Current Report Filing (8-k)

November 27 2018 - 4:31PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of the earliest event reported): November 27, 2018 (November 21, 2018)

Bausch Health Companies Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

British Columbia, Canada

|

|

001-14956

|

|

98-0448205

|

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

2150 St. Elzéar Blvd. West

Laval, Quebec

Canada H7L

4A8

(Address of Principal Executive Offices)(Zip Code)

514-744-6792

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the

Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Credit Agreement Amendment

On

November 27, 2018, Bausch Health Companies Inc. (the “Company”) entered into that certain First Incremental Amendment (the “Incremental Amendment”) to its existing Fourth Amended & Restated Credit and Guaranty

Agreement (the “Credit Agreement”), pursuant to which Valeant Pharmaceuticals International (“VPI”), a Delaware corporation and an indirect wholly-owned subsidiary of the Company, borrowed $1,500,000,000 of new term B loans (the

“New Term B Loans”).

The New Term B Loans incurred pursuant to the Incremental Amendment will mature on November 27, 2025

and have an amortization rate of 5.00% per annum. The New Term B Loans bear interest at a rate per annum equal to, at the borrower’s option, either (a) a base rate determined by reference to the higher of (1) the rate of interest

quoted in the print edition of The Wall Street Journal, Money Rates Section, as the “Prime Rate”, (2) the federal funds effective rate plus 1/2 of 1.00% or (3) the eurocurrency rate for a period of one month plus 1.00% (or if such

eurocurrency rate shall not be ascertainable, 1.00%) or (b) a eurocurrency rate which appears on the page of the Reuters Screen which displays the London interbank offered rate administered by ICE Benchmark Administration Limited (such page

currently being the LIBOR01 page) determined by reference to the costs of funds for U.S. dollar deposits for the interest period relevant to such borrowing adjusted for certain additional costs (provided however, that the eurocurrency rate in

respect of loans under the term loan facility shall at no time be less than zero), in each case plus an applicable margin. The applicable interest rate margins for the term loan facility loans are 1.75% with respect to base rate borrowings and 2.75%

with respect to eurocurrency rate borrowings. Except as amended by the Incremental Amendment, the terms of the Credit Agreement were not otherwise amended.

The Company paid a fee to each New Term B Loan lender immediately upon giving effect to the Incremental Amendment equal to 1.0% of the

aggregate principal amount of the New Term B Loans provided on the closing date for the Incremental Amendment.

The foregoing summary of

the Incremental Amendment, the New Term B Loans and the transactions contemplated thereby is not complete and is qualified in its entirety by reference to the full and complete text of the Incremental Amendment, a copy of which is attached as

Exhibit 10.1 to this Current Report on Form

8-K

and incorporated herein by reference.

Item 2.03. Creation

of a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement of a Registrant.

The information included in Item 1.01 above is incorporated by reference into this Item 2.03.

Item 2.04 Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement

On November 27, 2018, the Company issued a notice of

redemption to redeem all of its outstanding 7.500% Senior Notes due 2021 (the “Notes”), using cash on hand, on December 27, 2018 (the “Redemption Date”).

The Notes were issued under an indenture dated as of July 12, 2013 between the Company (as successor to VPII Escrow Corp.) and The Bank

of New York Mellon Trust Company, N.A., as trustee, as supplemented and amended, and will be redeemed pursuant to Article 3 of the indenture.

The redemption price for the 7.500% Notes will be $1,018.75 per $1,000 principal amount, plus accrued and unpaid interest to, but not

including, the Redemption Date. Unless the Company defaults in making the redemption payment, interest on the Notes will cease to accrue on and after the Redemption Date, and the only remaining right of the holders of the Notes will be to receive

payment of the redemption price and interest accrued to, but not including, the Redemption Date upon surrender to the paying agent of the Notes.

The press release is attached as Exhibit 99.1 and is incorporated by reference into this Item 2.04.

Item 8.01. Other Events.

Tender Offer

On November 21, 2018,

the Company issued a press release announcing the results as of the consent date of the previously announced tender offer and consent solicitation. A copy of the press release is attached hereto as Exhibit 99.2 and is incorporated by reference into

this Item 8.01.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

10.1

|

|

First Incremental Amendment, dated as of November 27, 2018, to the Fourth Amended and Restated Credit and Guaranty Agreement, dated as of June 1, 2018, among Bausch Health Companies Inc., Valeant Pharmaceuticals

International, certain subsidiaries of Bausch Health Companies Inc. as guarantors, each of the financial institutions named therein as lenders and issuing banks and Barclays Bank PLC, as Administrative Agent

|

|

|

|

|

99.1

|

|

Press release announcing closing of incremental amendment to Bausch Health Companies Inc.’s existing credit agreement and redemption of its 7.500% Senior Notes due 2021, dated November 27, 2018

|

|

|

|

|

99.2

|

|

Press release announcing early tender results and early settlement date for cash tender offer and consent solicitation for any and all of Bausch Health Companies Inc.’s 7.500% Senior Notes due 2021, dated November 21,

2018

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

10.1

|

|

First Incremental Amendment, dated as of November 27, 2018, to the Fourth Amended and Restated Credit and Guaranty Agreement, dated as of June

1, 2018, among Bausch Health Companies Inc., Valeant Pharmaceuticals International, certain subsidiaries of Bausch Health Companies Inc. as guarantors, each of the financial institutions named therein as lenders and issuing banks and Barclays Bank PLC,

as Administrative Agent

|

|

|

|

|

99.1

|

|

Press release announcing closing of incremental amendment to Bausch Health Companies Inc.’s existing credit agreement and redemption of its 7.500% Senior Notes due 2021, dated November 27, 2018

|

|

|

|

|

99.2

|

|

Press release announcing early tender results and early settlement date for cash tender offer and consent solicitation for any and all of Bausch Health Companies Inc.’s 7.500% Senior Notes due 2021, dated

November 21, 2018

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

BAUSCH HEALTH COMPANIES INC.

|

|

|

|

|

By:

|

|

/s/ Paul S. Herendeen

|

|

|

|

Name: Paul S. Herendeen

|

|

|

|

Title: Executive Vice President, Chief

Financial Officer

|

Date: November 27, 2018

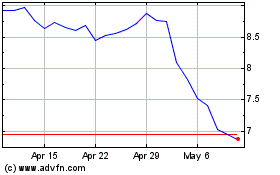

Bausch Health Companies (NYSE:BHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

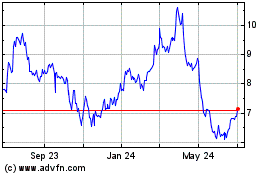

Bausch Health Companies (NYSE:BHC)

Historical Stock Chart

From Apr 2023 to Apr 2024