Société Générale to Pay $1.3 Billion to Resolve U.S. Sanctions, Money Laundering Violations -- Update

November 19 2018 - 2:06PM

Dow Jones News

By Samuel Rubenfeld and Alberto Delclaux By

French bank Société Générale SA agreed to pay $1.3 billion in

fines and penalties related to U.S. federal and state allegations

that it processed billions of dollars in transactions connected to

Iran, Sudan, Cuba and Libya over the course of a decade.

The transactions were in violation of U.S. sanctions law,

authorities said. The total represents the second-largest penalty

ever imposed on a financial institution for violations of U.S.

sanctions, prosecutors said.

The bank struck a deferred-prosecution agreement with the U.S.

Justice Department, agreeing to forfeit $717.2 million, prosecutors

said. The bank also agreed to pay $325 million to the New York

State Department of Financial Services, $162.8 million to the

Manhattan district attorney's office, $81.3 million to the Federal

Reserve and $53.9 million to the U.S. Treasury Department's

sanctions office.

Société Générale's said the penalty amount is fully covered by a

provision for disputes in its books.

The bank's chief executive said the lender regrets the

shortcomings identified in the multijurisdictional settlements, and

noted that the bank cooperated with authorities and said it has

taken a number of steps in recent years to enhance its sanctions

and anti-money-laundering compliance programs.

"These resolutions...allow the bank to close a chapter on our

most important historical disputes," CEO Frédéric Oudéa said in a

statement.

Write to Samuel Rubenfeld at samuel.rubenfeld@wsj.com

(END) Dow Jones Newswires

November 19, 2018 13:51 ET (18:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

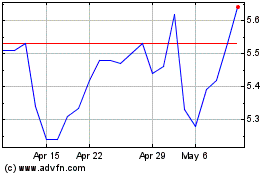

Societe Generale (PK) (USOTC:SCGLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

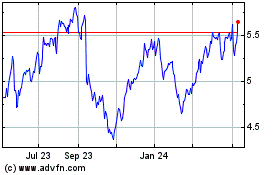

Societe Generale (PK) (USOTC:SCGLY)

Historical Stock Chart

From Apr 2023 to Apr 2024