Investors Look Past Rout in Tech Stocks -- WSJ

November 19 2018 - 3:02AM

Dow Jones News

By Akane Otani

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 19, 2018).

Many on Wall Street are weathering the autumn technology rout by

buying the shares of firms with slower, steadier earnings growth,

the latest sign that investors largely remain sanguine about U.S.

stocks despite recent reversals.

Trading has turned rocky since the S&P 500 finished the

third quarter with its biggest gain since 2013. The broad index is

down 6.1% since the end of September, while once-favored shares

like Netflix Inc. and Amazon.com Inc. have shed more than 20%

apiece.

Nine years into the U.S. stock rally, investors are grappling

with two forces. Many feel the best days of this economic cycle are

past, especially with windfalls from 2017's tax overhaul set to

fade. Though few economists foresee a recession soon, analysts and

portfolio managers say the fall pullback offers a reminder of the

ever-present risk that markets will fall sharply as rising interest

rates and slowing growth hit corporate profits.

But a hefty contingent contends there are still significant

gains to be had, thanks to the robustness of companies' bottom

lines. Third-quarter earnings at S&P 500 companies have surged

26% from the year-earlier period, according to FactSet, on track

for the largest gain since 2010.

While few traders and portfolio managers expect profit growth to

continue at anything approaching that clip, many say that buying

the shares of firms that are producing solid sales and earnings

growth will remain a winning strategy until profits actually begin

falling.

"You can't just buy willy-nilly anymore," said Michael Farr,

president of investment management firm Farr, Miller &

Washington in Washington, D.C. Rather than make bets on U.S. stocks

as a whole, Mr. Farr and his team have been scooping up shares of

companies whose potential to generate growth looks promising, like

Starbucks Corp. and Bristol-Myers Squibb Co., while trimming their

holdings of United Parcel Service Inc.

Starbucks delivered double the U.S. sales growth that analysts

had expected in the most recent quarter, while Bristol-Myers raised

its 2018 profit forecast after getting a boost from sales of drugs

like its cancer treatment Opdivo.

Mr. Farr isn't alone. In the third quarter, many hedge funds

retreated from shares of social-media firms that rallied sharply

over the past year, while picking up shares of businesses including

consumer staples firms, coffee chains and established software

developers.

Jana Partners LLC bought shares of packaged-food company Conagra

Brands Inc. while dumping all of its Facebook Inc. shares,

according to its most recent 13F filing. Activist investor Bill

Ackman disclosed a long position in Starbucks in October, while

Stanley Druckenmiller's Duquesne Family Office LLC dumped nearly a

quarter of its Amazon shares and picked up Microsoft Corp.

shares.

The jockeying reflects widespread expectations that economic

momentum will slow as factors like wage growth, rising interest

rates and a stronger dollar take more of a toll on profits,

analysts and investors say.

Earnings growth is expected to slow to 14% in the fourth quarter

before tapering off in the single-digit range in 2019. And although

more than three quarters of S&P 500 companies have posted

stronger-than-expected earnings, sales results have been less

impressive, with just 59% of firms beating analysts' estimates,

according to RBC Capital Markets.

That puts a premium on firms whose earnings are perceived to be

likely to hold up better as the economy slows. Oil giants Exxon

Mobil Corp. and Chevron Corp. each reported their best

third-quarter earnings in four years, thanks to a recovery in crude

prices earlier in 2018.

When Lori Calvasina, head of U.S. equity strategy at RBC Capital

Markets, traveled around the U.S. to meet with clients, she heard

the phrase "late cycle" in many of her conversations. It is a sign,

she said, many investors can't help but feel the end of the

economic expansion is drawing closer, even in the face of solid

economic data.

The firm lowered its year-end target for the S&P 500 to 2890

from 3000 in April and cut its rating for technology stocks to

"underweight."

There is a silver lining. The S&P 500 has historically

struggled in the short term after a peak in earnings growth. But

the stock market has managed to produce double-digit percentage

gains over the following three years when profit growth peaked and

then decelerated -- rather than outright contracting, according to

RBC Capital Markets.

"Equity markets are saying to companies that the easy money has

already been made," said Nicholas Colas, co-founder of DataTrek

Research. "In 2019, they'll have to work for it."

Write to Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

November 19, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

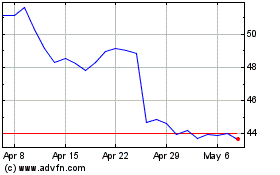

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

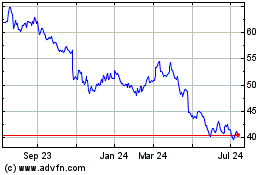

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024