CVS Urges Judge Not to Halt Integration of Aetna--Update

December 18 2018 - 5:36PM

Dow Jones News

By Brent Kendall

WASHINGTON -- A federal judge on Tuesday softened his previous

suggestion that he would likely issue a court order requiring CVS

Health Corp. to halt its integration of newly acquired insurer

Aetna Inc.

U.S. District Judge Richard Leon in recent weeks has voiced

concerns about the companies' settlement with Justice Department

antitrust enforcers that allowed the nearly $70 billion deal to

proceed.

The judge, who must decide whether to approve the settlement,

earlier this month raised the prospect of requiring CVS to hold

Aetna's assets separately for now, while he considers in more

detail whether the settlement is in the public interest.

During a brief hearing in Washington, D.C., on Tuesday, the

judge took a more conciliatory tone toward CVS, citing with

approval a voluntary offer the company made to keep certain aspects

of Aetna's operations separate for now.

CVS has argued that halting all integration would cause

irreparable harm to the company and its customers. Instead, it

offered four measures it said would help facilitate Judge Leon's

review.

Among them, CVS pledged that Aetna would maintain its historical

control over pricing, and that CVS and Aetna wouldn't exchange

competitively sensitive information for the time being.

Judge Leon said CVS's proposal was constructive and helpful, and

he suggested that an outside monitor be brought in to make sure

that the company lives up to those commitments.

Both CVS and the Justice Department are due to file more court

papers on Thursday.

DOJ approved the deal in October under the condition the

companies sell Aetna's Medicare drug business to preserve

competition. The companies sold those assets to WellCare Health

Plans Inc., and CVS completed the acquisition last month.

Judge Leon has questioned whether the settlement did enough to

protect competition in the health-care industry, citing objections

raised by critics including the American Medical Association.

The Justice Department has said its settlement fully addressed

the potential harms raised by the merger and that Judge Leon didn't

have the authority to object to other parts of the transaction that

the department didn't find problematic.

While the judge had kind words Tuesday for CVS, he said the

department's legal filings were "unhelpful" and "intemperate," and

he urged the government to change its tone.

Judge Leon and Justice Department antitrust lawyers have been at

odds for months; the judge in June rejected the DOJ's challenge to

AT&T Inc.'s acquisition of Time Warner. The department is

appealing that ruling, arguing that Judge Leon's decision ignored

"fundamental principles of economics and common sense."

CVS, for its part, has stressed that it and Aetna are no longer

separate companies. "Our focus is on transforming the consumer

health experience, " a CVS spokesman said. "The actions we've

highlighted for the court make a hold-separate order

unnecessary."

Judge Leon suggested it could take at least several months to

fully review the settlement. CVS said in court that it was happy to

abide by its voluntary commitments for six months, but may want to

reconsider if the case takes longer to resolve.

Beyond Judge Leon's review, integration presents a challenging

task for CVS because of the diverse and sprawling businesses

involved in the Aetna deal. The combined company includes an

insurance operation, a pharmacy-benefit manager and thousands of

retail drugstores.

CVS has said it will trim costs and offer new, integrated

services for consumers, partly by leveraging the huge store of data

it can now assemble.

Clients including major employers, which make decisions about

their health and pharmacy benefits many months in advance, will

already be expecting to hear about the company's offerings for

2019, 2020 and beyond. They will also be closely watching for any

signs of operational problems.

--Anna Wilde Mathews contributed to this article.

Write to Brent Kendall at brent.kendall@wsj.com

(END) Dow Jones Newswires

December 18, 2018 17:21 ET (22:21 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

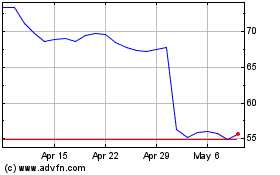

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

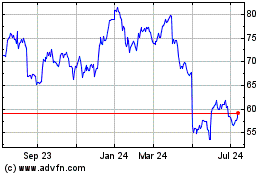

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024