Logistics Hiring Contributes 10% of October U.S. Job Growth

November 02 2018 - 3:14PM

Dow Jones News

By Jennifer Smith

Hiring in the transportation and warehousing sector soared in

October as employers heading into peak shipping season added 24,800

jobs, the biggest monthly gain since December and accounting for

nearly 10% of total U.S. job growth.

Parcel-delivery firms that bring packages to homes and business

added 7,600 positions last month, as did warehousing and storage

companies, according to preliminary figures the Labor Department

released Friday.

The gains come as surging e-commerce sales are expected to test

logistics networks' capacity this holiday season. Warehouse

operations have expanded dramatically in recent years as Amazon.com

Inc. and other companies open sprawling, labor-intensive

fulfillment centers where workers pick, pack and ship online

purchases. This year, consumers are expected to spend $124.1

billion online in November and December, up 14.8% from during the

same two-month period in 2017, according to software company Adobe

Systems Inc.

XPO Logistics Inc., one of the largest logistics and

transportation providers in the U.S., said this week that strong

e-commerce demand helped drive an 18% jump in its third-quarter

logistics segment revenue in North America. The Greenwich,

Conn.-based company is also ramping up a shared-space warehouse

network to meet demand for flexible distribution, including

additional holiday capacity.

"Most are e-commerce and retail customers. We also have some

manufacturers, and expect volumes to accelerate into peak," XPO

Chief Executive Brad Jacobs said in an interview.

United Parcel Service Inc., the largest private U.S.

package-delivery firm, is adding 100,000 seasonal workers and

building out more automated sorting hubs as it prepares for an

expected 6.7% boost in package volume between Thanksgiving and

Christmas.

Overall the U.S. economy added 250,000 positions last month,

while the unemployment rate held steady at 3.7%, a 49-year low.

Factory payrolls grew by 32,000, led by gains in the

transportation-equipment sector, which added 10,200 jobs as truck

manufacturers work to address a nearly 11-month backlog, though

factory activity slowed in October.

Wages grew 3.1% year-over-year as employers raise pay amid steep

competition for workers. Amazon.com Inc.'s new $15 minimum hourly

wage went into effect Thursday, raising the stakes for warehouse

operators that are already dangling raises and other incentives to

attract scarce employees.

Hiring at trucking companies slowed after a two-month period of

strong gains, with carriers adding 2,400 jobs in October. Fleet

payrolls have grown by 36,000 positions over the past 12 months as

companies add capacity to meet strong freight demand, though many

report difficulty recruiting and retaining drivers.

This year Pitt Ohio, a less-than-truckload carrier based in

Pittsburgh, Penn., began an apprentice program to bring recent

high-school graduates into the trucking firm before they can

qualify for an interstate commercial driver's license.

The company raised driver wages 2% in May and another 2% in

October. "We get lots of responses even with the job market [so]

tight, but a lot of those aren't qualified because of their driving

records" and other reasons, said Chief Executive Chuck Hammel.

--Paul Page contributed to this article.

Write to Jennifer Smith at jennifer.smith@wsj.com

(END) Dow Jones Newswires

November 02, 2018 14:59 ET (18:59 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

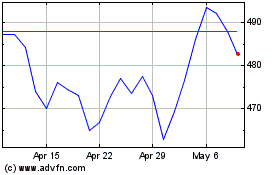

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

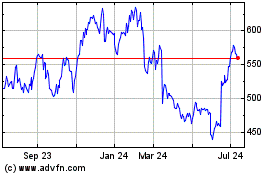

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Apr 2023 to Apr 2024