Mobicard announces the

completion of its negotiations with Think Latitude, discloses

specific details, and provides a progress report

on Mobicard's

financials.

Cambridge,

MA -- December 3, 2018 -- InvestorsHub NewsWire

-- Following multiple

presentations from Mobicard Inc. to Think Latitude Inc.

and multiple rounds of negotiations, the two parties have come to

an agreement that will (once executed) provide a path forward to

pursue a continued relationship and advance the technology

of Mobicard together.

The strategic plan to build a

cross-functional application, that

places an

emphasis on creating digital business cards to share and network

with other individuals, uses the newest technology strategies for

the future of the Mobicard platform. The total cost for

the enterprise application will be $145,000 and Think Latitude will

become an equity partner upon completion of the Statement of Work.

In accordance with "your success is our success" philosophy, Think

Latitude will be issued shares of Mobicard (PTOP), which equates to 15%

of the Mobicard equity with an anti-dilution

clause. This partnership ensures that Think Latitude will work

towards Mobicard's

success with a

vested interest in Mobicard Inc.'s business.

Misha Shah, COO of Think

Latitude states "Our executive team is both honored and invested in

moving the current landscape of Mobicard to the next

level. Throughout the course of the

year, we have had numerous meetings and design discussions to truly

understand the essence of how the platform is envisioned and what

our development team is going to achieve in the coming

months. With a significant equity

partnership with Mobicard, Think Latitude can help

cater the enterprise platform to realize scalable milestones over

the course of the coming months". Think Latitude will also be

granted a Technology Advisory role on Mobicard's

Advisory Board to

provide advice on current technology, new technology insights,

advancements, and general climate of technology as it relates to

the Mobicard landscape of

business.

Andy Sajnani, CEO of Think Latitude Inc.

added, "I'm excited to serve as the Technology Advisor on

the Mobicard advisory

board. Being thoroughly involved

from the early discussions to the present state of this project has

enabled me to take an active role in understanding the business

model, and potential of Mobicard which in turn allowed me to

assist in choosing the proper technologies to develop their future

vision and new platform. While we are taking a

phase-based approach to releasing the beta and first version of the

platform, our goal is to create a strong landscape that can support

many advanced features in future versions to

come. As our companies have completed

negotiations, we believe this ongoing partnership will continue to

foster the Think Latitude-Mobicard relationship while we are

progressing through the development phase. I strongly believe that the

alignment of our goals will allow the Mobicard platform to experience much

success in the coming release."

The Statement of Work and

Agreement (SOW) will be executed upon an upfront payment of $25,000

and the signed agreement from Mobicard to Think

Latitude. Another $25,000 will be due

within the following 60 days of the project kick off date. The

remainder of the payments can be made in three subsequent equal

installments after 5 weeks, 10 weeks, and 15 weeks of the

project.

Through application

development, Think Latitude will be responsible for the design and

implementation of Mobicard application's new platform

with the newest coding languages on six major levels once the

SOW is executed. The six major

levels include; one iOS application, one Android application, one

web application, one master admin portal, one organizational admin

portal, and one individual analytics portal, which will be tied

into the interface of the user application. Additionally, Think

Latitude will cover the landing webpage, quality assurance testing

and inherent services such as server architecture setup, scaling,

load balancing, database setup, application deployment, and bug fix

support.

The period of performance and

first beta release of the new platform is projected for approximate

March release, with the start date contingent upon the day

Joshua Sodaitis, CEO of Mobicard (PTOP), accepts the Statement

of work and sends the first payment to Think Latitude. While this

timeframe is too short to complete the entire enterprise-level

platform, the Think Latitude Development team will complete the

majority of the features within this timeframe as a beta

application that can be released to the market. Some features may

continue to be worked on and releases will still be loaded as

enhancements are made until full completion. Any modifications or

extensions will be requested through Think Latitude and

Mobicard

for review and

discussion. Extension guidelines may occur due to resource

allocation issues, scope requirement changes, additional services

needed, and or QA testing delays from the client releases, which

will need to be amended into the existing SOW. Extensions due to

scope changes may also incur an additional

cost payable by Mobicard.

CEO of Mobicard Joshua Sodaitis said "I am excited for a

partnership with Think Latitude and believe the final conclusion to

the negotiation process will be advantageous for both companies in

the long term, specifically the equity stake gives the core

businesses product developers an added incentive to add value and

ideas to differentiate and elevate Mobicard from our competitors. I chose

Think Latitude after extensive research and I think they are

exactly the right partner to make Mobicard the superior choice in our

market." Josh went on to say "Even though we have not executed

final documents or sent the 1st payment, Think Latitude is

excited to get started and already have their senior architect

developers laying out the framing of the

project. They

expressed to me they know it's not a matter of "if" but "when" we

return the SOW. Disclosing the terms of this agreement so

that I can

communicate to shareholders the use of proceeds to accredited

investors that we will seek new funding from. I will be hosting a

conference call for a number of interested parties with the

intention to obtain funding that will ensure the project is

financed through completion as well as aid the company in operating

capital and completing the financials to bring them current. The

idea will be that each interested party can contribute part of the

total so that Mobicard does not have to take on any

toxic debt. Our goal is to have the final agreement and first

payment executed after our corporate council securities attorney

structures the equity and anti-dilution clause and get the project

started by Monday of next week."

In Addition,

Mobicard's

CFO James Bento

giving a financials progress report told the CEO that it has been

progressing according to the proper GAAP & PCAOB accredited

standards and that the audit review firm was going through a

confirmation phase for fiscal year ending 9/30/2015.

The accountants have turned a

corner and as per the agreement with Mobicard have completed phase

one. Mobicard in compliance with the terms

of their agreement with the accountants has sent an additional

payment to cover completion of work associated with the fiscal year

ending 9/30/2016 to be delivered to the auditors for review upon

completion. A conference call between the accountants and

Mobicard

discussing

multiple topics including, but not limited to, the Code2Action note

in (PTOP) detailed in an 8(k) filing with the SEC in 2015 for

valuation purposes necessary for the auditors is scheduled for

today (Monday 12/3/2018).

The implementation of the

vision of the future growth of Mobicard and the terms of the SOW

should pave the way for long term shareholder

profitability.

Safe Harbor

Statement:

This release includes

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The Company invokes

the protections of the Private Securities Litigation Reform Act of

1995. All statements regarding our expected future financial

position, results of operations, cash flows, financing plans,

business strategies, products and services, competitive positions,

growth opportunities, plans and objectives of management for future

operations, as well as statements that include words such as

"anticipate," "if," "believe," "plan," "estimate," "expect,"

"intend," "may," "could," "should," "will," and other similar

expressions are forward-looking statements. All forward-looking

statements involve risks, uncertainties and contingencies, many of

which are beyond our control, which may cause actual results,

performance, or achievements to differ materially from anticipated

results, performance, or achievements. Factors that may cause

actual results to differ materially from those in the

forward-looking statements include those set forth in our filings

at www.sec.gov. The company is no longer a

fully reporting SEC filing company.

We are under no obligation to (and expressly disclaim any such

obligation to) update or alter our forward-looking statements,

whether as a result of new information, future events or

otherwise.

Joshua Sodaitis, CEO

MobiCard, Inc.

45 Prospect

Street, Cambridge, MA 02139

Phone:

1-617-651-2460

Email: info@freemobicard.com

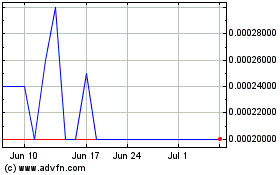

Peer to Peer Network (PK) (USOTC:PTOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

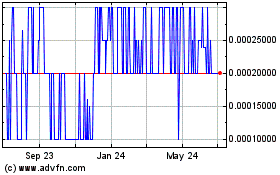

Peer to Peer Network (PK) (USOTC:PTOP)

Historical Stock Chart

From Apr 2023 to Apr 2024