Valuation of $38 billion would surpass that of several

well-known tech startups

By Dana Mattioli, Jennifer Maloney and Dana Cimilluca

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 20, 2018).

Altria Group Inc. is nearing a deal to take a 35% stake in

e-cigarette startup Juul Labs Inc. at a roughly $38 billion

valuation, according to people familiar with the matter, an

investment that would make Juul one of the most valuable private

companies.

The $12.8 billion cash injection could be announced as soon as

this week, the people said. It would more than double what Juul was

valued at just a few months ago, a sign of how quickly the startup

has been growing and Altria's desire to find growth outside its

shrinking cigarette business. The Wall Street Journal earlier

reported on the discussions.

At $38 billion, three-year-old Juul would be worth more than

several well-known Silicon Valley startups, including Airbnb, the

home-sharing service; Elon Musk's space venture SpaceX; and three

times as much as Pinterest. Juul's valuation would be on par with

the market capitalization of public companies such as Delta Air

Lines Inc., Target Corp. and Ford Motor Co.

The rich valuation comes at a time that the San Francisco

company is under fire from regulators, educators and public health

officials over its popularity among children and teens. Juul says

its products are designed to help adult cigarette smokers switch to

a less-harmful way to inhale nicotine, but the company's own

research shows its sleek device has hooked many people who had

never smoked or had quit smoking.

Juul, which has about 1,500 employees, was on track for $2

billion in annual revenue. It has outperformed its internal

forecasts from its last funding round, according to a person

familiar with the matter. The company has profit margins as high as

75%, the person added, which is much higher than traditional

tobacco.

The investment would give the Marlboro maker greater access to a

rapidly growing but increasingly controversial segment of the

nicotine market. It would also expand Altria's reach beyond the

U.S. Currently, Philip Morris International Inc. sells Marlboro and

other Altria brands outside the U.S. Juul products are sold in

Canada, the U.K., Israel and Russia, and the company has expansion

plans in Europe and Asia.

Some Juul employees have been upset by their company's talks

with Altria, saying it is a betrayal of the startup's mission to

help cigarette smokers switch to less-harmful products. In an

all-hands meeting after the Journal first reported the discussions,

Juul Chief Executive Kevin Burns told staff that any deal would

have to meet criteria including Juul maintaining full control of

the company, employees having the option to cash out shares and the

new investor taking actions to support Juul's mission, according to

a person familiar with the matter.

A deal with Altria would give Juul access to better shelf space

at retailers and marketing access to millions of cigarette

smokers.

Youth use of e-cigarettes has soared over the past year, thanks

largely to Juul's thumb-drive shaped vaporizers, whose sales have

skyrocketed since mid-2017. One out of every five high-school

students -- more than three million teens -- reported using

e-cigarettes recently, according to a federal survey conducted this

past spring.

Altria's stock had declined nearly 30% over the past year as the

company grappled with declines in traditional smokers and a

potential U.S. ban on menthol cigarettes.The Richmond, Va.-based

company is now pivoting to areas of growth in the market. Earlier

this month, Altria made a $1.8 billion investment in Canadian

cannabis company Cronos Group Inc. That deal will give Altria

access to a growing part of the industry as marijuana becomes

legalized in more markets.

Altria's pursuit of Juul signals a lack of confidence in a

heat-not-burn device called IQOS that it hopes to market in the

U.S. in a partnership with Philip Morris International. The

product, which heats tobacco but doesn't burn it, has gained

traction in Japan and other countries, but its prospects in the

U.S. are unclear.

In January, an advisory committee to the Food and Drug

Administration said scientific evidence was insufficient to support

an ambitious marketing claim proposed by Philip Morris that

switching to IQOS from cigarettes reduces the risks of

tobacco-related disease.

A Philip Morris spokesman said six million cigarette smokers

around the world have switched to IQOS. "No other innovation has

yet approached the tremendous reduction in cigarette use that IQOS

has achieved in such a short period of time," he said.

Juul, like many other e-cigarette devices, is sold without

formal FDA approval and has been able to advertise on social media

unlike traditional cigarette brands. The FDA has given e-cigarettes

already on the market several years before they must apply for

approval.

To combat underage use, the FDA recently imposed restrictions on

the sale of certain flavors of e-cigarettes that it says appeal to

teens. Juul refills with non-tobacco flavors such as mango and

cucumber account for a sizable chunk of its sales, according to

analysts.

Juul has taken steps to restrict sales to minors, including

pulling all but its mint, menthol and tobacco-flavored products

from bricks-and-mortar stores. It continues to sell all its flavors

on its website, which it says has age verification technology. The

company has discontinued its use of U.S. social media.

Altria recently discontinued its own e-cigarette products, sold

under the MarkTen and Green Smoke brands, which had failed to gain

much traction in the marketplace.

Write to Dana Mattioli at dana.mattioli@wsj.com, Jennifer

Maloney at jennifer.maloney@wsj.com and Dana Cimilluca at

dana.cimilluca@wsj.com

(END) Dow Jones Newswires

December 20, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

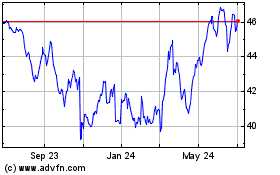

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

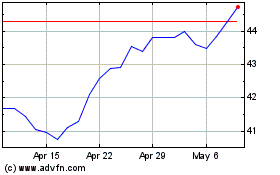

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024