Current Report Filing (8-k)

November 28 2018 - 5:32PM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November

28, 2018 (November 21, 2018)

Cuentas Inc.

(Exact name of registrant as specified in its

charter)

|

Florida

|

|

333-148987

|

|

20-3537265

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File Number)

|

|

Identification Number)

|

19 W. Flagler St., Suite 507

Miami, FL

(Address of principal executive offices)

33130

(Zip Code)

(800) 611-3622

(Registrant’s telephone number, including

area code)

Cuentas Inc.

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 4.01

|

Changes in Registrant’s Certifying Accountant.

|

(a) Dismissal of Independent Registered

Public Accountant

On November 21, 2018, Cuentas, Inc.’s

(the “Company”) and Marcum LLP’s (“Marcum”) auditor client relationship was terminated.

During the fiscal years ended December 31,

2017 and 2016, and the subsequent interim period through November 28, 2018 (the “Term”), Marcum did not issue any report

on any financial statements of the Company that contained an adverse opinion or a disclaimer of opinion, or was qualified or modified

as to uncertainty, audit scope or accounting principles. Furthermore, during the Term: (i) there were no disagreements between

the Company and Marcum on any matter of accounting principles or practices, financial statement disclosure or auditing scope or

procedure, which, if not resolved to the satisfaction of Marcum would have caused Marcum to make reference to the subject matter

of the disagreement in connection with a report by it on the Company’s consolidated financial statements; and (ii) there

were no “reportable events” as defined in paragraph (a)(1)(v) of Item 304 of Regulation S-K.

On November 27, 2018, the Company provided

Marcum with a copy of the disclosures it is making above in response to Item 4.01 in this Current Report on Form 8-K, and requested

that Marcum furnish the Company with a letter addressed to the Securities and Exchange Commission (the “SEC”) stating

whether it agreed with those disclosures. A copy of the resulting letter from Marcum, dated November 27, 2018, is filed as Exhibit

16.1 to this Current Report on Form 8-K.

(b) Newly Appointed Independent Registered

Public Accountant

On November 28, 2018, the Audit Committee

of the board of directors (the “Board”) of the Company approved the appointment of Halperin Ilanit, CPA (“Halperin”)

to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018. The

effective date of Halperin’s appointment as the Company’s independent registered public accounting firm for the fiscal

year ending December 31, 2018, is November 28, 2018. During the fiscal years ended December 31, 2017 and 2016, and the subsequent

interim period through November 28, 2018, neither the Company, nor anyone acting on the Company’s behalf, has consulted

with Halperin regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed,

or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, in any case where

either a written report or oral advice was provided to the Company by Halperin that Halperin concluded was an important factor

considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter

that was either the subject of a “disagreement” (within the meaning of Item 304(a)(1)(iv) of Regulation S-K and the

related instructions) or a “reportable event” (as that term is defined in Item 304(a)(1)(v) of Regulation S-K).

|

Item 5.02

|

Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(c) Appointment of Chief Financial Officer

On November 28, 2018, the

Board appointed Ran Daniel to serve as the Company’s Chief Financial Officer.

Mr.

Daniel has more than 20 years of financial and business management experience. Since June 2018, Mr. Daniel has served as a member

of the Board of Directors of Maayan Ventures Ltd (MAYN.TA). Mr. Daniel has also served as the Chief Financial Officer of Blue Sphere

Corporation from April 2016 through April 2018. From August 2014 to March 2016, Mr. Daniel served as the General Counsel and

Head of the Family Office of Elie Tahari Ltd., and from December 2012 to August 2014, he has served as Executive Vice President

of IDH Properties LLC, an affiliate of the Elad Group. He was responsible for the financial and accounting functions in several

companies and has extensive experience working as a CFO in both rapidly growing companies and publicly traded companies. He has

worked with real estate, fashion, high-tech companies as well as remote institutional and high net worth individuals. Ran is licensed

as a CPA, CFA and is admitted to practice law in New York. Mr. Daniel is licensed as a Certified Public Accountant (CPA) in the

United States and Israel, admitted to practice law in the State of New York, licensed as a Real Estate Broker in the State of New

York and a Chartered Financial Analyst (CFA). Mr. Daniel is a member of the CFA Institute, the New York Society of Security Analysts

and the New York State Bar Association. Mr. Daniel holds a Bachelor of Economics, a Bachelor of Accounting and an MBA in Finance

from the Hebrew University, as well as a Graduate Degree in Law from the University of Bar-Ilan.

There are no arrangements

or understandings between Mr. Daniel and any other persons pursuant to which Mr. Daniel was selected to be an officer of the Company.

Mr. Daniel does not have any family relationships subject to disclosure under Item 401(d) of Regulation S-K of the Securities Act

of 1933, as amended (the “Securities Act”) or any direct or indirect material interest in any transaction required

to be disclosed pursuant to Item 404(a) of Regulation S-K of the Securities Act.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

1

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CUENTAS INC.

|

|

|

|

|

|

Date: November 28, 2018

|

By:

|

/s/

Arik Maimon

|

|

|

|

Arik Maimon

|

|

|

|

Chief Executive Officer

|

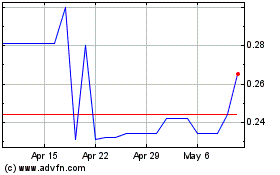

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

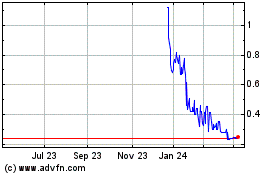

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Apr 2023 to Apr 2024