Milestone towards Completing Transaction to

Establish Leadership in South American Market

Aurora Cannabis Inc. (

Aurora) (NYSE: ACB) (TSX:

ACB) (Frankfurt: 21P; WKN: A1C4WM) and ICC Labs Inc.

(

ICC) (TSX-V: ICC) are pleased to announce that

Aurora has received, from its consortium of lenders led by Bank of

Montreal (collectively, the

Lenders), consent and

approval as required under its credit agreement with the Lenders to

the previously announced plan of arrangement (the

Arrangement) between ICC and Aurora. Subject to

the terms and conditions of the arrangement agreement dated

September 8, 2018 (the

Arrangement Agreement),

Aurora will acquire all of the issued and outstanding common shares

(

ICC Shares) of ICC. Obtaining such consent and

approval is one of the conditions to completing the Arrangement.

Strategic Rationale

The Arrangement, once approved, will create a

strong foundation for expansion, and will leverage ICC’s

first-mover advantage in South America, bringing significant

low-cost production capacity, a well-diversified product portfolio,

and extensive distribution channels throughout South America and

internationally.

Led by CEO Alejandro Antalich, a

widely-recognized leader in the South American cannabis market with

over 25 years of experience in the pharmaceutical sector, the

acquisition of ICC will establish Aurora as the industry leader in

South America, a continent with over 420 million people. ICC

is based in Uruguay, the first country in the world to legalize

cannabis for adult consumer use. In addition, ICC holds licenses in

Colombia for the production of medical cannabis.

Special Meeting of ICC

Shareholders

A special meeting (the Meeting)

of holders of ICC Shares (ICC Shareholders) will

be held on Tuesday November 6, 2018 at 9:00 a.m. (Toronto time) at

Norton Rose Fulbright Canada LLP, located at Royal Bank Plaza,

South Tower, Suite 3800, 200 Bay Street, Toronto. At the Meeting,

ICC Shareholders will be asked to consider and vote on a special

resolution (the Arrangement Resolution) approving

the Arrangement.

Full details of the Arrangement and certain

other matters are set out in the management information circular of

ICC dated October 3, 2018 (as updated by the news release of ICC

dated October 15, 2018) (the Circular). A copy of

the Circular and other meeting materials can be found under ICC’s

profile on SEDAR at www.sedar.com.

ICC Board Recommendation

ICC’s board of directors has unanimously

approved the Arrangement and recommends that ICC Shareholders vote

FOR the Arrangement Resolution.

Timing and Conditions

Assuming approval of the Arrangement at the

Meeting, ICC will, on or about November 8, 2018, return to the

Supreme Court of British Columbia to seek a final order to

implement the Arrangement. The closing of the Arrangement remains

subject to receipt of certain other approvals (including certain

Uruguayan regulatory approvals) and the satisfaction or waiver of

certain other customary closing conditions. Approval by

shareholders of Aurora is not required. Assuming all conditions are

satisfied, ICC and Aurora expect that the closing of the

Arrangement will be completed in the fourth quarter of 2018.

Proxy Solicitation

ICC has retained Laurel Hill Advisory Group to

solicit proxies, on behalf of management, to vote FOR the

Arrangement Resolution. If you have any questions relating to your

vote, please contact Laurel Hill by telephone toll free at

1-877-452-7184 (1-416-304-0211 by collect call) or by email at

assistance@laurelhill.com.

About Aurora

Headquartered in Edmonton, Alberta, Canada with

funded capacity in excess of 500,000 kg per annum and sales and

operations in 19 countries across five continents, Aurora is one of

the world’s largest and leading cannabis companies. Aurora is

vertically integrated and horizontally diversified across every key

segment of the value chain, from facility engineering and design to

cannabis breeding and genetics research, cannabis and hemp

production, derivatives, high value-add product development, home

cultivation, wholesale and retail distribution. Highly

differentiated from its peers, Aurora has established a uniquely

advanced, consistent and efficient production strategy, based on

purpose-built facilities that integrate leading-edge technologies

across all processes, defined by extensive automation and

customization, resulting in the massive scale production of high

quality product at low cost. Intended to be replicable and scalable

globally, our production facilities are designed to produce

cannabis of significant scale, with high quality, industry-leading

yields, and low per gram production costs. Each of Aurora’s

facilities is built to meet EU GMP standards, and its first

production facility, the recently acquired MedReleaf Markham

facility, and its wholly owned European medical cannabis

distributor Aurora Deutschland, have achieved this level of

certification.

In addition to Aurora’s rapid organic growth and

strong execution on strategic M&A, which to date includes 15

wholly owned subsidiary companies – MedReleaf, CanvasRX, Peloton

Pharmaceutical, Aurora Deutschland, H2 Biopharma, Urban Cultivator,

BC Northern Lights, Larssen Greenhouses, CanniMed Therapeutics,

Anandia Labs, HotHouse Consulting, MED Colombia, Agropro, Borela,

and the pending acquisition of ICC – Aurora is distinguished by its

reputation as a partner and employer of choice in the global

cannabis sector, having invested in and established strategic

partnerships with a range of leading innovators, including: Radient

Technologies Inc., Hempco Food and Fiber Inc., Cann Group Ltd.,

Micron Waste Technologies Inc., Choom Holdings Inc., Capcium Inc.

(private), Evio Beauty Group (private), Wagner Dimas (private), CTT

Pharmaceuticals, and Alcanna Inc..

Aurora's Common Shares trade on the TSX and NYSE

under the symbol "ACB", and are a constituent of the S&P/TSX

Composite Index.

For more information about Aurora, please visit

our investor website, investor.auroramj.com

About ICC

ICC is a fully licensed producer and distributor

of medicinal cannabinoid extracts, recreational cannabis and

industrial hemp products in Uruguay as well as a fully licensed

producer of medicinal cannabis in Colombia. ICC has active

operations in Uruguay, and is focused on becoming the worldwide

leading producer of cannabinoid extracts, giving support and

promoting responsible use for medicinal purposes, backed by

scientific research and innovation, while following strict

compliance with standards for quality and safety.

Neither the TSX, TSX-V nor their

Regulation Services Provider (as that term is defined in the

policies of the TSX and TSX-V) accepts responsibility for the

adequacy or accuracy of this release.

Terry Booth, CEO Aurora Cannabis Inc.

Alejandro Antalich, CEOICC Labs Inc.

Further information

For Media:

Heather MacGregor (416) 509-5416

heather.macgregor@auroramj.com

For Investors:

Marc Lakmaaker (647) 269-5523

marc.lakmaaker@auroramj.com

Rob Kelly (647) 331-7228 rob.kelly@auroramj.com

U.S. Investors:

Phil Carlson / Elizabeth BarkerKCSA Strategic

Communications(212) 896-1233 / (212)

896-1203pcarlson@kcsa.com / ebarker@kcsa.com

For ICC:

Alejandro Antalich, CEO(598) 2900-0000 ext.

404ir@icclabs.com

Caution Concerning Forward-Looking

Statements

This news release includes statements containing

certain "forward-looking information" within the meaning of

applicable securities law (forward-looking statements).

Forward-looking statements are frequently characterized by words

such as "plan", "continue", "expect", "project", "intend",

"believe", "anticipate", "estimate", "may", "will", "potential",

"proposed" and other similar words, or statements that certain

events or conditions "may" or "will" occur. Forward-looking

statements in this news release include, but are not limited to

statements with respect to: the anticipated timing of the Meeting

and the closing of the Arrangement; the satisfaction of closing

conditions including required ICC Shareholder approval; necessary

court approvals; the requisite Uruguayan regulatory approvals being

obtained; certain other customary closing conditions; and the

expected benefits of the Arrangement.

Implicit in the forward-looking statements

referred to above are assumptions regarding, among other things:

the ability of the parties to receive, in a timely manner and on

satisfactory terms, the necessary ICC Shareholder approval and

regulatory, court, stock exchange and other third party approvals;

the ability of the parties to satisfy, in a timely manner, the

conditions to the closing of the Arrangement; and other

expectations and assumptions concerning the Arrangement. The

anticipated timing provided herein in connection with the

Arrangement may change for a number of reasons, including the

inability to secure necessary ICC Shareholder approval and

regulatory, court, stock exchange or other third party approvals in

the time assumed or the need for additional time to satisfy the

other conditions necessary to complete the Arrangement. ICC

Shareholders are urged to carefully read the Circular (as updated

by the news release of ICC dated October 15, 2018) in its

entirety.

Forward-looking statements are based on the

opinions and estimates of management of ICC and Aurora at the date

the statements are made, and are subject to a variety of risks and

uncertainties and other factors that could cause actual events or

results to differ materially from those projected in the

forward-looking statement, whether expressed or implied, including,

without limitation: the potential risk that the Arrangement

Resolution will not be approved by ICC Shareholders or that the

Arrangement Agreement could be terminated in certain circumstances;

failure to, in a timely manner, or at all, obtain the required

regulatory, court, stock exchange or other third party approvals

for the Arrangement or any ancillary transaction; failure of the

parties to otherwise satisfy the conditions to complete the

Arrangement; the possibility that ICC’s board of directors could

receive an acquisition proposal and approve a superior proposal;

significant transaction costs or unknown liabilities; the risk of

litigation or adverse actions or awards that would prevent or

hinder the completion of the Arrangement; failure to realize the

expected benefits of the Arrangement; compliance with all

applicable laws and other customary risks associated with

transactions of this nature; and general economic conditions. If

the Arrangement is not completed, and ICC continues as an

independent entity, there are serious risks that the announcement

of the Arrangement and the dedication of substantial resources of

ICC to the completion of the Arrangement could have an adverse

impact on ICC’s business and strategic relationships, operating

results and business generally. If the Arrangement is completed,

ICC Shareholders will forego any potential future increase in ICC’s

value as an independent public company. ICC’s failure to comply

with the terms of the Arrangement Agreement may, in certain

circumstances, also result in ICC being required to pay a

termination fee or expense reimbursement to Aurora, the result of

which could have a material adverse effect on ICC’s financial

position, operating results and ability to fund growth prospects.

Readers are cautioned that the foregoing list is not exhaustive.

Forward-looking statements should be considered carefully and undue

reliance should not be placed on them.

Management of Aurora and ICC provide

forward-looking statements because they believe they provide useful

information to readers when considering their investment objectives

and cautions readers that the information may not be appropriate

for other purposes. Consequently, all of the forward-looking

statements made in this news release are qualified by these

cautionary statements and other cautionary statements or factors

contained herein, and there can be no assurance that the actual

results or developments will be realized or, even if substantially

realized, that they will have the expected consequences to, or

effects on, ICC and Aurora. In particular, there can be no

assurance that the Arrangement will be completed. Readers are

further cautioned not to place undue reliance on forward-looking

statements as there can be no assurance that the plans, intentions

or expectations upon which they are placed will occur. Such

information, although considered reasonable by management of Aurora

and ICC at the time of preparation, may prove to be incorrect and

actual results may differ materially from those anticipated.

These forward-looking statements are made as of

the date of this news release and each of ICC and Aurora assume no

obligation to update or revise them to reflect subsequent

information, events or circumstances or otherwise, except as

expressly required by applicable law.

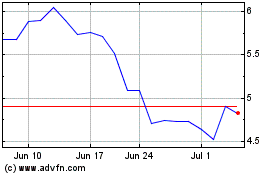

Aurora Cannabis (NASDAQ:ACB)

Historical Stock Chart

From Mar 2024 to Apr 2024

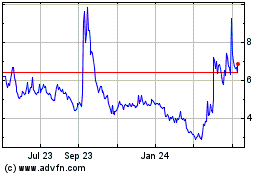

Aurora Cannabis (NASDAQ:ACB)

Historical Stock Chart

From Apr 2023 to Apr 2024