Glaxo's Shingles Vaccine Gave Earnings a Shot in the Arm

October 31 2018 - 11:43AM

Dow Jones News

By Denise Roland

LONDON -- GlaxoSmithKline PLC reported a rise in third-quarter

earnings and said full-year profit would come in at the top end of

expectations, mainly thanks to strong demand for its new shingles

vaccine.

Demand for Shingrix, which is aimed at people age 50 and over,

has outpaced Glaxo's expectations since it launched the vaccine

late last year. The company says it now expects sales of GBP700

million to GBP750 million ($893 million to $957 million) this year,

up from previous guidance of GBP600 million to GBP650 million. The

vaccine protects against shingles, a disease that leads to a

painful rash and that is caused by the reactivation of the chicken

pox virus in people whose immune systems have weakened with

age.

Shingrix got a boost when the U.S. Centers for Disease Control

and Prevention last year gave the vaccine favored status over a

rival, Merck & Co's Zostavax. The CDC also recommended that

adults who had previously received Zostavax should still receive

Shingrix.

That has led to some supply shortages. The British

pharmaceutical giant said it had implemented an "allocation

process" to make sure customers can complete the two-dose course.

"We are working extremely hard to improve our capacity for supply,"

Chief Executive Emma Walmsley said.

Shingrix's strong performance helped push Glaxo's third-quarter

revenue to GBP8.1 billion, up 3% from the same period last year.

Glaxo's HIV franchise and new respiratory drugs also contributed to

the higher sales.

Adjusted operating profit, a measure that strips out one-time

items and is closely watched by analysts, rose 2% to GBP2.5

billion. Taking currency fluctuations into account, revenue and

adjusted operating profit both rose 6%. Net profit for the three

months ended Sept. 30 was GBP1.42 billion, compared with GBP1.21

billion in the same period last year.

Glaxo said it now expects full-year adjusted earnings a share to

grow 8% to 10%, taking currency fluctuations into account, having

previously guided to a 7%-to-10% rise.

Glaxo said it expected to hit that guidance regardless of

whether a generic version of its top-selling inhaler Advair hits

the market before the end of the year. Global generic

pharmaceutical company Mylan has said it believes an approval from

the U.S. Food and Drug Administration for its cut-price version of

the blockbuster product is "imminent."

Glaxo also said it would pay a dividend of 19 pence a share for

the quarter and that it still expects the full-year dividend to be

80 pence a share.

The company added that it has continued cutting early-stage

research projects that failed to show enough promise to pour more

money into drug candidates with more potential, as part of Ms.

Walmsley's broader push to revive the company's research pipeline.

"We wanted to be more proactive about intervening earlier to stop

things...so that we can really focus our resources on the big bets

that are going to have meaningful impact on patients," Ms. Walmsley

said.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

October 31, 2018 11:28 ET (15:28 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

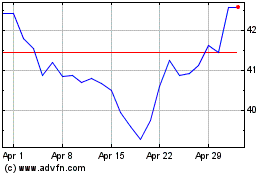

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024