By Amrith Ramkumar and Avantika Chilkoti

A punishing stretch for markets continued Wednesday, with

technology stocks leading major indexes lower yet again as worries

about global economic growth and corporate earnings continued to

spook investors.

The tech-heavy Nasdaq Composite slumped 2.3% and was on track to

close in correction territory, defined as a drop of 10% from a

recent peak. Semiconductor stocks dragged the technology sector

lower following weaker-than-expected sales targets from Texas

Instruments, and downbeat earnings from AT&T hurt

communications shares.

The S&P 500 slid 1.5% and is on pace for a sixth consecutive

decline and 13th drop in the past 15 sessions. The Dow Jones

Industrial Average fell 230 points, or 0.9%, to 24961 after opening

slightly higher. Like the S&P, the blue-chip index is more than

7% off its recent all-time high and has been recording

bigger-than-normal intraday swings.

Anxiety about weakness in the global economy and a slowdown in

corporate profitability have swung global stocks and commodities

lately. The declines in tandem across asset classes have raised

concerns that the worst could still be ahead for investors, who are

also grappling with the impact of higher interest rates.

"We just have a bunch of different uncertainties, and that

raises the fear factor all around," said Jerry Braakman, chief

investment officer of First American Trust.

Analysts have been weighing whether the recent selloff heralds

the end of a prolonged period of strength in the U.S. or is simply

a temporary adjustment.

While some investors expect another steady quarter of earnings

growth to help the market stabilize, others are worried about

pockets of weakness and that revenue gains might be peaking.

Downbeat sales targets from Texas Instruments dragged down

shares of companies that make computer chips, leading to declines

across the broader technology sector. Texas Instruments, Nvidia and

Advanced Micro Devices all fell at least 4%, and the S&P 500

information technology group dropped 2.1%.

Fast-growing internet and technology firms have been among the

hardest hit by the recent bout of market turbulence, with some

analysts wondering if their outsize sales increases can

continue.

AT&T was also an S&P 500 laggard, dropping 6% as the

telecommunications company continued to suffer losses of

traditional pay-TV customers. Shares of Netflix also tumbled,

declining 6.6%. The streaming company has erased the initial

advance last week that followed its latest earnings report.

In other sectors, United Parcel Service shares fell 3.8%

following a quarterly sales miss from the package-delivery

company.

Shares of aerospace giant Boeing rose 3.3%, helping the Dow

industrials after it said its business is booming, thanks to strong

demand for commercial jets and new defense projects. Still, the

S&P 500 industrials sector declined 1.8%, after it was battered

Tuesday following weak earnings from Caterpillar and 3M.

A number of companies are scheduled to post quarterly results

after the market closes Wednesday, including Microsoft, Ford, Visa

and Tesla.

Some executives have raised tighter financial conditions and

higher input costs as challenges moving forward, with the Federal

Reserve expected to continue to gradually boosting interest

rates.

On Wednesday, the yield on the benchmark 10-year U.S. Treasury

yield fell to 3.124%, according to Tradeweb, from 3.166%. Bond

yields fall as prices rise and have pulled back recently with some

investors seeking safety in Treasurys. The WSJ Dollar Index, which

tracks the dollar against a basket of 16 other currencies, added

0.3%.

President Trump blasted Fed Chairman Jerome Powell in an

interview with The Wall Street Journal Tuesday, saying the head of

the central bank threatened growth and appeared to enjoy raising

interest rates.

But tightening monetary policy alone doesn't explain the recent

market tremors, said Robin Creswell, managing principal at Payden

& Rygel, who pointed to geopolitical tensions as another source

of angst.

"What is complicating the picture is a range of extraneous

factors," Mr. Creswell said. "Those are much more difficult to

price, so in the short term the market will react more to those

short-term stimuli."

Investors are waiting to see if the U.S. and China can resolve

their monthslong tariff fight ahead of planned meetings between

leaders from the world's two largest economies next month.

Even if the two sides compromise, some analysts see challenges

to the global economy ahead.

Weakness in the housing and auto markets have unnerved investors

bracing for a pullback in the U.S., where growth has surged this

year. Sales of new homes in the U.S. fell for the fourth month in a

row in September, the Commerce Department said Wednesday.

Preliminary eurozone purchasing managers index data on Wednesday

suggested the regional economy grew at its slowest pace in over two

years in October. The figure dropped to 52.7 from 54.1 last month.

That is the lowest level since September 2016.

The Stoxx Europe 600 erased early gains Wednesday, closing down

0.2% in a sixth consecutive session of declines.

In Asia, Japan's Nikkei Stock Average rose 0.4%, while South

Korea's Kospi benchmark and Hong Kong's Hang Seng fell 0.4%.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

October 24, 2018 14:14 ET (18:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

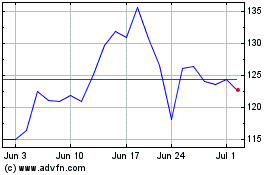

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024