By Katherine Blunt and Russell Gold

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 15, 2018).

California's largest utility suffered its steepest stock plunge

in 16 years Wednesday as concerns grew that potential liability

costs from destructive wildfires threaten the company's financial

future.

Shares in PG&E Corp. fell nearly 22% and its bonds were also

hammered, capping five straight days of losses that have dragged

shares down more than 47%, its worst such stretch on record.

The free fall began after the company reported to state

regulators that one of its transmission lines had malfunctioned

before the start of a massive fire in Northern California. The fire

has now destroyed more than 7,600 single-family homes and killed at

least 48 people.

The San Francisco-based company reported in a securities filing

Tuesday night that it had exhausted its revolving lines of credit

and warned that its $1.4 billion of insurance coverage for

wildfires occurring between Aug. 1 and July 31, 2019, may be

insufficient to cover all potential liability claims against the

company.

Geisha Williams, PG&E's chief executive, said in an

interview that it was premature to speculate about whether the

company would need to seek bankruptcy protection. She said the

company tapped its credit lines to create more financial

flexibility.

"The cause of the fire has not been determined, so it's not

clear if we're going to be held responsible," Ms. Williams said,

adding that it is currently focused on assisting communities and

first responders.

State investigators have yet to determine whether PG&E

equipment caused any current wildfires, or whether the company was

negligent, findings that could trigger state fines as well as fuel

lawsuits from homeowners and others who lost property.

But the utility, already facing billions in potential liability

costs from last year's wildfires, is confronting a sobering

situation without any easy fixes, as an extended drought and

population growth into fire-prone forested areas turns parts of

California into a dangerous tinderbox.

PG&E's Pacific Gas & Electric Co. unit serves about 16

million people from Santa Barbara almost all the way up to the

Oregon border. The company owns and operates hundreds of miles of

electrical wires that crisscross an increasingly dry region at

rising risk of fire, a new reality that California Gov. Jerry Brown

has attributed in part to a changing climate. State investigators

have already concluded PG&E equipment helped spark at least 16

fires last year, generating hundreds of lawsuits.

The company was worth more than $36 billion in September 2017,

before the recent spate of fires in Northern California. It closed

on Wednesday worth $13.27 billion. PG&E cut its dividend and

took a $2.5 billion charge earlier this year.

"The reality is that fire season is year round and fires are

spreading at rates we've never seen before," said Ms. Williams,

PG&E's CEO. "We must work together across all sectors and

disciplines to address this issue with urgency."

Citi analyst Praful Mehta estimated the total damage caused by

the current fire could reach $15 billion, comparable to the 2017

fire damages, though PG&E wouldn't necessarily bear those costs

in full if found liable for the blaze.

Mr. Mehta said those potential liability costs could raise the

risk of bankruptcy for PG&E, which could force the California

Legislature to consider rescuing the company.

"All roads lead to Sacramento," he said. "There is no way they

could face all of those liabilities without a legislative

solution."

PG&E has already sought help from the state. Earlier this

year, it successfully pushed for legislation that would allow it to

pass on wildfire-liability costs to its customers under certain

circumstances. But the bill takes effect in January, leaving the

company currently unprotected from liability claims arising from

the current blaze in Northern California, known as the Camp

Fire.

Another fire, known as the Woolsey Fire, was burning to the

south in parts of Los Angeles and Ventura County that aren't within

PG&E's coverage area.

The liabilities could be enormous. Lawyers who sued PG&E

following devastating fires in 2015 and 2017 are already mobilizing

to sue the company for the Camp Fire.

A coalition of law firms calling itself Northern California Fire

Lawyers filed a negligence lawsuit Tuesday on behalf of more than a

dozen residents affected by the blaze, alleging PG&E failed to

properly maintain its equipment. The lawsuit details what the

lawyers call a "regular pattern of placing its own profits before

the safety of the California residents it serves."

Following the 2017 fires, individuals, municipalities and

insurance companies filed more than 800 civil lawsuits against

PG&E. The first trial in those cases is slated to take place

next September.

Britt Strottman, a lawyer with Baron & Budd who has

successfully sued PG&E over previous fires and a natural-gas

explosion, said the company had neglected safety considerations,

creating the current situation.

"They continue to have a culture where they neglect the

maintenance of their system and divert money that should be used

for safety to executive bonuses," she said.

PG&E spokeswoman Lynsey Paulo strongly disagreed. "Nothing

is more important to PG&E than the safety of our customers, our

communities, our employees and our contractors," she said.

It could take years to sort out fines and liabilities, according

to Height Capital Markets. It estimated that state fire

investigators wouldn't formally determine the cause of the current

fire, including PG&E's role, until next summer, and that

settlements on claims could take until 2020 at the earliest.

PG&E expressed concern last week about the potential for

more wildfires, fueled by the state's Santa Ana winds. It notified

about 70,000 customers that it might turn off their power as a

safety measure. Strong winds can blow electrical lines into trees

or into each other, generating electrical arcs that can drop sparks

and molten material onto dry vegetation. The company ultimately

decided there wasn't enough risk to warrant shutting off the

power.

At 6:15 a.m. on Nov. 8, PG&E detected an outage on a

high-voltage transmission line that connects a century-old dam in

the Sierra Nevada mountains to the rest of the state's power grid.

The problem on the line occurred near Pulga in Northern California.

Fifteen minutes later, a wildfire was reported in that vicinity.

Whipped by high winds, the fire grew quickly into the deadliest in

California history.

--Maria Armental and Sara Randazzo contributed to this

article.

Write to Russell Gold at russell.gold@wsj.com

(END) Dow Jones Newswires

November 15, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

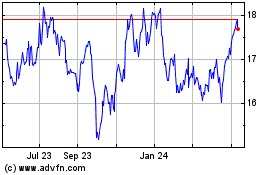

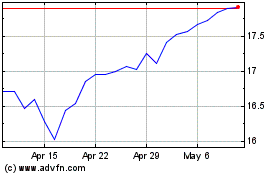

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024