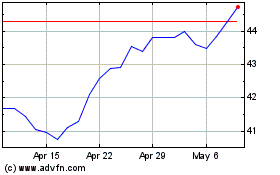

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024