Silicon Valley Helped Build Huawei. Washington Could Dismantle It.

December 09 2018 - 7:59AM

Dow Jones News

By Dan Strumpf

American companies have been crucial in helping Huawei

Technologies Co. become the world's dominant telecommunications

player.

Silicon Valley giants from Intel Corp. to Broadcom Inc. and

Qualcomm Inc. are top suppliers of Huawei, which buys their

components to make equipment such as base stations and routers and

Huawei mobile phones. By one estimate, Huawei will buy up to $10

billion of components from American companies this year--roughly

the value of China's automobile imports from the U.S.

Qualcomm and Intel are also working with Huawei on its

development of next-generation 5G technologies, a field in which

the Chinese company's aim to be a global leader has alarmed some in

Washington.

These interdependencies show how any U.S. actions against Huawei

for alleged sanctions violations, which could go as far as a ban on

it buying from American suppliers, could devastate Huawei's

operations, and curtail business for U.S. tech companies. Huawei's

chief financial officer, Meng Wanzhou, was arrested in Vancouver on

Dec. 1 at the behest of U.S. authorities investigating fraud

related to sales to Iran.

The arrest raised the stakes for Huawei and its overseas

partners and has cast a pall over trade negotiations between the

world's two largest economies. Shares of tech companies in China

and the U.S. have already slumped this year as fears rise that

trade tensions will disrupt business across the Pacific.

In the wake of Ms. Meng's arrest, Huawei has sought to reassure

its suppliers. In a memo dated Dec. 6 and viewed by The Wall Street

Journal, Huawei said it knew of no wrongdoing by Ms. Meng and it is

"unreasonable of the U.S. government to use these sorts of

approaches to exert pressure on a business entity." Huawei's

partnerships with global suppliers wouldn't change, it said.

If the U.S. concludes Huawei evaded U.S. sanctions, further

actions could follow. Huawei's chief Chinese rival, ZTE Corp., was

originally slapped with a fine after it admitted to evading U.S.

sanctions, but subsequent violations of its settlement agreement

led the U.S. government to temporarily ban American companies from

selling it products--sending ZTE to the brink of collapse.

Authorities imposed a similar ban on Chinese chip maker Fujian

Jinhua Integrated Circuit Co. in October, citing national-security

and economic concerns.

U.S. companies stand to lose too, with China being the

second-biggest buyer of its $58.4 bilSHYlion of semiconducSHYtor

exports last year, acSHYcordSHYing to the U.S. InSHYternational

Trade AdSHYminSHYisSHYtraSHYtion. Huawei alone is on track to buy

about $10 billion of components from U.S. companies this year, up

from $8 billion in 2017, estimates Handel Jones, chief executive of

technology consulting firm International Business Strategies Inc.,

which tracks China's high-tech sector.

"It's a pretty extensive list of companies that would be heavily

impacted" if Huawei were to lose access to its American suppliers,

Mr. Jones said. "It would be a very serious situation."

Huawei is by far the biggest-spending Chinese tech company when

it comes to research and development. It has an in-house

chip-design unit that is the seventh largest in the world. It is

working on high-end chips for artificial intelligence, and its

chips are increasingly displacing foreign suppliers in its

smartphones: Only 7% of the semiconductors inside Huawei's

top-of-the-line P20 Pro are from American suppliers, according to

ABI Research, compared with 60% in ZTE's high-end Axon M

device.

Yet Huawei still relies on imports from U.S. chip companies such

as Broadcom, Xilinx Inc. and Analog Devices Inc. for components

used in its telecom equipment, according to a breakdown of its

suppliers by investment bank Jefferies. Huawei buys equipment from

data-storage equipment maker Seagate Technology PLC for use in its

enterprise business, and uses memory chips made by Micron

Technology Inc. in its smartphones, the bank said.

A Xilinx spokeswoman said the company "is aware of the situation

and is monitoring it closely." The other suppliers either declined

to comment or didn't respond to requests for comment.

Intel and Qualcomm, which draw huge revenue from China, are seen

by Huawei as more than suppliers. In Huawei's annual report, Intel

is described as a "strategic partner," and the companies work

together in a range of areas, including next-generation 5G

technology.

On Dec. 5, Huawei announced it had completed a test of key 5G

technology using Intel processors and a Huawei base station. In

September, Huawei credited help from Intel as it made its first

phone call on a type of 5G network.

Intel declined to comment.

Qualcomm has also been a collaborator in 5G. Earlier this year,

the San Diego chip maker said it supplied prototype equipment used

in a 5G test by Huawei. In 2015, Qualcomm, Huawei and China's

largest chip maker, Semiconductor Manufacturing International

Corp., launched a joint venture in Shanghai to work on

next-generation chip technology.

Fears about Huawei's dominance in 5G technology were behind the

U.S.'s decision to scuttle the takeover of Qualcomm by Broadcom

earlier this year. Both companies declined to comment.

Yifan Wang, Jay Greene and Tripp Mickle contributed to this

article.

Write to Dan Strumpf at daniel.strumpf@wsj.com

(END) Dow Jones Newswires

December 09, 2018 07:44 ET (12:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

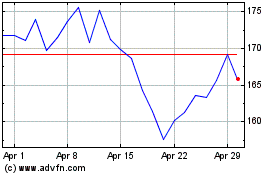

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024