General Mills Struggles to Lift Sales in North America, but Profit Margins Improve --update

December 19 2018 - 9:19AM

Dow Jones News

By Annie Gasparro and Micah Maidenberg

General Mills Inc. said raising prices this year helped improve

its profit margin despite record-high freight costs and

disappointing sales growth.

The maker of Cheerios cereal and Yoplait yogurt has struggled

this year with what it says are unprecedented logistics costs and

higher food prices. Like other packaged-food makers, General Mills

has started charging more for its food, even as the popularity of

products such as cereal and yogurt falters.

For its fiscal second quarter, which ended Nov. 25, General

Mills' adjusted gross profit margin rose slightly to 34.5%. But its

North American retail sales fell 3%.

"Our job to do in the second half is to accelerate our sales

growth while maintaining that same discipline," Chief Executive

Officer Jeff Harmening said Wednesday in prepared remarks.

General Mills's shares rose 5% on Wednesday morning.

Grocery stores have recently started allowing more price

increases from big brands, after pushing back in recent years to

compete with lower-priced food retailers. Many of those price

increases have come in the form of smaller packaging, new flavors

or fewer discounts.

General Mills pointed to that strategy on Wednesday as a way to

boost profitability. But fewer promotional displays and discounts

in its cereal brands hurt sales in the latest quarter.

The company also wrote off $193 million in an impairment charge

for Progresso, Food Should Taste Good, and Mountain High brands in

the quarter, primarily because it now expects those product lines

to generate weaker sales in the future.

In response to lackluster sales of some of its biggest brands,

General Mills got into the faster-growing dog-food business with an

$8 billion acquisition of Blue Buffalo Pet Products this year.

Sales are rising as it brings the premium, natural pet food to more

stores, but it hasn't been the savior investors expected. In the

latest quarter, operating profit in the pet-food division fell 20%

to $71 million due to higher costs, lower sales volume and factory

startup costs.

General Mills is also working to shed older food brands that

aren't core to its strategy. Mr. Harmening hasn't specified which

ones are on the chopping block.

Overall, General Mills earned a profit of $343 million in the

quarter, down 20% from a year earlier. Adjusted profit of 85 cents

a share beat the 81 cents a share analysts expected, sending shares

up 3% in early trading Wednesday. Sales climbed 5% to $4.41

billion, falling short of the $4.51 billion analysts polled by

FactSet expected.

Write to Annie Gasparro at annie.gasparro@wsj.com and Micah

Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

December 19, 2018 09:04 ET (14:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

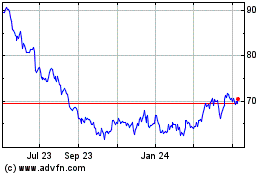

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

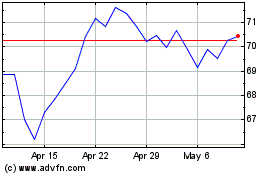

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024