Altria Is Nearing a Deal to Take a 35% Stake in Juul

December 19 2018 - 1:28PM

Dow Jones News

By Dana Mattioli and Jennifer Maloney

Altria Group Inc. is nearing a deal to take a 35% stake in

e-cigarette startup Juul Labs Inc. at a roughly $38 billion

valuation, according to people familiar with the matter, an

investment that would make Juul one of the most valuable private

companies.

The $12.8 billion cash injection could be announced as soon as

this week. It would more than double what Juul was valued at just a

few months ago, a sign of how quickly the startup has been growing

and Altria's desire to find growth outside its shrinking cigarette

business. The Wall Street Journal earlier reported on the

discussions.

At $38 billion, three-year-old Juul would be worth more than

several well-known Silicon Valley startups, including Airbnb, the

home-sharing service, and Elon Musk's space venture SpaceX, and

nearly three times as much as Pinterest. Juul's valuation would be

on par with the market capitalization of public companies such as

Delta Air Lines Inc., Target Corp. and Ford Motor Co.

Juul, which has about 1,500 employees, was on track for $2

billion in annual revenue. It has outperformed its internal

forecasts from its funding round over the summer, according to a

person familiar with the matter. The company has profit margins as

high as 75%, the person added, which is much higher than

traditional tobacco.

Write to Dana Mattioli at dana.mattioli@wsj.com and Jennifer

Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

December 19, 2018 13:13 ET (18:13 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

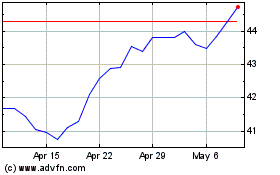

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

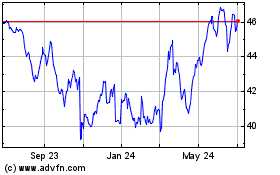

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024