StanChart Spins off Private-Equity Arm in Deal With ICG

December 17 2018 - 5:54AM

Dow Jones News

By Adam Clark

Standard Chartered PLC (STAN.LN) said Monday that it will spin

off its private-equity business and sell the majority of its

portfolio to Intermediate Capital Group PLC (ICP.LN), as the bank

slims down its troubled principal-finance unit.

The portfolio consists of private-equity investments in 35

companies across Asia and Africa. Intermediate Capital Group said

the deal is worth around 790 million pounds ($993 million) and

transfers GBP2.85 billion in assets under management.

Standard Chartered said the management team of its

private-equity unit will lead a new firm called Affirma Capital,

which will continue to manage the unit for ICG. The deal is

expected to be completed in the first half of 2019.

The sale is part of the emerging-markets-focused bank's

commitment to cut back on its principal-finance business, which

makes direct investments using the bank's and client's money.

Standard Chartered said it will reduce its exposure to the business

after it booked a major loss in 2016.

Standard Chartered said it expects to take a $160 million

restructuring charge related to the deal.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

December 17, 2018 05:39 ET (10:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

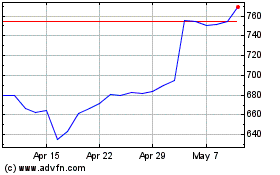

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

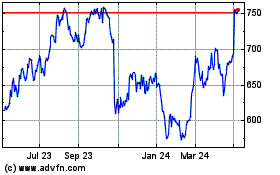

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024